Segment Reporting

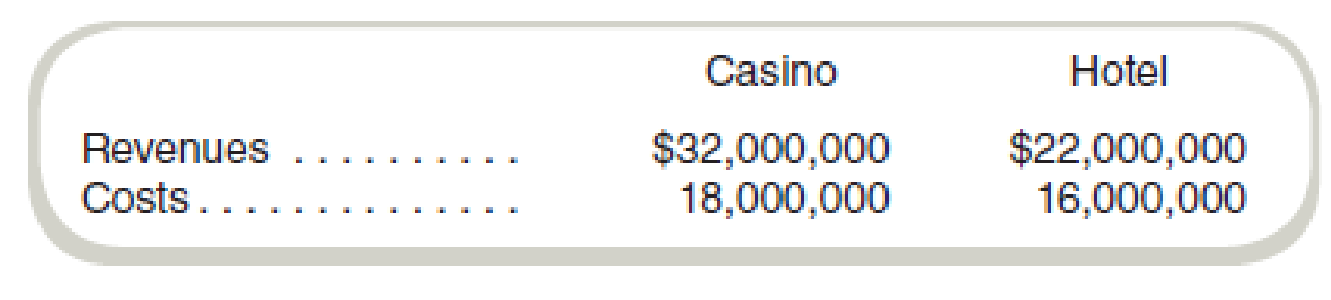

Perth Corporation has two operating divisions, a casino and a hotel. The two divisions meet the requirements for segment disclosures. Before transactions between the two divisions are considered, revenues and costs are as follows:

The casino and the hotel have a joint marketing arrangement by which the hotel gives coupons redeemable at casino slot machines and the casino gives discount coupons good for stays at the hotel. The value of the coupons for the slot machines redeemed during the past year totaled $4,800,000. The discount coupons redeemed at the hotel totaled $2,000,000. As of the end of the year, all coupons for the current year expired.

Required

What are the operating profits for each division considering the effects of the costs arising from the joint marketing agreement?

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

FUNDAMENTAL'S OF COST ACCOUNTING LL

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning