Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

7th Edition

ISBN: 9781337384285

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 27BEB

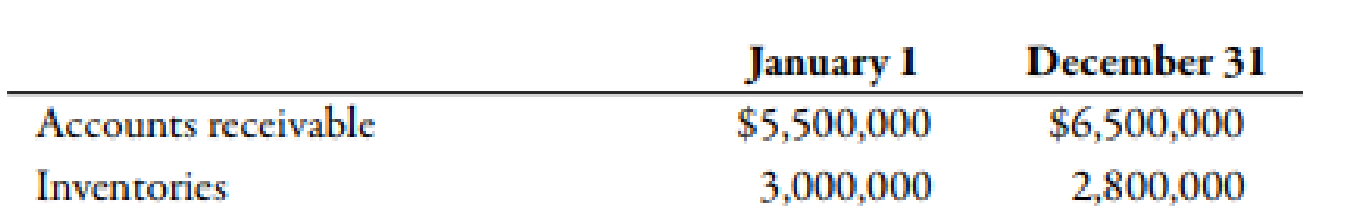

Last year, Toby’s Hats had net sales of $45,000,000 and cost of goods sold of $29,000,000. Toby’s had the following balances:

Refer to the information for Toby’s on the previous page.

Required:

Note: Round answers to one decimal place.

- 1. Calculate the average

accounts receivable . - 2. Calculate the accounts receivable turnover ratio.

- 3. Calculate the accounts receivable turnover in days.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Logan Enterprises purchased a forklift for $45,000 on January 1, 2018. The forklift has an expected salvage value of $2,500 and is expected to be used for 150,000 hours over its estimated useful life of 6 years. Actual usage was 17,500 hours in 2018 and 14,200 hours in 2019. Calculate depreciation expense per hour under the units-of-activity method. (Round the answer to 2 decimal places.) Correct answer

Provide answer

Logan Enterprises purchased a forklift for $45,000 on January 1, 2018. The forklift has an expected salvage value of $2,500 and is expected to be used for 150,000 hours over its estimated useful life of 6 years. Actual usage was 17,500 hours in 2018 and 14,200 hours in 2019. Calculate depreciation expense per hour under the units-of-activity method. (Round the answer to 2 decimal places.)

Chapter 15 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

Ch. 15 - Name the two major types of financial statement...Ch. 15 - Prob. 2DQCh. 15 - Explain how creditors, investors, and managers can...Ch. 15 - What are liquidity ratios? Leverage ratios?...Ch. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - A high inventory turnover ratio provides evidence...Ch. 15 - A loan agreement between a bank and a customer...Ch. 15 - Prob. 10DQ

Ch. 15 - Explain why an investor would be interested in a...Ch. 15 - Prob. 12DQCh. 15 - Prob. 13DQCh. 15 - When a company participates in a stock buyback...Ch. 15 - Explain the significance of the inventory turnover...Ch. 15 - In a JIT manufacturing environment, the current...Ch. 15 - Prob. 1MCQCh. 15 - Prob. 2MCQCh. 15 - Fractions or percentages computed by dividing one...Ch. 15 - Prob. 4MCQCh. 15 - Pedee Companys inventory turnover in days is 80...Ch. 15 - Prob. 6MCQCh. 15 - Prob. 7MCQCh. 15 - Prob. 8MCQCh. 15 - A small pizza restaurant, founded and owned by the...Ch. 15 - Prob. 10MCQCh. 15 - Prob. 11BEACh. 15 - Scherer Company provided the following income...Ch. 15 - Chen Company has current assets equal to...Ch. 15 - Last year, Nikkola Company had net sales of...Ch. 15 - Last year, Nikkola Company had net sales of...Ch. 15 - Paxton Company provided the following income...Ch. 15 - Ernst Companys balance sheet shows total...Ch. 15 - Prob. 18BEACh. 15 - Prob. 19BEACh. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - Jasmine Company provided the following income...Ch. 15 - Jasmine Company provided the following income...Ch. 15 - LoLo Lemon Company has current assets equal to...Ch. 15 - Last year, Tobys Hats had net sales of 45,000,000...Ch. 15 - Last year, Tobys Hats had net sales of 45,000,000...Ch. 15 - Alessandra Makeup Manufactures provided the...Ch. 15 - Klynveld Companys balance sheet shows total...Ch. 15 - Prob. 31BEBCh. 15 - Prob. 32BEBCh. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - Sundahl Companys income statements for the past 2...Ch. 15 - Sundahl Companys income statements for the past 2...Ch. 15 - Cuneo Companys income statements for the last 3...Ch. 15 - Cuneo Companys income statements for the last 3...Ch. 15 - Prob. 41ECh. 15 - Upton Company has current assets equal to...Ch. 15 - Montalcino Company had net sales of 54,000,000....Ch. 15 - Whalen Company had net sales of 125,500,250,000....Ch. 15 - Prob. 45ECh. 15 - Prob. 46ECh. 15 - Bryce Company manufactures pet supplies. However,...Ch. 15 - Prob. 48ECh. 15 - Prob. 49ECh. 15 - Juroe Company provided the following income...Ch. 15 - Juroe Company provided the following income...Ch. 15 - Juroe Company provided the following income...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - The following selected information is taken from...Ch. 15 - Grammatico Company has just completed its third...Ch. 15 - The following information has been gathered for...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Prob. 60PCh. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Albion Inc. provided the following information for...Ch. 15 - Prob. 65PCh. 15 - Prob. 66PCh. 15 - Prob. 67C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Original cost of fixed assets?arrow_forwardOn Jan 1, Year 1, White Co grants its three top employees, Mr. Blue, Ms. Orange, and Mrs. Green, 3,000 options each to purchase its $10-par common stock. Each option allows the purchase of 10 shares at $25 per share during Years 3 and 4. In order for these options to be exercisable, each of the top employees must demonstrate a high level of performance during years 1 and 2. The fair market value of these options was $90,000. At that grant date, Mr. Blue declined the offer. How much will White record for compensation expense each year for years 1 and 2?arrow_forwardYellow Co foresees the possibility of being unsuccessful in a lawsuit that may result in incurring a major loss associated with its related liability. Which of the following is correct? A If it is remote, and a guarantee was given, a disclosure is necessary, but not an accrual. B If it is probable, a disclosure is necessary, but not an accrual. C If it is probable, an accrual is necessary but not a disclosure. D If it is reasonably possible, neither accrual nor disclosure is necessary.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

HR Basics: Compensation; Author: HR Basics: Compensation;https://www.youtube.com/watch?v=wZoRId6ADuo;License: Standard Youtube License