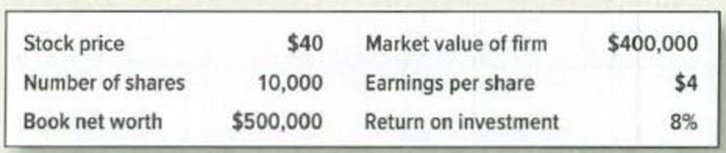

Dilution Here is recent financial data on Pisa Construction Inc.

Pisa has not performed spectacularly to date. However, it wishes to issue new shares to obtain $80,000 to finance expansion into a promising market. Pisa’s financial advisers think a stock issue is a poor choice because, among other reasons, “sale of stock at a price below book value per share can only depress the stock price and decrease shareholders’ wealth.” To prove the point they construct the following example: “Suppose 2,000 new shares are issued at $40 and the proceeds are invested. (Neglect issue costs.) Suppose

Thus, EPS declines, book value per share declines, and share price will decline proportionately to $38.70.”

Evaluate this argument with particular attention to the assumptions implicit in the numerical example.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Consider a situation involving determining right and wrong. Do you believe utilitarianism provides a more objective viewpoint than moral rights in this context? Why or why not? How about when comparing utilitarianism to principles of justice? Share your thoughts. Reflect on this statement: "Every principle of distributive justice, whether that of the egalitarian, the capitalist, the socialist, the libertarian, or Rawls, in the end is illegitimately advocating some type of equality." Do you agree or disagree with this assertion? Why might someone claim this, and how would you respond?arrow_forwardI need help checking my spreadsheet. Q: Assume that Temp Force’s dividend is expected to experience supernormal growth of 73%from Year 0 to Year 1, 47% from Year 1 to Year 2, 32% from Year 2 to Year 3 and 21% from year3 to year 4. After Year 4, dividends will grow at a constant rate of 2.75%. What is the stock’sintrinsic value under these conditions? What are the expected dividend yield and capital gainsyield during the first year? What are the expected dividend yield and capital gains yield duringthe fifth year (from Year 4 to Year 5)?arrow_forwardwhat are the five components of case study design? Please help explain with examplesarrow_forward

- Commissions are usually charged when a right is exercised. a warrant is exercised. a right is sold. all of the above will have commissions A and B are correct, C is not correctarrow_forwardWhat is Exploratory Research Case Study? What is the main purpose of Exploratory Research?arrow_forwardplease help with how to solve this thank you.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning