FINANCIAL & MANAGERIAL ACCW/CENGAGENOWV

15th Edition

ISBN: 9781337955423

Author: WARREN, JONES

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 1PB

The following is a list of costs that were incurred in the production and sale of lawn mowers:

- a. Attorney fees for drafting a new lease for headquarter offices

- b. Cash paid to outside firm for janitorial services for factory

- c. Commissions paid to sales representatives, based on the number of lawn mowers sold

- d. Cost of advertising in a national magazine

- e. Cost of boxes used in packaging lawn mowers

- f. Electricity used to run the robotic machinery

- g. Engine oil used in mower engines prior to shipment

- h. Factory cafeteria employees’ wages

- i. Filter for spray gun used to paint the lawn mowers

- j. Gasoline engines used for lawn mowers

- k. Hourly wages of operators of robotic machinery used in production

- l. License fees for use of patent for lawn mower blade, based on the number of lawn mowers produced

- m. Maintenance costs for new robotic factory equipment, based on hours of usage

- n. Paint used to coat the lawn mowers, the cost of which is immaterial to the cost of the final product

- o. Payroll taxes on hourly assembly line employees

- p. Plastic for outside housing of lawn mowers

- q. Premiums on insurance policy for factory buildings

- r. Property taxes on the factory building and equipment

- s. Salary of factory supervisor

- t. Salary of quality control supervisor who inspects each lawn mower before it is shipped

- u. Salary of vice president of marketing

- v. Steel used in producing the lawn mowers

- w. Steering wheels for lawn mowers

- x. Straight-line depreciation on the robotic machinery used to manufacture the lawn mowers

- y. Telephone charges for company controller’s office

- z. Tires for lawn mowers

Instructions

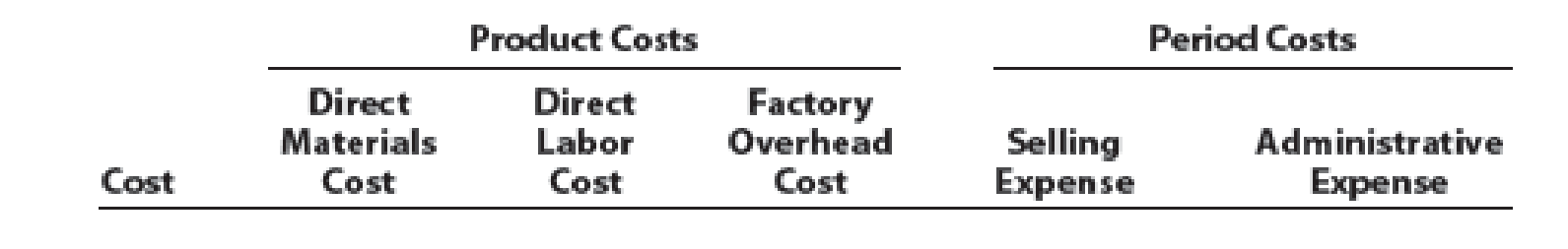

Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

A copy machine cost $78,000 when new and has accumulated depreciation of $72,000. Suppose Print and Photo Center sold the machine for $6,000. What is the result of this disposal transaction? Give me Answer

A copy machine cost $78,000 when new and has accumulated depreciation of $72,000. Suppose Print and Photo Center sold the machine for $6,000. What is the result of this disposal transaction?

Choose best answer

Chapter 15 Solutions

FINANCIAL & MANAGERIAL ACCW/CENGAGENOWV

Ch. 15 - What are the major differences between managerial...Ch. 15 - Prob. 2DQCh. 15 - Prob. 3DQCh. 15 - Distinguish between prime costs and conversion...Ch. 15 - What is the difference between a product cost and...Ch. 15 - Name the three inventory accounts for a...Ch. 15 - In what order should the three inventories of a...Ch. 15 - What are the three categories of manufacturing...Ch. 15 - How do the manufacturing costs incurred during a...Ch. 15 - How does the Cost of goods sold section of the...

Ch. 15 - Management process Three phases of the management...Ch. 15 - Direct materials, direct labor, and factory...Ch. 15 - Prob. 3BECh. 15 - Product and period costs Identify the following...Ch. 15 - Cost of goods sold, cost of goods manufactured...Ch. 15 - Prob. 6BECh. 15 - Prob. 1ECh. 15 - Indicate whether the following costs of Procter ...Ch. 15 - Prob. 3ECh. 15 - For apparel manufacturer Abercrombie Fitch, Inc....Ch. 15 - From the choices presented in parentheses, choose...Ch. 15 - From the choices presented in parentheses, choose...Ch. 15 - Classifying costs In a service company A partial...Ch. 15 - Classifying costs The following is a manufacturing...Ch. 15 - Financial statements of a manufacturing firm The...Ch. 15 - Manufacturing company balance sheet Partial...Ch. 15 - Cost of direct materials used in production for a...Ch. 15 - Cost of goods manufactured for a manufacturing...Ch. 15 - Cost of goods manufactured for a manufacturing...Ch. 15 - Income statement for a manufacturing company Two...Ch. 15 - Statement of cost of goods manufactured for a...Ch. 15 - Cost of goods sold, profit margin, and net income...Ch. 15 - Cost flow relationships The following information...Ch. 15 - The following is a list of costs that were...Ch. 15 - The following is a list of costs incurred by...Ch. 15 - A partial list of Foothills Medical Centers costs...Ch. 15 - Manufacturing income statement, statement of cost...Ch. 15 - Statement of cost of goods manufactured and income...Ch. 15 - The following is a list of costs that were...Ch. 15 - Prob. 2PBCh. 15 - A partial list of The Grand Hotels costs follows:...Ch. 15 - Several items are omitted from the income...Ch. 15 - Statement of cost of goods manufactured and income...Ch. 15 - Comfort Plus, Inc., has a hotel with 300 rooms in...Ch. 15 - Hilton Hotels and Marriott International:...Ch. 15 - Comparing occupancy for two hotels Sunrise Suites...Ch. 15 - Prob. 4MADCh. 15 - Prob. 5MADCh. 15 - Prob. 1TIFCh. 15 - Communication Todd Johnson is the Vice President...Ch. 15 - For each of the following managers, describe how...Ch. 15 - The following situations describe scenarios that...Ch. 15 - Geek Chic Company provides computer repair...Ch. 15 - Which of the following items would not be...Ch. 15 - Prob. 2CMACh. 15 - A firm has 100,000 in direct materials costs,...Ch. 15 - In practice, items such as wood screws and glue...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the value of ending inventory assuming the use of direct costing?arrow_forwardHow many time par year does the company turn over its accounts receivable?arrow_forwardThe following information is taken from the financial statements of a company for the current year: Current assets $ 3,95,000 Total assets $ 8,90,000 Cost of goods sold $ 6,50,000 Gross profit $ 2,00,000 $ 1,20,000 Net income The gross profit percentage for the current year: A. 24% B. 31% C. 76% D. 60%.arrow_forward

- Zeel Corporation has an inventory period of 48 days, an accounts receivable period of 8 days, and an accounts payable period of 5 days. The company's annual sales are $195,620. How many times per year does the company turn over its accounts receivable?arrow_forwardWhat is Anna's asset turnover forarrow_forward4 MCQarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost control, Why cost control is necessary for a business?; Author: Educationleaves;https://www.youtube.com/watch?v=yMg3gJx48Fg;License: Standard youtube license