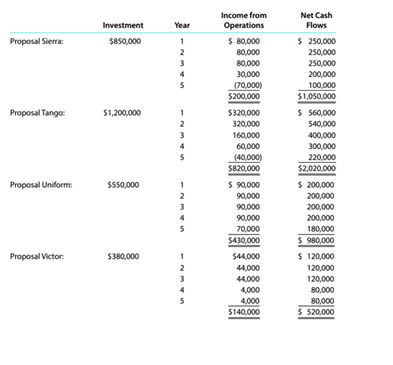

Capital rationing decision involving four proposals

Kopecky Industries Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated income from operations, and net

The company’s capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average

Instructions

Compute the present value index for each oldie proposals in part (4). Round to two decimal places.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Survey of Accounting - With CengageNOW 1Term

- OFF BALANCE SHEET ACCOUNTS PENSION PENSION EARNINGS OCI Pension Transaction Description CASH ASSETS LIABILITIES Assets Opening Balances Net Change in Pension Liabilities Closing Balances Pension Obligationarrow_forwardI need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forwardprovide correct solution accounting questionarrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardCan you guide me through solving this financial accounting problem using proper techniques?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning