Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 3PB

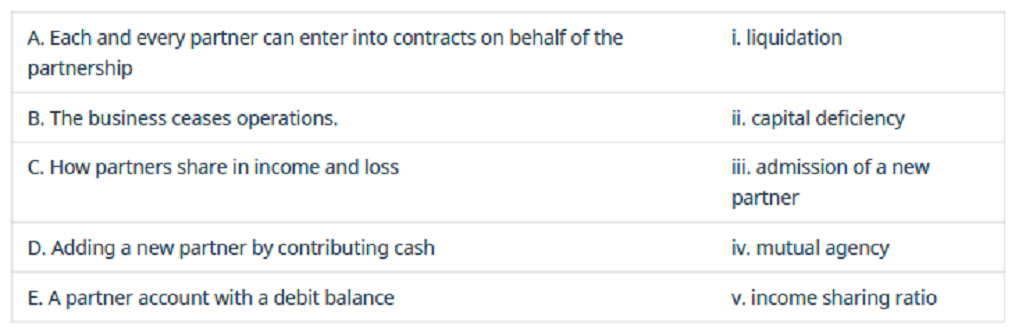

Match each of the following descriptions with the appropriate term related to

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you solve this general accounting problem with appropriate steps and explanations?

No WRONG ANSWER

I need help with this general accounting question using standard accounting techniques.

Chapter 15 Solutions

Principles of Accounting Volume 1

Ch. 15 - A partnership ________. A. has one owner B. can...Ch. 15 - Any assets invested by a particular partner in a...Ch. 15 - Which of the following is a disadvantage of the...Ch. 15 - Mutual agency is defined as: A. a mutual agreement...Ch. 15 - Chani contributes equipment to a partnership that...Ch. 15 - Juan contributes marketable securities to a...Ch. 15 - Which one of the following would not be considered...Ch. 15 - A well written partnership agreement should...Ch. 15 - What type of assets may a partner not contribute...Ch. 15 - How does a newly formed partnership handle the...

Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - Thandie and Marco are partners with capital...Ch. 15 - When a partnership dissolves, the first step in...Ch. 15 - When a partnership dissolves, the last step in the...Ch. 15 - Prior to proceeding with the liquidation, the...Ch. 15 - Does a partnership pay income tax?Ch. 15 - Can a partners personal assets in a limited...Ch. 15 - Can a partnership assume liabilities as part of...Ch. 15 - Does each partner have to contribute an equal...Ch. 15 - What types of bases for dividing partnership net...Ch. 15 - Angela and Agatha are partners in Double A...Ch. 15 - On February 3, 2016 Sam Singh invested $90,000...Ch. 15 - Why do partnerships dissolve?Ch. 15 - What are the four steps involved in liquidating a...Ch. 15 - When a partner withdraws from the firm, which...Ch. 15 - What is the first step in a partnership...Ch. 15 - When a partnership liquidates, do partners get...Ch. 15 - Coffee Partners decides to close due to the...Ch. 15 - On May 1, 2017, BJ and Paige formed a partnership....Ch. 15 - The partnership of Chase and Chloe shares profits...Ch. 15 - The partnership of Tasha and Bill shares profits...Ch. 15 - Cheese Partners has decided to close the store. At...Ch. 15 - The partnership of Michelle, Amal, and Maureen has...Ch. 15 - The partnership of Tatum and Brook shares profits...Ch. 15 - Arun and Margot want to admit Tammy as a third...Ch. 15 - When a partnership is liquidated, any gains or...Ch. 15 - The partnership of Magda and Sue shares profits...Ch. 15 - The partnership of Arun, Margot, and Tammy has...Ch. 15 - Match each of the following descriptions with the...Ch. 15 - While sole proprietorships and corporations are...Ch. 15 - A partnership is thriving. The three partners get...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Capital structure theory) Match each of the following definitions to the appropriate terms:

Foundations Of Finance

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (5th Edition)

Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

The change in equity cost of capital, debt cost of capital, and the weighted average cost of capital when a fir...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditio...

Engineering Economy (17th Edition)

Determining Acquisition Cost. Tarpley, Inc. acquired land for 400,000. The closing costs amounted to 11,000, an...

Intermediate Accounting (2nd Edition)

Knowledge Booster

Similar questions

- Innovations Inc. had a $38,000 beginning inventory and a $45,000 ending inventory. Net sales were $215,000; purchases were $110,000; purchase returns and allowances were $5,000; and freight-in was $9,000. Cost of goods sold for the period is $107,000. What is Innovations Inc.'s gross profit percentage?arrow_forwardCompute Lancaster taxable income for the year.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

- I am looking for the most effective method for solving this financial accounting problem.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation technical.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardMeagan Industries completes Job #843, which has a standard of 450 labor hours at a standard rate of $24.50 per hour. The job was completed in 420 hours, and the average actual labor rate was $25.20 per hour. What is the labor efficiency (quantity) variance?arrow_forwardSolve this Accounting Problemarrow_forward

- Harmony Beverages produces a fruit juice blend using three ingredients: Apple, Orange, and Mango. The standard mix ratio is 50% Apple, 30% Orange, and 20% Mango. The standard cost per gallon is $2.00 for Apple, $3.50 for Orange, and $5.00 for Mango. Standard production calls for 100 gallons of ingredients to yield 95 gallons of finished juice due to waste. Last week, the company used 60 gallons of Apple, 25 gallons of Orange, and 20 gallons of Mango, which yielded 98 gallons of finished juice. Calculate the materials yield variance.arrow_forwardWhat is the company's projected net operating profit after tax for 2024?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,