Construction Accounting And Financial Management (4th Edition)

4th Edition

ISBN: 9780135232873

Author: Steven J. Peterson MBA PE

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 22P

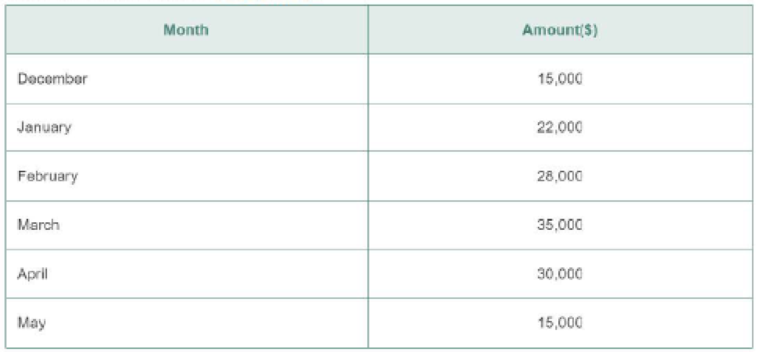

Determine the future value at the end of June for the

Table 15-6 Cash Flows for Problem 22

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

In 2014, LL Bean sold 450,000 pairs of boots. At one point in 2014, it had a back order of 100,000. In 2015, LL Bean expects to sell 500,000 pairs of boots. As of late November 2015, it has a back order of 50,000.Question: When would LL Bean see sales revenue from the sale of its back order on the boots?

Help me to solve this questions

correct answer please

Chapter 15 Solutions

Construction Accounting And Financial Management (4th Edition)

Ch. 15 - On what three things is equivalence based?Ch. 15 - Prob. 2DQCh. 15 - How do you find the interest rate at which two or...Ch. 15 - Prob. 4DQCh. 15 - How does inflation affect interest rates?Ch. 15 - Prob. 6DQCh. 15 - What is the future value, ten years from now, of...Ch. 15 - What is the future value, ten years from now, of...Ch. 15 - Prob. 9PCh. 15 - Prob. 10P

Ch. 15 - Prob. 11PCh. 15 - What is the future value, five years from now, of...Ch. 15 - Prob. 13PCh. 15 - Prob. 14PCh. 15 - Prob. 15PCh. 15 - Prob. 16PCh. 15 - Prob. 17PCh. 15 - Prob. 18PCh. 15 - Prob. 19PCh. 15 - Prob. 20PCh. 15 - Prob. 21PCh. 15 - Determine the future value at the end of June for...Ch. 15 - Prob. 23PCh. 15 - Prob. 24PCh. 15 - Prob. 25PCh. 15 - Prob. 26PCh. 15 - Prob. 27PCh. 15 - Prob. 28PCh. 15 - Prob. 29PCh. 15 - At what periodic interest rate is a 4,000 cash...Ch. 15 - Prob. 31PCh. 15 - Prob. 32PCh. 15 - Prob. 33PCh. 15 - Prob. 34PCh. 15 - How much money needs to be set aside today to...Ch. 15 - How much money needs to be set aside today to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Give this question financial accountingarrow_forward1.3 1.2.5 za When using a computerised accounting system, the paper work will be reduced in the organisation. Calculate the omitting figures: Enter only the answer next to the question number (1.3.1-1.3.5) in the NOTE. Round off to TWO decimals. VAT report of Comfy shoes as at 30 April 2021 OUTPUT TAX INPUT TAX NETT TAX Tax Gross Tax(15%) Gross (15%) Standard 75 614,04 1.3.1 Capital 1.3.2 9 893,36 94 924,94 Tax (15%) 1.3.3 Gross 484 782,70 75 849,08 -9 893,36 -75 849,08 Bad Debts TOTAL 1.3.4 4 400,00 1 922,27 14 737,42 -1 348,36 1.3.5 (5 x 2) (10arrow_forwardNonearrow_forward

- What was her capital gains yield? General accountingarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question:arrow_forwardWhat was her capital gains yield?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Debits and credits explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=n-lCd3TZA8M;License: Standard Youtube License