South-Western Federal Taxation 2019: Individual Income Taxes (Intuit ProConnect Tax Online 2017 & RIA Checkpoint 1 term (6 months) Printed Access Card)

42nd Edition

ISBN: 9781337702546

Author: James C. Young, William H. Hoffman, William A. Raabe, David M. Maloney, Annette Nellen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 2CPA

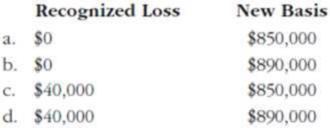

Chad owned an office building that was destroyed in a tornado. The area was declared a Federal disaster area. The adjusted basis of the building at the time was $890,000. After the deductible, Chad received an insurance check for $850,000. He used the $850,000 to purchase a new building that same year. How much is Chad’s recognized loss, and what is his basis in the new building?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Johnson owned a business-use office

building that was destroyed in a flood. The

adjusted basis at the time was $890k.

Johnson got an insurance check for $850k.

He used the $850k to buy a new building in

the same year that the flood hit. How much is

Johnson's recognized loss, what is his new

building's basis?

Fenwick operates a grocery store and his retail building was completely destroyed by a hurricane on August 22, Year 10. The fair market value of the building before the hurricane was $1,200,000 with an adjusted basis of $800,000. His insurance company reimbursed him $1,200,000 of December 2, Year 10. When is the last date that Fenwick can replace this building with qualifying property and avoid recognizing gain from this transaction?

Rebecca Botson purchased a personal residence for $286,000. It had a fair market value of $300,000 in the current year when it was damaged by a flood that resulted in the entire area being declared a federal disaster area. The fair market value after the flood was $240,000 and insurance proceeds totaled $15,000. What is the net amount of federal casualty loss she can claim if her adjusted gross income is $120,000?

Chapter 15 Solutions

South-Western Federal Taxation 2019: Individual Income Taxes (Intuit ProConnect Tax Online 2017 & RIA Checkpoint 1 term (6 months) Printed Access Card)

Ch. 15 - Prob. 1DQCh. 15 - Prob. 2DQCh. 15 - Prob. 3DQCh. 15 - Prob. 4DQCh. 15 - LO.2 Melissa owns a residential lot in Spring...Ch. 15 - LO.2 Ross would like to dispose of some land he...Ch. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQ

Ch. 15 - Prob. 11DQCh. 15 - Prob. 12DQCh. 15 - Prob. 13DQCh. 15 - Prob. 14DQCh. 15 - Prob. 15DQCh. 15 - Prob. 16CECh. 15 - Prob. 17CECh. 15 - Prob. 18CECh. 15 - Prob. 19CECh. 15 - Prob. 20CECh. 15 - LO.3 Camilos property, with an adjusted basis of...Ch. 15 - Prob. 22CECh. 15 - Prob. 23CECh. 15 - Prob. 24CECh. 15 - Prob. 25CECh. 15 - Prob. 26CECh. 15 - Prob. 27PCh. 15 - Prob. 28PCh. 15 - Prob. 29PCh. 15 - Prob. 30PCh. 15 - Prob. 31PCh. 15 - Prob. 32PCh. 15 - Prob. 33PCh. 15 - Ed owns investment land with an adjusted basis of...Ch. 15 - Prob. 35PCh. 15 - Prob. 36PCh. 15 - Prob. 37PCh. 15 - Prob. 38PCh. 15 - Prob. 39PCh. 15 - Prob. 40PCh. 15 - LO.3 Howards roadside vegetable stand (adjusted...Ch. 15 - Prob. 42PCh. 15 - Prob. 43PCh. 15 - Prob. 44PCh. 15 - Prob. 45PCh. 15 - Prob. 46PCh. 15 - What are the maximum postponed gain or loss and...Ch. 15 - Prob. 48PCh. 15 - Prob. 49PCh. 15 - Prob. 50PCh. 15 - Prob. 51PCh. 15 - Prob. 52PCh. 15 - Prob. 53PCh. 15 - Prob. 54PCh. 15 - Prob. 55PCh. 15 - Prob. 56PCh. 15 - Prob. 57CPCh. 15 - Prob. 1RPCh. 15 - Prob. 2RPCh. 15 - Taylor owns a 150-unit motel that was constructed...Ch. 15 - Prob. 5RPCh. 15 - Prob. 1CPACh. 15 - Chad owned an office building that was destroyed...Ch. 15 - Prob. 3CPACh. 15 - Marsha exchanged land used in her business in...Ch. 15 - Prob. 5CPACh. 15 - Prob. 6CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alicia's automobile destroyed in a tornado on 5/4/2021. This did not occur in a Federally declared disaster area. Her car was used 70% for business and 30% for personal use. The car had originally cost $40,000. At the time of the accident, the car was worth $20,000 and Alicia had taken $8,000 of depreciation. The car was totally destroyed and Alicia had let her car insurance expire. If her AGI is $50,000 (before considering the loss), determine her AGI and itemized deduction for the casualty loss. $34,000;$-0- $30,000;$-0- $26,000;$5,700 None of these $34,000;$4,500arrow_forwardJes had a personal casualty loss in 20X1 due to a hurricane damaging his home. The area where his loss occurred was a declared federal disaster area. Jes’s 20X1 adjusted gross income was $ 200,000. • The fair market value of John’s home before the casualty was $ 450,000, the fair market value after the casualty was $ 275,000.• John purchased his home 6 years ago for $ 150,000 and made no capital improvements while he owned the house.• John received $ 110,000 from his insurance company due to this loss. How much will Jes deduct as a casualty loss in 20X1 if he itemizes his deductions? a. Zerob. $ 65,000c. $ 40,000d. $ 44,900e. $ 19,900arrow_forwardMr. and Mrs. Marcum live in southern California in an area devastated by wildfires that the President designated a federally declared disaster. Because of fire damage, the Marcums had to replace the roof of their home at a cost of $62,000. Their homeowners insurance reimbursed them for only $37,200 of the cost. The Marcums' $24,800 unreimbursed loss was their only casualty loss this year. Assume the taxable year is 2023. Required: a. Compute their deductible casualty loss if their AGI is $166,500. b. Compute their deductible casualty loss if their AGI is $383,500. Complete this question by entering your answers in the tabs below. Required Required B Compute their deductible casualty loss if their AGI is $166,500. Note: Leave no cells blank be sure to enter "0" wherever required. Mr. and Mrs Marcum's deductible casualty loss Required B >arrow_forward

- Christopher's main home was damaged by a tornado, and his county was later deemed a federal disaster area. He incurred $80,000 worth of damage to his home, but $65,000 was reimbursed by his homeowner's insurance. His basis in the home was $175,000 at the time of the tornado. Christopher's employer had a disaster relief fund for its employees. He received $5,000 from the fund and spent the entire amount on repairs to his home. What is Christopher's casualty loss (before the calculation of any limitations)? Group of answer choices $0 $10,000 $15,000 $5,000arrow_forwardIvy Gordon's home in Charleston was recently gutted in a fire. Her living and dining rooms were destroyed completely, and the damaged personal property had a replacement price of $36,000. The average age of the damaged personal property was 5 years, and its useful life was estimated to be 13 years. What is the maximum amount the insurance company would pay Ivy, assuming that it reimburses losses on an actual cash-value basis and has a $500 deductible? Assume that the total coverage requirement is met. Do not round intermediate calculations. Round the answer to the nearest cent.arrow_forward2. Jordan has some damages on his business property when tornado hit his area. Her truck was used 100 percent for business use in her sole proprietorship. The truck had originally cost $35,000 and she had taken $5,000 depreciation. At the time of the disaster, it was worth $25,000. After the accident, it was $0. She received insurance company's payment of $20,000. How much is her deducible casualty loss? What is her deductible casualty loss if the truck's residual value was $5,000? 3. Fill in the blanks on the following like-kind exchanges Boot FMV of Adjusted basis of given new asset old asset a. b. 17000 15000 4000 C. d. 16000 e. 7000 0 0 6000 0 0 14000 29000 8000 28000 12000 Boot Realized received Gain/(loss) 0 0 500 0 4000 Recognized Postponed gain/loss Gain/loss New basis of received propertyarrow_forward

- Alma is in the business of dairy farming. During the year, one of her barns was completely destroyed by fire. The adjusted basis of the barn was $90,000. The fair market value of the barn before the fire was $75,000. The barn was insured for 95% of its fair market value, and Alma recovered this amount under the insurance policy. She has adjusted gross income of $40,000 for the year (before considering the casualty). Determine the amount of loss she can deduct on her tax return for the current year.arrow_forward-Betty is an unmarried attorney. During the year a hurricane completely destroys her home, which had a basis of $60,000. The value of her home before the tornado is $100,000 and the value afterwards is $35,000. Betty's home is located in a federally declared natural disaster area. Her AGI is $50,000. What is the amount that Betty can deduct after limitations? Group of answer choices $29,900. $54,900. $59,900. $65,000.arrow_forwardIn the current year, Brit had a federally declared disaster fire hit her house that damaged a couch and completely destroyed a bed and an antique table. She had no fire insurance. The couch cost $300, the bed $450, and the table $65. Just before the fire, the couch had a fair market value of $70, the bed had a value of $275, and the table had a value of $200. After the fire, the couch was worth $20. Brit's casualty loss before any dollar limitations is А. $815 В. $545 С. $390 D. $525arrow_forward

- Eric and Susan just purchased their first home, which cost $166,000. They purchased a homeowner’s policy to insure the home for $156,000 and personal property for $93,000. They declined any coverage for additional living expenses. The deductible for the policy is $500. Soon after Eric and Susan moved into their new home, a strong windstorm caused damage to their roof. They reported the roof damage to be $26,000. While the roof was under repair, the couple had to live in a nearby hotel for three days. The hotel bill amounted to $680. Assuming the insurance company settles claims using the replacement value method, what amount will the insurance company pay for the damages to the roof?arrow_forwardA hurricane (federally declared disaster) destroyed the Palmer's boat. The couple purchased the boat for $30,000 ten years ago and it was appraised at a FMV of $35,000 before the hurricane. Unfortunately, the Palmers did not have insurance on their boat. Compute the Palmer's casualty loss deduction before applying the 10% AGI threshold? Question 35 Ms. Donor contributed $300.000 in cash to qualified charities this year during 2020. Her AGI was $275.000. How much is Ms. Donor's charitable contribution carry forward. if any. to 2021? (Ignore any temporary changes made to the charitable contribution rules for 2020 made by The Cares Act)arrow_forwardTeresa's manufacturing plant is destroyed by fire. The plant has an adjusted basis of $270,000, and Teresa receives insurance proceeds of $410,000 for the loss. Teresa reinvests $420,000 in a replacement plant within 2 years of receiving the insurance proceeds.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License