Concept explainers

Comprehensive Problem 2:

Accounting Cycle with Subsidiary Ledgers, Part 1

During the second half of December 20-1, TJ’s Specialty Shop engaged in the following transactions:

CengageNowv2 provides “Show Me How” videos for selected exercises and problems. Additional resources, such as Excel templates for completing selected exercises and problems, are available for download from the companion website at Cengage.com.

Dec. 16 Received payment from Lucy Greene on account, $1,960.

16 Sold merchandise on account to Kim Fields, $160, plus sales tax of $8. Sale No. 640.

17 Returned merchandise to Evans Essentials for credit, $150.

18 Issued Check No. 813 to Evans Essentials in payment of December 1 balance of $1,250, less the credit received on December 17.

19 Sold merchandise on account to Lucy Greene, $620, plus tax of $31. Sale No. 641.

22 Received payment from John Dempsey on account, $1,560.

23 Issued Check No. 814 for the purchase of supplies, $120. (Debit Supplies)

24 Purchased merchandise on account from West Wholesalers, $1,200.

Invoice No. 465, dated December 24, terms n/30.

26 Purchased merchandise on account from Nathen Co., $800.

Invoice No. 817, dated December 26, terms 2/10, n/30.

27 Issued Check No. 815 to KC Power & Light (Utilities Expense) for the month of December, $630.

27 Sold merchandise on account to John Dempsey, $2,020, plus tax of $101. Sale No. 642.

29 Received payment from Martha Boyle on account, $2,473.

29 Issued Check No. 816 in payment of wages (Wages Expense) for the two-week period ending December 28, $1,100.

30 Issued Check No. 817 to Meyers Trophy Shop for a cash purchase of merchandise, $200.

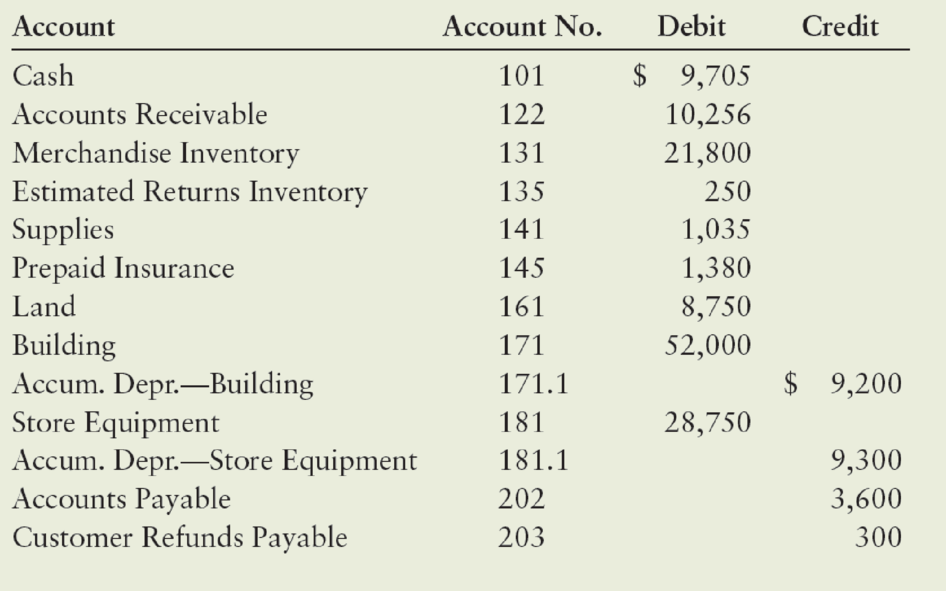

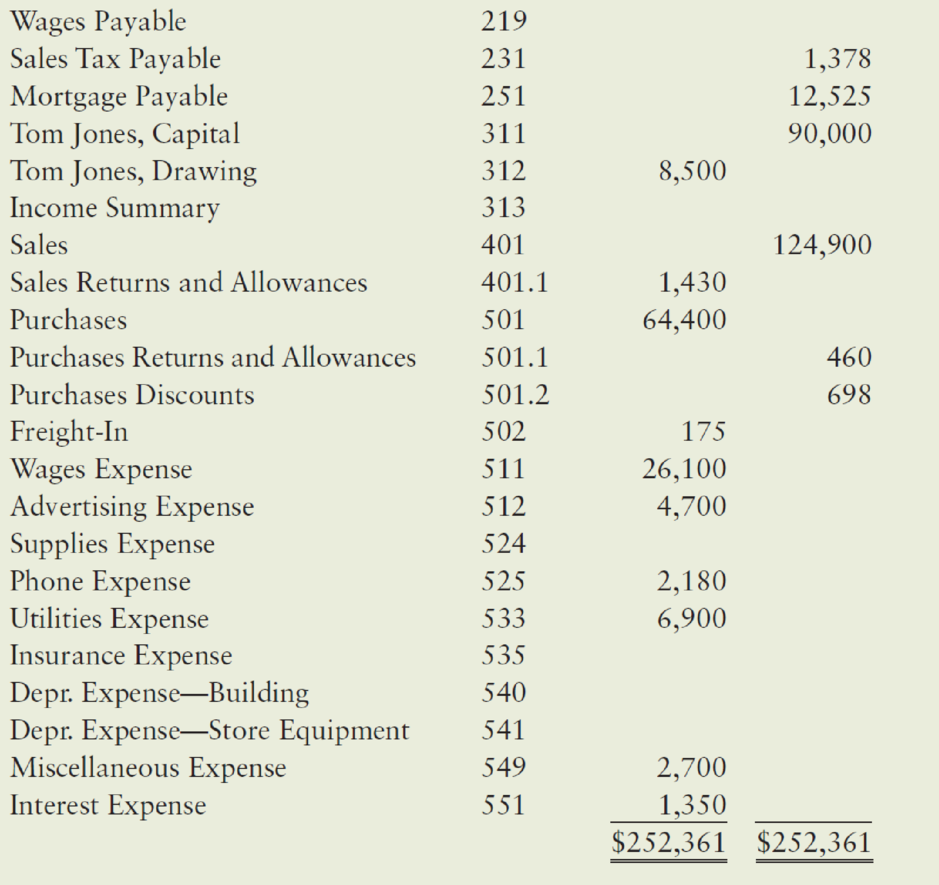

As of December 16, TJ’s account balances were as follows:

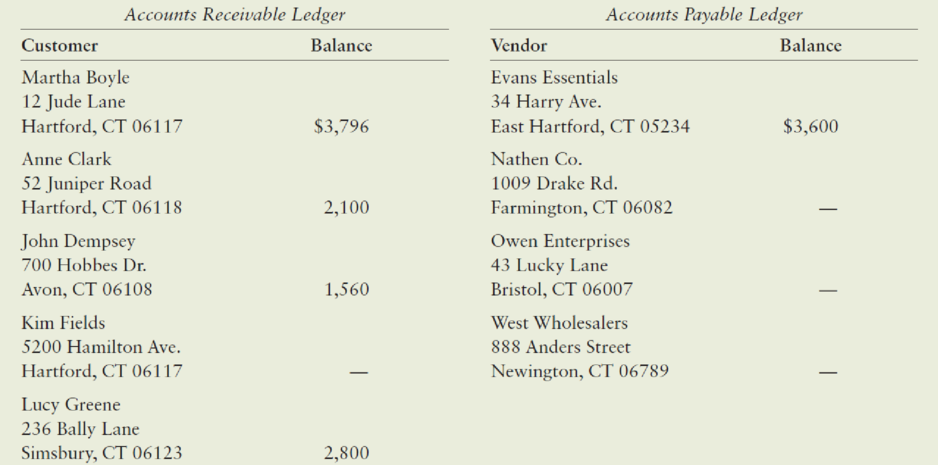

TJ’s also had the following subsidiary ledger balances as of December 16:

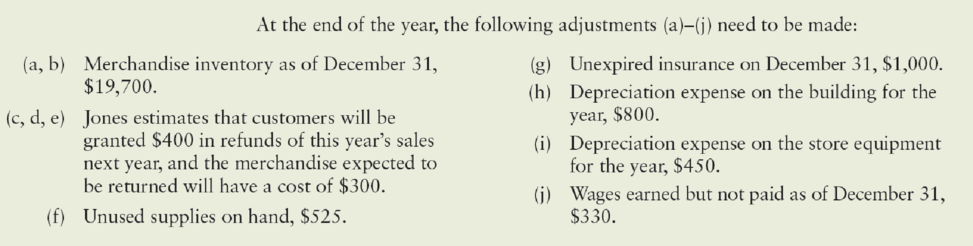

5. Prepare a year-end spreadsheet, an income statement, a statement of owner’s equity, and a

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

EP CENGAGENOWV2 FOR HEINTZ/PARRY'S COLL

- Match the budget types to the definitions. Budget Types 5. Financial 6. Flexible 7. Operating 8. Operational 9. Static 10. Strategic Definitions a. Includes sales, production, and cost of goods sold budgets b. Long-term budgets c. Includes only one level of sales volume d. Includes various levels of sales volumes e. Short-term budgets f. Includes the budgeted financial statementsarrow_forward14. Cain Company is a sporting goods store. The company sells a tent that sleeps six people. The store expects to sell 280 tents in 2024 and 360 tents in 2025. At the beginning of 2024, Cain Company has 30 tents in Merchandise Inventory and desires to have 60% of the next year's sales available at the end of the year. How many tents will Cain Company need to purchase in 2024? Begin by selecting the labels, then enter the amounts to compute the budgeted tents to be purchased. Plus: Total tents needed Less: Budgetec Budgeted tents returned Budgeted tents to be sold Desired tents in ending inventory Tents in beginning inventory Zarrow_forwardCalculate Airbnb inventory turnover for the year 2024. ( (COGS) was $1.829 billion for the previous 12 months)(average inventory for 2024 is showing a significant increase, with the company reporting over $491 million) What does inventory turnover tells an investor?arrow_forward

- Cariman Company manufactures and sells three styles of door Handles: Gold, Bronze and Silver. Production takes 50, 50, and 20 machine hours to manufacture 1,000-unit batches of Gold, Bronze, and Silver Handles, respectively. The following additional data apply: Projected sales in units Per Unit data: Gold Bronze Silver 60,000 100,000 80,000 2. Determine the activity cost driver rate for setup costs and inspection costs? 3. Using the ABC system, for the Gold style of Handle: a. Calculate the estimated overhead costs per unit? b. Calculate the estimated operating profit per unit? 4. Explain the difference between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Selling price $80 $40 $60 Direct materials $16 $8 $16 Direct labour $30 $6 $18 Overhead cost based on direct labour hours (traditional system) $24 $6 $18 Hours per 1,000-unit batch: Direct labour hours Machine hours Setup hours Inspection hours 80 20 60…arrow_forwardI need some help with problem B. I have done the work, but I'd like to make sure if I have done the calculations correctly. If you see anything else that is wrong, please let me know.arrow_forwardModule 6 Discussion Discuss the significance of recognizing the time value of money in the long-term impact of the capital budgeting decision. 60 Replies, 59 Unread Σarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College