Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 4EA

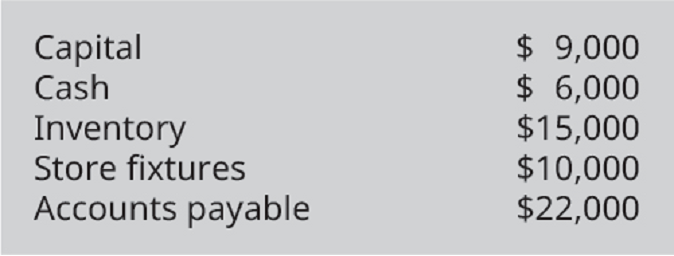

Cheese Partners has decided to close the store. At the date of closing, Cheese Partners had the following account balances:

A competitor agrees to buy the inventory and store fixtures for $20,000. Prepare the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cheese Partners has decided to close the store. At the date of dosing, Cheese Partners had the following account balances:

Capital

Cash

8,000

Inventory

18,000

Store fixtures

10,000

Accounts payable,

20,000

A competitor agrees to buy the inventory and store fixtures for $24,000.

Prepare the journal entries detailing the liquidation, assuming that partners Colette and Swarma are sharing profits on a 50:50 basis. If an amount box does not require

an entry, leave it blank.

Cash

The partnership of Folly and Frill is in the process of liquidation. On January 1, 2021, the booksshow account balances as follows:Cash 10,000 Accounts Payable 15,000Accounts Receivable 25,000 Folly Capital 40,000Lumber Inventory 40,000 Frill Capital 20,000On January 10, 2021, the lumber inventory is sold for $25,000. During January, AccountsReceivable of $21,000 are collected. No further collections on the receivables are expected.Profits are shared 60% to Folly and 40% to Frill.1) Compute the final distribution to Folly2) Compute the final distribution to Frill

On December 31, 2018, the Statement of Financial Position of JKL Partnership with profit or loss ratio of 4:1:5 is presented below: On January 1, 2019, JKL partnership decided to liquidate. During their first month of liquidation, noncash asset with book value of P1,500,000 has been sold at a loss of P500,000. Liquidation expense amounting to P100,000 has been incurred and paid for the month of January while P150,000 is anticipated in the coming period. Liability to creditors has been paid in the amount of P750,000. What is the amount of cash distributed to K on the first month of liquidation?a. 175,000b. 250,000c. 162,500d. None

Chapter 15 Solutions

Principles of Accounting Volume 1

Ch. 15 - A partnership ________. A. has one owner B. can...Ch. 15 - Any assets invested by a particular partner in a...Ch. 15 - Which of the following is a disadvantage of the...Ch. 15 - Mutual agency is defined as: A. a mutual agreement...Ch. 15 - Chani contributes equipment to a partnership that...Ch. 15 - Juan contributes marketable securities to a...Ch. 15 - Which one of the following would not be considered...Ch. 15 - A well written partnership agreement should...Ch. 15 - What type of assets may a partner not contribute...Ch. 15 - How does a newly formed partnership handle the...

Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - When a partnership dissolves, the first step in...Ch. 15 - When a partnership dissolves, the last step in the...Ch. 15 - Prior to proceeding with the liquidation, the...Ch. 15 - Does a partnership pay income tax?Ch. 15 - Can a partners personal assets in a limited...Ch. 15 - Can a partnership assume liabilities as part of...Ch. 15 - Does each partner have to contribute an equal...Ch. 15 - What types of bases for dividing partnership net...Ch. 15 - Angela and Agatha are partners in Double A...Ch. 15 - On February 3, 2016 Sam Singh invested $90,000...Ch. 15 - Why do partnerships dissolve?Ch. 15 - What are the four steps involved in liquidating a...Ch. 15 - When a partner withdraws from the firm, which...Ch. 15 - What is the first step in a partnership...Ch. 15 - When a partnership liquidates, do partners get...Ch. 15 - Coffee Partners decides to close due to the...Ch. 15 - On May 1, 2017, BJ and Paige formed a partnership....Ch. 15 - The partnership of Chase and Chloe shares profits...Ch. 15 - The partnership of Tasha and Bill shares profits...Ch. 15 - Cheese Partners has decided to close the store. At...Ch. 15 - The partnership of Michelle, Amal, and Maureen has...Ch. 15 - The partnership of Tatum and Brook shares profits...Ch. 15 - Arun and Margot want to admit Tammy as a third...Ch. 15 - When a partnership is liquidated, any gains or...Ch. 15 - The partnership of Magda and Sue shares profits...Ch. 15 - The partnership of Arun, Margot, and Tammy has...Ch. 15 - Match each of the following descriptions with the...Ch. 15 - While sole proprietorships and corporations are...Ch. 15 - A partnership is thriving. The three partners get...

Additional Business Textbook Solutions

Find more solutions based on key concepts

In addition to the owners of a business, who are some of the other stakeholders that managers should consider w...

Principles of Management

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

Define cost object and give three examples.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

What are some of the problems with using the CPI?

Construction Accounting And Financial Management (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 30, 2021 – Gold, Titanium and Silver have decided to liquidate their partnership. The shared profits of the partners are in the ratio of 2:2:1, respectively. The partnership's post-closing trial balance is given in the picture. Required: 1.Prepare the liquidation journal entries. 2. Prepare the statement of liquidation.arrow_forwardAssume the sale occurs on December 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. (a) What entry is required by the partnership if the sales price is $66,600?arrow_forwardImmediately prior to the process of liquidation, partners Micco, Niccum, and Orwell have capital balances of $70,000, $20,000, and $30,000, respectively. There is a cash balance of $10,000, noncash assets total $160,000, and liabilities total $50,000. The partners share net income and losses in the ratio of 2:2:1. Journalize the entries for the following liquidation using Noncash Assets as the account title for the noncash assets and Liabilities as the account title for all creditors' claims. Sold the noncash assets for $80,000 in cash. Divided the loss on realization. Paid the liabilities. Received cash from the partner with the deficiency. Distributed the cash to the partners. If an amount box does not require an entry, leave it blank.arrow_forward

- Under the following four independent assumptions, prepare the journal entries for the sale of the land and buildings, allocation of any loss or gain,any deficits, the payment of the liability, and the distributions to the partners if: A) the land and buildings were sold for $420,000arrow_forwardInstructions:1. Prepare a Cash priority program.2. Prepare a Statement of Liquidation.3. Prepare the necessary journal entries to record the liquidation process.arrow_forwardOn December 31, 2019, the balance sheet for the XYZ Partnership follows: The percentages shown are for the residual profit and loss sharing ratios. The partners dissolved the partnership on January 1, 2020 and began the liquidation process. During January the following events occurred: Receivables of P7,500 were collected. All inventory was sold for P10,000. All available cash was distributed on January 31, 2020, except for P5,000 that was set aside for contingent expenses. How much cash would Xander receive from the cash that is available for distribution on January 31?arrow_forward

- The partnership of Anthony and Davis had an unprotitable year and agreed to liquidate their business on December 31, 2019. The Statement of Financial Position as of December 31, 2019 is presented below: ASSETS P 1,000 Cash P 80,000 20,000 Accounts Receivable Less Allowance for Bad Debts Merchandise Inventory Prepaid Advertising Office Equipment Less Accumulated Depreciation TOTAL ASSETS 60,000 50,000 2,000 P 100,000 60,000 40.000 P 153,000 LIABILITIES AND EQUITY Accounts Payable Notes Payable (due October 31, 2020) Anthony, Capital Davis, Capital P 20,000 86,000 30,000 17,000 P 153,000 TOTAL LIABILITIES AND EQUITY The information concerning liquidation are as follows: 1. Accounts receivable's net carrying value plus 20% of the estimated bad debts were collected. 2. Merchandise inventory were realized for P 25,000 3. The contract for Prepaid Advertising has a cancellation value of P 800. 4. Office Equipment were realized equal to 60% of their book value. 5. Unrecorded Accounts Payable…arrow_forwardOn October 01, 2019, Benny and Joey pooled their resources in a partnership with the firm taking over their business assets and assuming their business liabilities. They agreed to make the following adjustments and to make settlement among themselves to conform to the 40:60 capital and profit and loss ratio. ➢ Joey’s inventory be reduced by P3,000. ➢ Allowance for doubtful accounts be recognized in the amount of P1,500 each. ➢ P4,000 of unrecorded accounts payable to supplier be recorded in the books of Benny ➢ Accrued utilities be recognized in the books of Benny, P1,200. ➢ Store equipment in the books of Joey are under depreciated by P5,000. The individual trial balance before adjustments show the following: BennyJoey AssetsP120,000P150,000 Liabilities 25,000 35,000 Capital 95,000 115,000 The capital balances of the partners that conform with their agreement are: Benny: ___________________Joey: _____________________arrow_forwardOn July 1, 2020, Wency and William agreed to form a partnership from their respective proprietorship businesses and to share profits equally. Wency and William’s balance sheet before the formation were: Wency William Cash P 6,000 P 15,000 Accounts receivable 36,000 21,000 Merchandise inventory 99,000 126,000 Prepaid rent 12,000 Store equipment 120,000 90,000 Accum. Depreciation ( 45,000) ( 54,000) Building 375,000 Accum. Depreciation (75,000) Land 180,000 - Totals P 696,000 P 210,000 Accounts payable P 22,500 P 9,000 Mortgage payable 180,000 - Capital 493,500 201,000 Totals P 696,000 P 210,000 The fair values of Wency’s and William’s assets were: Wency William Merchandise inventory P 81,000 P 135,000 Prepaid rent - 0 Store equipment 45,000 19,500 Building 750,000 -…arrow_forward

- On May 1 of the current year, Anna Austin and Dave Walls form a partnership. Austin agrees toinvest $10,500 in cash and merchandise inventory valued at $39,500. Walls invests certainbusiness assets at valuations agreed upon, transfers business liabilities, and contributes sufficientcash to bring his total capital to $40,000. Details regarding the book values of the businessassets and liabilities, and the agreed valuations, follow: Wall’s Ledger Balance Agreed Valuation Accounts Receivable $20,750 $19,500 Allowance for Doubtful Accounts 950 800 Equipment 79,100} 45,000 Accumulated Depreciation 35,200} Accounts Payable 14,000 14,000 Notes Payable 15,000 15,000 (See Image) Required: 3. After adjustments and the closing of revenue and expense accounts at April 30. the end of the first full year of operations, the income summary account has a credit balance of $68,000, and the drawing accounts have debit balances of $20,000…arrow_forwardWhat is the journal entry to record the revaluation of the assets on June 5 prior to the dissolution of the firm?arrow_forwardBen, Bev, and Ron are partners in a business that is in the process of liquidation. On January 1, 2016, the ledger accounts show the balances indicated: Cash $25,000 Ben capital $72,000 Inventory 72,000 Bev capital 28,000 Supplies 18,000 Ron capital 15,000 The cash is distributed to partners on January 1, 2016. Inventory and supplies are sold for a lump-sum price of $81,000 on February 9, 2016, and on February 10, 2016, cash on hand is distributed to the partners in final liquidation of the business. RequiredPrepare the journal entry to distribute available cash on January 1, 2016. Include a safe payments schedule as proper explanation of who should receive cash. Prepare journal entries necessary on February 9, 2016, to record the sale of assets and distribution of the gain or loss to the partners’ capital accounts. Prepare the journal entry to distribute cash on February 10, 2016, in final liquidation of the business.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License