Concept explainers

Comprehensive Problem 2:

Accounting Cycle with Subsidiary Ledgers, Part 1

During the second half of December 20-1, TJ’s Specialty Shop engaged in the following transactions:

CengageNowv2 provides “Show Me How” videos for selected exercises and problems. Additional resources, such as Excel templates for completing selected exercises and problems, are available for download from the companion website at Cengage.com.

Dec. 16 Received payment from Lucy Greene on account, $1,960.

16 Sold merchandise on account to Kim Fields, $160, plus sales tax of $8. Sale No. 640.

17 Returned merchandise to Evans Essentials for credit, $150.

18 Issued Check No. 813 to Evans Essentials in payment of December 1 balance of $1,250, less the credit received on December 17.

19 Sold merchandise on account to Lucy Greene, $620, plus tax of $31. Sale No. 641.

22 Received payment from John Dempsey on account, $1,560.

23 Issued Check No. 814 for the purchase of supplies, $120. (Debit Supplies)

24 Purchased merchandise on account from West Wholesalers, $1,200.

Invoice No. 465, dated December 24, terms n/30.

26 Purchased merchandise on account from Nathen Co., $800.

Invoice No. 817, dated December 26, terms 2/10, n/30.

27 Issued Check No. 815 to KC Power & Light (Utilities Expense) for the month of December, $630.

27 Sold merchandise on account to John Dempsey, $2,020, plus tax of $101. Sale No. 642.

29 Received payment from Martha Boyle on account, $2,473.

29 Issued Check No. 816 in payment of wages (Wages Expense) for the two-week period ending December 28, $1,100.

30 Issued Check No. 817 to Meyers Trophy Shop for a cash purchase of merchandise, $200.

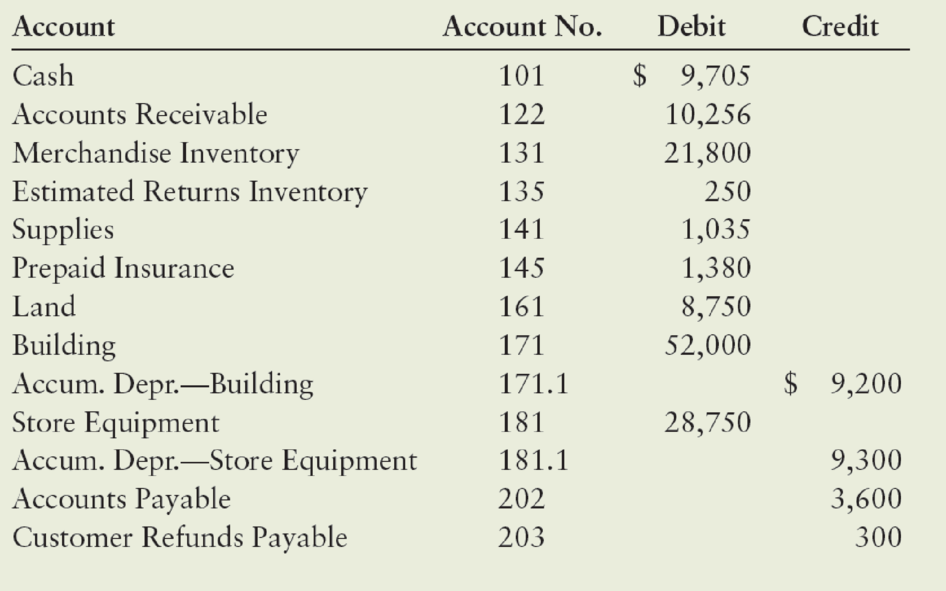

As of December 16, TJ’s account balances were as follows:

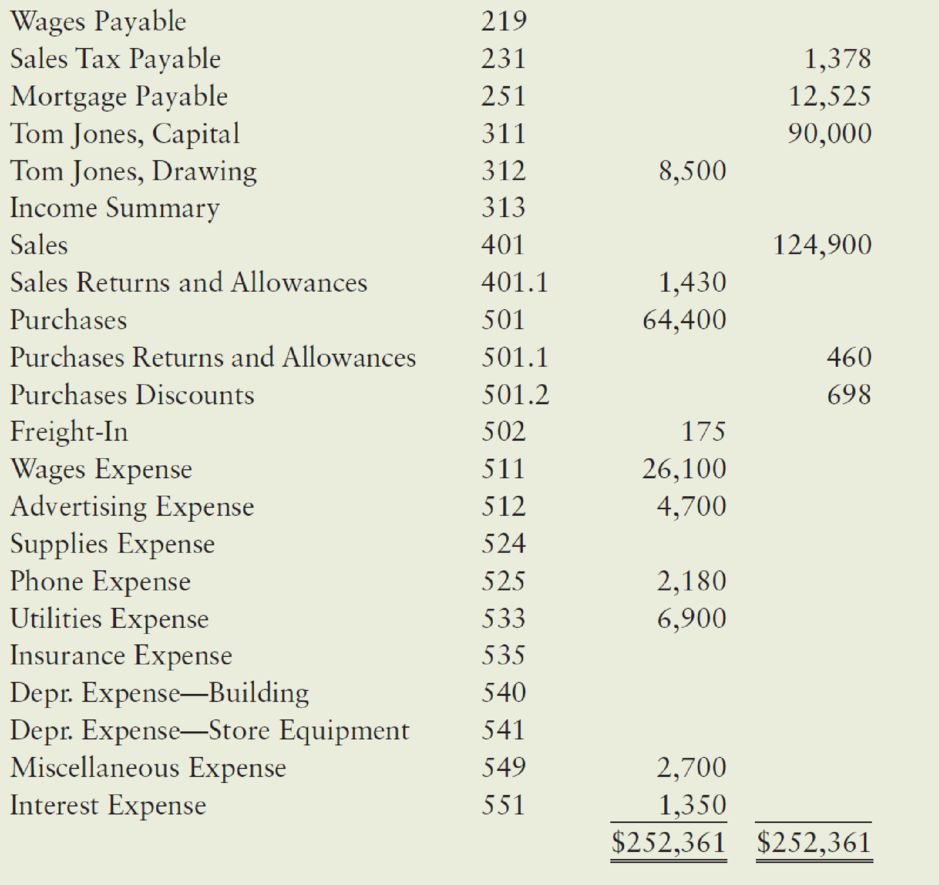

TJ’s also had the following subsidiary ledger balances as of December 16:

6. Journalize and

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 23rd + Cengagenowv2, 2 Terms Printed Access Card

- what is the level of fixed costs? general accountingarrow_forwardwhat is the level of fixed costs?arrow_forwardLui Coffee Company roasts and packs coffee beans. The process begins by placing coffee beans into the Roasting Department. From the Roasting Department, coffee beans are then transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at March 31: ACCOUNT ACCOUNT NO. Date Item Debit Credit BalanceDebit BalanceCredit March 1 Bal., 25,000 units, 10% completed 21,250 31 Direct materials, 600,000 units 450,000 471,250 31 Direct labor 244,600 715,850 31 Factory overhead 415,820 1,131,670 31 Goods transferred, 605,000 units ? 31 Bal., ? units, 45% completed ? Required:1. Prepare a cost of production report, and identify the missing amounts for Work in Process—Roasting Department.arrow_forward

- Jane Yoakim, President of Estefan Co., recently read an article that claimed that at least 100 of the country's 500 largest companies were either adopting or considering adopting the last in, first out (LIFO) method for valuing inventories. The article stated that the firms were switching to LIFO to (1) neutralize the effect of inflation in their financial statements, (2) eliminate inventory profits, and (3) reduce income taxes. Ms. Yoakim wonders if the switch would benefit her company. Estefan currently uses the first-in, first-out (FIFO) method of inventory valuation in its periodic inventory system. The company has a high inventory turnover rate, and inventories represent a significant proportion of the assets. Ms. Yoakim has been told that the LIFO system is more costly to operate and will provide little benefit to companies with high turnover. She intends to use the inventory method that is best for the company in the long run rather than selecting a method just because it is the…arrow_forwardplease help with how im supposed to solve thisarrow_forwardINVOLVE was incorporated as a not-for-profit organization on January 1, 2023. During the fiscal year ended December 31, 2023, the following transactions occurred. 1. A business donated rent-free office space to the organization that would normally rent for $35,600 a year. 2. A fund drive raised $188,000 in cash and $106,000 in pledges that will be paid next year. A state government grant of $156,000 was received for program operating costs related to public health education. 3. Salaries and fringe benefits paid during the year amounted to $209,160. At year-end, an additional $16,600 of salaries and fringe benefits were accrued. 4. A donor pledged $106,000 for construction of a new building, payable over five fiscal years, commencing in 2025. The discounted value of the pledge is expected to be $94,860. 5. Office equipment was purchased for $12,600. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of $10,200 was donated by a local office…arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College