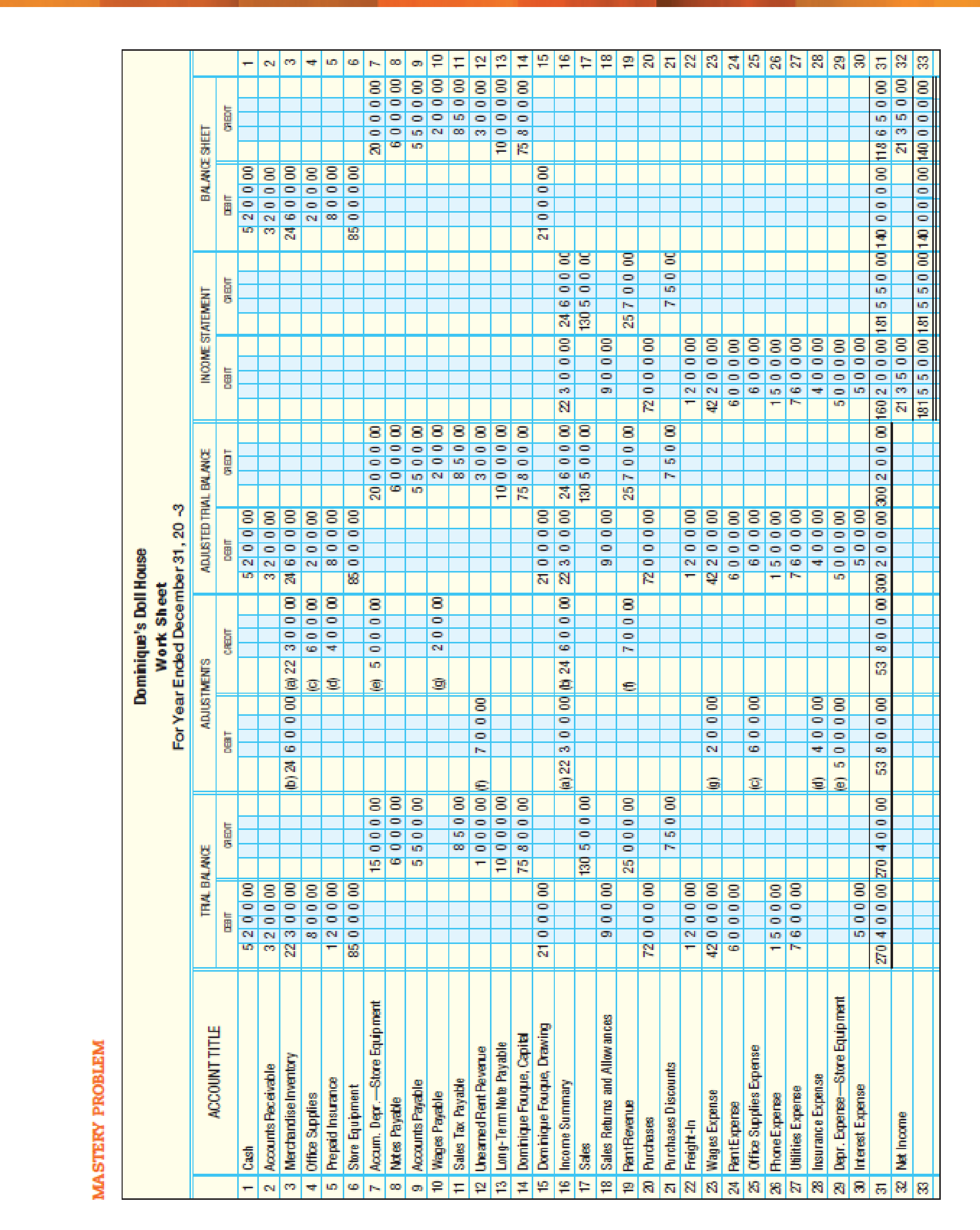

Dominique Fouque owns and operates Dominique’s Doll House. She has a small shop in which she sells new and antique dolls. She is particularly well known for her collection of antique Ken and Barbie dolls. A completed work sheet for 20-3 is shown on page 612. Fouque made no additional investments during the year and the long-term note payable is due in 20-9. No portion of the long-term note is due within the next year. Net credit sales for 20-3 were $35,300, and receivables on January 1 were $2,500.

REQUIRED

- 1. Prepare a multiple-step income statement.

- 2. Prepare a statement of owner’s equity.

- 3. Prepare a

balance sheet . - 4. Compute the following measures of performance and financial condition for 20-3:

- (a)

Current ratio - (b) Quick ratio

- (c)

Working capital - (d) Return on owner’s equity

- (e)

Accounts receivable turnover and average number of days required to collect receivables

- (e)

- (f) Inventory turnover and the average number of days required to sell inventory

- (a)

- 5. Prepare

adjusting entries and indicate which should be reversed and why. - 6. Prepare closing entries.

- 7. Prepare reversing entries for the adjustments where appropriate.

1.

Prepare a multi-step income statement of DD House.

Explanation of Solution

Multi-step income statement: The income statement represented in multi-steps with several subtotals, to report the income from principal operations, and separate the other expenses and revenues which affect net income, is referred to as multi-step income statement.

Prepare a statement of multi-step income statement.

| DD | |||

| Income Statement | |||

| For Year Ended December 31, 20-3 | |||

| Particulars | Amount | Amount | Amount |

| Revenue from sales: | |||

| Sales | $130,500 | ||

| Less: sales returns and allowances | $900 | ||

| Net sales | $129,600 | ||

| Cost of goods sold: | |||

| Merchandise inventory, Jan. 1, 20-3 | $22,300 | ||

| Purchases | $72,000 | ||

| Less: Purchases discounts | $750 | ||

| Net purchases | $71,250 | ||

| Add freight-in | 1,200 | ||

| Cost of goods purchased | 72,450 | ||

| Goods available for sale | $94,750 | ||

| Less: march. inventory, Dec. 31, 20-3 | 24,600 | ||

| Cost of goods sold | $70,150 | ||

| Gross profit | $59,450 | ||

| Operating expenses: | |||

| Wages expense | $42,200 | ||

| Rent expense | $6,000 | ||

| Office supplies expense | $600 | ||

| Phone expense | $1,500 | ||

| Utilities expense | $7,600 | ||

| Insurance expense | $400 | ||

| Depreciation expense—store equipment | $5,000 | ||

| Total operating expenses | $63,300 | ||

| Income (loss) from operations | ($3,850) | ||

| Other revenues: | |||

| Rent revenue | $25,700 | ||

| Other expenses: | |||

| Interest expense | ($500) | $25,200 | |

| Net income | $21,350 | ||

Table (1)

2.

Prepare a statement of owners’ equity of DD house.

Explanation of Solution

Statement of Owners’ equity: This statement reports the beginning stockholder's equity and all the changes which led to ending stockholder's equity. Additional capital, net income from income statement is added to and drawings or dividends are deducted from beginning stockholder's equity to arrive at the end result, closing balance of stockholder's equity.

Prepare an owners’ equity statement.

| DD | ||

| Statement of Owner’s Equity | ||

| For Year Ended December 31, 20-3 | ||

| Particulars | Amount | Amount |

| DF's, capital, January 1, 20-3 | $75,800 | |

| Net income for the year | $21,350 | |

| Less: withdrawals for the year | $21,000 | |

| Add: Increase in capital | $350 | |

| DF's, capital, December 31, 20-3 | $76,150 | |

Table (2)

3.

Prepare a balance sheet of DD House.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare a balance sheet.

| DD | ||

| Balance Sheet | ||

| For Year Ended December 31, 20-3 | ||

| Amount | Amount | |

| Assets | ||

| Current assets: | ||

| Cash | $5,200 | |

| Accounts receivable | $3,200 | |

| Merchandise inventory | $24,600 | |

| Office supplies | $200 | |

| Prepaid insurance | $800 | |

| Total current assets | $34,000 | |

| Property, plant, and equipment: | ||

| Store equipment | $85,000 | |

| Less accumulated depreciation | $20,000 | $65,000 |

| Total assets | $99,000 | |

| Liabilities | ||

| Current liabilities: | ||

| Notes payable | $6,000 | |

| Accounts payable | $5,500 | |

| Wages payable | $200 | |

| Sales tax payable | $850 | |

| Unearned rent revenue | $300 | |

| Total current liabilities | $12,850 | |

| Long-term liabilities: | ||

| Long-term note payable | $10,000 | |

| Total liabilities | $22,850 | |

| Owner’s Equity | ||

| DF's, capital | $76,150 | |

| Total liabilities and owner’s equity | $99,000 | |

Table (3)

4.

Compute the following measures of performance and financial condition for 20-3.

- (a) Current ratio

- (b) Quick ratio

- (c) Working capital

- (d) Return on owners’ equity

- (e) Accounts receivable turnover and average number of days required to collect receivables.

- (f) Inventory turnover and the average number of days required to sell inventory.

Explanation of Solution

(a)

Current ratio: The financial ratio which evaluates the ability of a company to pay off the debt obligations which mature within one year or within completion of operating cycle is referred to as current ratio. This ratio assesses the liquidity of a company.

Calculate current ratio.

(b)

Quick ratio: The financial ratio which evaluates the ability of a company to pay off the instant debt obligations is referred to as quick ratio. Quick assets are cash, marketable securities, and accounts receivables. This ratio assesses the short-term liquidity of a company.

Calculate quick ratio.

(c)

Working capital: Working capital refers to the excess amount of current assets over its current liabilities of a business. It measures the excess funds that are required for the companies to carry out their day to day operations, excluding any new funds that have been invested during the year.

Calculate working capital.

(d)

Calculate return on owners’ equity.

(e)

Calculate accounts receivable turnover and average collection period.

(f)

Calculate inventory turnover and average days to sell inventory.

5.

Prepare adjusting entries and indicate which should be reversed and why.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries.

| Date | Account titles and Explanation | Debit | Credit | |

| December 31 | a. | Income summary | $22,300 | |

| Merchandise inventory | $22,300 | |||

| December 31 | b. | Merchandise inventory | $24,600 | |

| Income summary | $24,600 | |||

| December 31 | c. | Office supplies expense | $600 | |

| Office supplies | $600 | |||

| December 31 | d. | Insurance expense | $400 | |

| Prepaid insurance | $400 | |||

| December 31 | e. | Depreciation expense - Store equipment | $5,000 | |

| Accumulated depreciation - Store equipment | $5,000 | |||

| December 31 | f. | Unearned rent revenue | $700 | |

| Rent revenue | $700 | |||

| December 31 | g. | Wages expense | $200 | |

| Wages payable | $200 |

Table (4)

Indicate the adjusting entry that should be reversed.

- a. Never reverse adjustments for merchandise inventory.

- b. Never reverse adjustments for merchandise inventory.

- c. No. No asset or liability with a zero balance has been increased.

- d. No. No asset or liability with a zero balance has been increased.

- e. Never reverse adjustments for depreciation.

- f. No. No asset or liability with a zero balance has been increased.

- g. Yes. A liability with a zero balance has been increased.

6.

Prepare closing entries.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries.

| Date | Account titles and Explanation | Debit | Credit |

| December 31 | Sales | $130,500 | |

| Rent revenue | $25,700 | ||

| Purchase discounts | $750 | ||

| Income summary | $156,950 | ||

| Income summary | $137,900 | ||

| Sales returns and allowances | $900 | ||

| Purchases | $72,000 | ||

| Freight in | $1,200 | ||

| Wages expense | $42,200 | ||

| Rent expense | $6,000 | ||

| Office supplies expense | $600 | ||

| Phone expense | $1,500 | ||

| Utilities expense | $7,600 | ||

| Insurance expense | $400 | ||

| Depreciation expense - store equipment | $5,000 | ||

| Interest expense | $500 | ||

| Income summary | $21,350 | ||

| DF's Capital | $21,350 | ||

| DF's Capital | $21,000 | ||

| DF's Drawings | $21,000 |

Table (5)

7.

Prepare reversing entry.

Explanation of Solution

Reversing entry: Entries made on the first day of the next accounting cycle, and it abridges the recording transactions in the different period. It is an opposite of adjusting entry.

Prepare reversing entry

| Date | Account titles and Explanation | Debit | Credit |

| January 1 - 20-4 | Wages payable | $200 | |

| Wages expense | $200 |

Table (6)

Want to see more full solutions like this?

Chapter 15 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

- Provide correct answer general accounting questionarrow_forwardOn average, FurniStyle Ltd. is able to sell its inventory in 30 days. The firm takes 90 days on average to pay for its purchases. On the other hand, its average customer pays with a credit card, which allows the firm to collect its receivables in 6 days. What is the length of the operating cycle?arrow_forwardwhat is the cost of goods sold.arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT