Financial And Managerial Accounting

15th Edition

ISBN: 9781337912143

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 2MAD

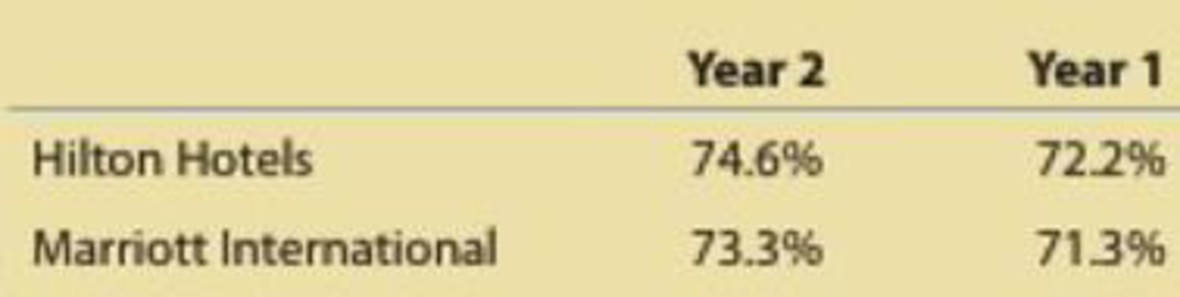

Hilton Hotels and Marriott International: Occupancy

A recent annual report of Hilton Hotels and Marriott International provided the following occupancy data for two recent years:

- A. Is the occupancy trend favorable or unfavorable for Hilton Hotels?

- B. Is the occupancy trend favorable or unfavorable for Marriott International?

- C. Which company has the stronger occupancy?

- D. What additional information would supplement occupancy in evaluating the performance of these two hotels?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Help needed

What was the total cost of completed projects during the period for the financial accounting?

What was the interest earned ratio for the year on these financial accounting question?

Chapter 15 Solutions

Financial And Managerial Accounting

Ch. 15 - What are the major differences between managerial...Ch. 15 - Prob. 2DQCh. 15 - Prob. 3DQCh. 15 - Distinguish between prime costs and conversion...Ch. 15 - What is the difference between a product cost and...Ch. 15 - Name the three inventory accounts for a...Ch. 15 - In what order should the three inventories of a...Ch. 15 - What are the three categories of manufacturing...Ch. 15 - How do the manufacturing costs incurred during a...Ch. 15 - How does the Cost of goods sold section of the...

Ch. 15 - Management process Three phases of the management...Ch. 15 - Direct materials, direct labor, and factory...Ch. 15 - Prob. 3BECh. 15 - Product and period costs Identify the following...Ch. 15 - Cost of goods sold, cost of goods manufactured...Ch. 15 - Prob. 6BECh. 15 - Prob. 1ECh. 15 - Indicate whether the following costs of Procter ...Ch. 15 - Prob. 3ECh. 15 - For apparel manufacturer Abercrombie Fitch, Inc....Ch. 15 - From the choices presented in parentheses, choose...Ch. 15 - From the choices presented in parentheses, choose...Ch. 15 - Classifying costs In a service company A partial...Ch. 15 - Classifying costs The following is a manufacturing...Ch. 15 - Financial statements of a manufacturing firm The...Ch. 15 - Manufacturing company balance sheet Partial...Ch. 15 - Cost of direct materials used in production for a...Ch. 15 - Cost of goods manufactured for a manufacturing...Ch. 15 - Cost of goods manufactured for a manufacturing...Ch. 15 - Income statement for a manufacturing company Two...Ch. 15 - Statement of cost of goods manufactured for a...Ch. 15 - Cost of goods sold, profit margin, and net income...Ch. 15 - Cost flow relationships The following information...Ch. 15 - The following is a list of costs that were...Ch. 15 - The following is a list of costs incurred by...Ch. 15 - A partial list of Foothills Medical Centers costs...Ch. 15 - Manufacturing income statement, statement of cost...Ch. 15 - Statement of cost of goods manufactured and income...Ch. 15 - The following is a list of costs that were...Ch. 15 - Prob. 2PBCh. 15 - A partial list of The Grand Hotels costs follows:...Ch. 15 - Several items are omitted from the income...Ch. 15 - Statement of cost of goods manufactured and income...Ch. 15 - Comfort Plus, Inc., has a hotel with 300 rooms in...Ch. 15 - Hilton Hotels and Marriott International:...Ch. 15 - Comparing occupancy for two hotels Sunrise Suites...Ch. 15 - Prob. 4MADCh. 15 - Prob. 5MADCh. 15 - Prob. 1TIFCh. 15 - Communication Todd Johnson is the Vice President...Ch. 15 - For each of the following managers, describe how...Ch. 15 - The following situations describe scenarios that...Ch. 15 - Geek Chic Company provides computer repair...Ch. 15 - Which of the following items would not be...Ch. 15 - Prob. 2CMACh. 15 - A firm has 100,000 in direct materials costs,...Ch. 15 - In practice, items such as wood screws and glue...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need help this questionsarrow_forwardquestion 1. Toodles Inc. had sales of $1,840,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an income statement and compute its OCF?Question 2 Anti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes = $76,000; Dividends = $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capitalQuestion 3Footfall Manufacturing Ltd. reports the following financial information at the end of the current year:…arrow_forwardhi expert please help mearrow_forward

- compared to the individual risks of constituting assets. Question 5 (6 marks) The common shares of Almond Beach Inc, have a beta of 0.75, offer a return of 9%, and have an historical standard deviation of return of 17%. Alternatively, the common shares of Palm Beach Inc. have a beta of 1.25, offer a return of 10%, and have an historical standard deviation of return of 13%. Both firms have a marginal tax rate of 37%. The risk-free rate of return is 3% and the expected rate of return on the market portfolio is 9½%. 1. Which company would a well-diversified investor prefer to invest in? Explain why and show all calculations. 2. Which company Would an investor who can invest in the shares of only one firm prefer to invest in? Explain why. RELEASED BY THE CI, MGMT2023, MARCH 2, 2025 5 Use the following template to organize and present your results: Theoretical CAPM Actual offered prediction for expected return (%) return (%) Standard deviation of return (%) Beta Almond Beach Inc. Palm Beach…arrow_forwardprovide correct answerarrow_forwardPlease solve. The screen print is kind of split. Please look carefully.arrow_forward

- Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardCoronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardThe completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license