Concept introduction:

Open Market Operations: It refers to the buying and selling of government securities by the Federal Reserve from or to the banking system with a view to prevent the economy from overheating or slipping into a recession.

Depository Institution: A depository institution is a financial institution that accepts deposits from its customers and renders various services to them.

Total Reserves: They are the total reserves held by a depository institution and consist of both required and excess reserves.

Answer:

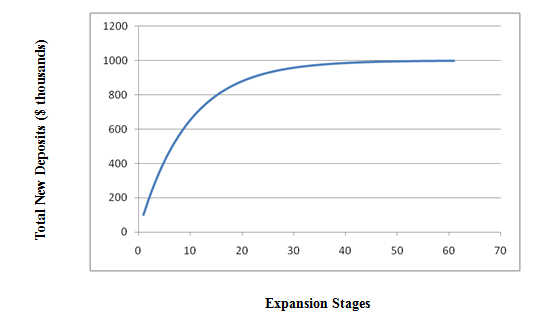

The figure shown below depicts that the Federal Reserve injects $ 100,000 into the banking system through an open market purchase and increases the excess reserves of the banking system. Increase in excess reserves increases the lending capacity of the banking system and thereby increases money supply by $ 1 million.

The potential money multiplier is 10.

The money supply will decrease by $ 1 million.

Explanation:

It is clear from the figure that if the Federal Reserve injects $ 100,000 into the banking system through an open market purchase, money supply in the economy expands by $ 1 million.

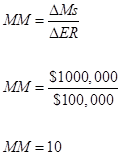

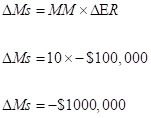

MM denotes money multiplier, △ER denotes change in excess reserves of the brought about by an open market purchase and △Ms denotes the resultant change in money supply.

The potential money multiplier can be calculated as follows:

Thus, the potential money multiplier is 10.

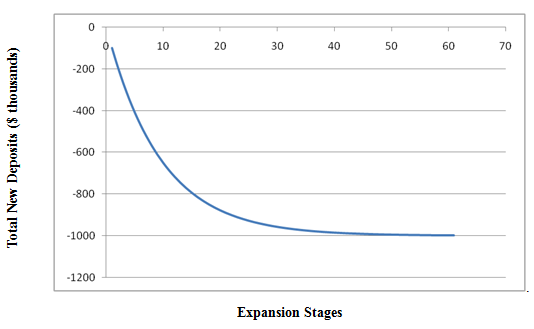

If the Federal Reserve withdrew $ 100,000 from the banking system through an open market sale, excess reserves of the banking system would contract by $100,000. As a result, money supply in the economy would contract over multiple rounds through the money multiplier process as shown in the figure below:

The change in money supply resulting from the open market sale can be calculated as follows:

Thus, the money supply would decrease by $ 1 million.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Economics Today: The Macro View (19th Edition) (Pearson Series in Economics)

- 1) Use the supply and demand schedules to graph the supply and demand functions. Find and show on the graph the equilibrium price and quantity, label it (A). P Q demanded P Q supplied 0 75 0 0 5 65 5 0 10 55 10 0 15 45 15 10 20 35 20 20 25 25 25 30 30 15 30 40 35 40 5 0 35 40 50 60 2) Find graphically and numerically the consumers and producers' surplus 3) The government introduced a tax of 10$, Label the price buyers pay and suppliers receive. Label the new equilibrium for buyers (B) and Sellers (S). How the surpluses have changed? Give the numerical answer and show on the graph. 4) Calculate using midpoint method the elasticity of demand curve from point (A) to (B) and elasticity of the supply curve from point (A) to (C).arrow_forwardFour heirs (A, B, C, and D) must divide fairly an estate consisting of three items — a house, a cabin and a boat — using the method of sealed bids. The players' bids (in dollars) are: In the initial allocation, player D Group of answer choices gets no items and gets $62,500 from the estate. gets the house and pays the estate $122,500. gets the cabin and gets $7,500 from the estate. gets the boat and and gets $55,500 from the estate. none of thesearrow_forwardJack and Jill are getting a divorce. Except for the house, they own very little of value so they agree to divide the house fairly using the method of sealed bids. Jack bids 140,000 and Jill bids 160,000. After all is said and done, the final outcome is Group of answer choices Jill gets the house and pays Jack $80,000. Jill gets the house and pays Jack $75,000. Jill gets the house and pays Jack $70,000. Jill gets the house and pays Jack $65,000. none of thesearrow_forward

- The problem statement never defines whether the loan had compound or simple interest. The readings indicate that the diference in those will be learned later, and the formula used fro this answer was not in the chapter. Should it be assumbed that a simple interest caluclaton should be used?arrow_forwardNot use ai pleasearrow_forwardNot use ai pleasearrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education