Concept explainers

Selected transactions completed by Equinox Products Inc. during the fiscal year ended

December 31, 2016, were as follows:

a. Issued 15,000 shares of $20 par common stock at $30, receiving cash.

b. Issued 4, 000 shares of $80 par preferred 5% stock at $100, receiving cash.

c. Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually.

d. Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on

e. Paid the cash dividends declared in (d).

f. Purchased 7,500 shares of Solstice Corp. at $40 per share, plus a $150 brokerage commission. The investment is classified as an available-for-sale investment.

g. Purchased 8,000 shares of

h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for $24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment.

i. Declared a $ 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued.

j. Paid the cash dividends to the preferred stockholders.

k. Received $27,500 dividend from Pinkberry Co. investment in (h).

l. Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of $37 5. The bonds are classified as a held-to-maturity long -term investment.

m. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (g).

n. Received a dividend of $0 .60 per share from the Solstice Corp. investment in (f).

o. Sold 1,000 shares of Solstice Corp. at $45, including commission.

p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method .

q. Accrued interest for three months on the Dream Inc. bonds purchased in (I).

r. Pinkberry Co. recorded total earnings of $240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income.

s. The fair value for Solstice Corp. stock was $39. 02 per share on December 31,

2016. The investment is adjusted to fair value , using a valuation allowance account.

Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero.

Instructions

1. Journalize the selected transactions.

2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all

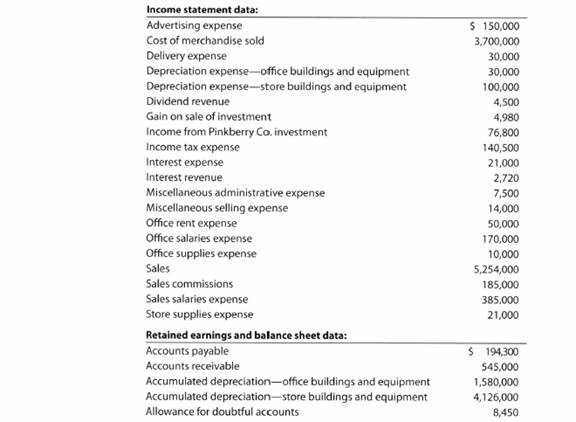

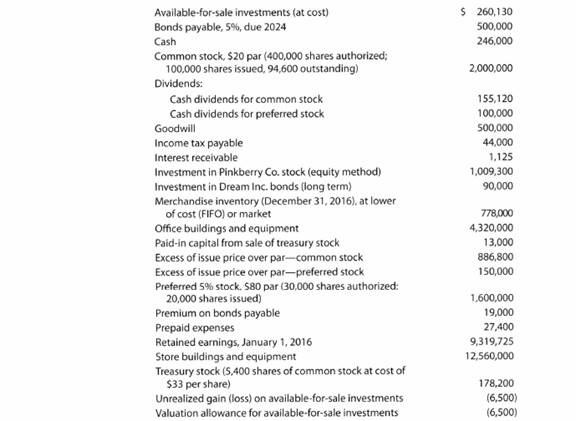

a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were $100,000. ( Round earnings per share to the nearest cent.)

b. Prepare a

c. Prepare a

Trending nowThis is a popular solution!

Chapter 15 Solutions

Bundle: Accounting, Chapters 1-13, 26th + Working Papers, Chapters 1-17 For Warren/reeve/duchac's Accounting, 26th And Financial Accounting, 14th + ... For Warren/reeve/duchac's Accounting, 26th

- Financial accountingarrow_forwardHow can the results from the accounts receivable visualizations be used to estimate bad debts expense and allowance for doubtful accounts? Using the Top 5 Customers by Accounts Receivable Amount Due visualization, which customer has the lowest allowance for doubtful accounts value?arrow_forwardBased on the results of the Sales Order Aging as of December 31, 2022 visualization, what conclusion can be made regarding the outstanding sales orders? a. The sales aging group with the highest value of outstanding sales orders is 90+ days and the sales aging group with the lowest value of outstanding sales orders is 31-60 days. b. The 90+ days sales aging group had a value of outstanding sales orders that was twice as much as the 31-60 days sales aging group. c. The 61-90 days sales aging group had a value of outstanding sales orders that was twice as much as the 31-60 days sales aging group. d. The sales aging group with the highest value of outstanding sales orders is 90+ days and the sales aging group with the lowest value of outstanding sales orders is 61-90 days.arrow_forward

- I am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardI need help solving this financial accounting question with the proper methodology.arrow_forward

- Kindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forwardHello tutor please given General accounting question answer do fast and properly explain all answerarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning