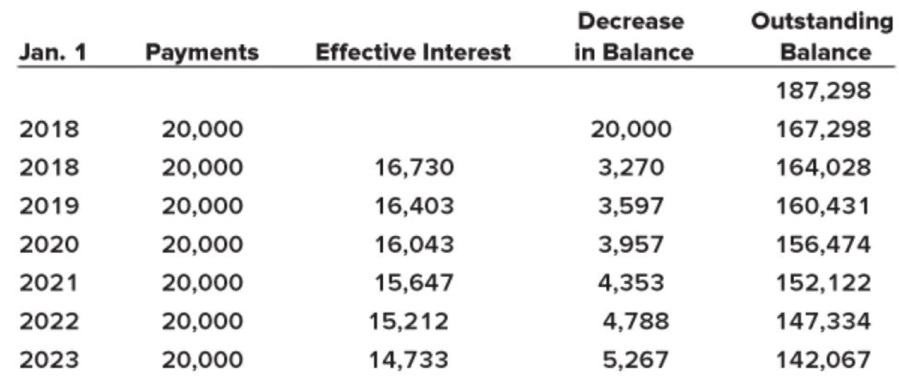

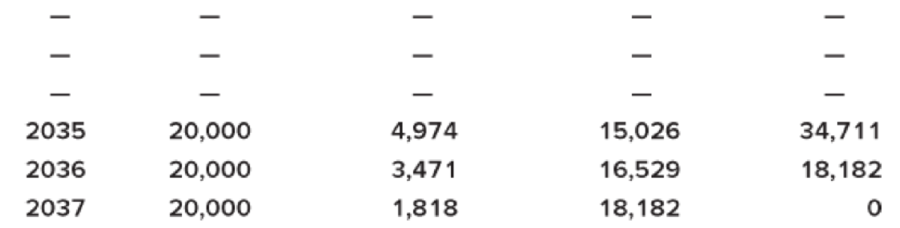

Problem 15.1Q Problem 15.2Q Problem 15.3Q Problem 15.4Q: A lessee should classify a lease transaction as a finance lease if it is noncancelable and one or... Problem 15.5Q: Lukawitz Industries leased non-specialized equipment to Seminole Corporation for a four year period,... Problem 15.6Q: In accounting for a finance lease/sales-type lease, how are the lessees and lessors income... Problem 15.7Q: What is selling profit on a sales-type lease? How do we account for a sales-type lease with a... Problem 15.8Q: At the beginning of an operating lease, the lessee will record what asset and liability, if any? Problem 15.9Q: At the beginning of an operating lease, the lessor will record what asset or assets, if any? Problem 15.10Q: In accounting for an operating lease, how are the lessees and lessors income statements affected? Problem 15.11Q: Briefly describe the conceptual basis for asset and liability recognition under the right-of-use... Problem 15.12Q: In a financing lease, front loading of lease expense and lease revenue occurs. What does this mean,... Problem 15.13Q: The discount rate influences virtually every amount reported in connection with a lease by both the... Problem 15.14Q: A lease that has a lease term (including any options to terminate or renew that are reasonably... Problem 15.15Q: A lease might specify that lease payments may be increased (or decreased) at some future time during... Problem 15.16Q: What is a purchase option? How does it affect accounting for a lease? Problem 15.17Q: A six-year lease can be renewed for two additional three-year periods, and it also can be terminated... Problem 15.18Q: Culinary Creations leased kitchen equipment under a five-year lease with an option to renew for... Problem 15.19Q: What situations cause us to remeasure a lease liability and right-of-use asset? How is that... Problem 15.20Q Problem 15.21Q: Compare the way a purchase option that is reasonably certain to be exercised and a lessee-guaranteed... Problem 15.22Q: What nonlease costs might be included as part of lease payments? How are they accounted for by the... Problem 15.23Q: The lessors initial direct costs often are substantial. What are initial direct costs? Problem 15.24Q: When are initial direct costs recognized in an operating lease? In a sales-type lease with selling... Problem 15.25Q Problem 15.26Q Problem 15.27Q Problem 15.28Q: When a company sells an asset and simultaneously leases it back, what criteria must be met to apply... Problem 15.29Q Problem 15.1BE: Lease classification LO151 (Note: Brief Exercises 1 and 2 are two variations of the same basic... Problem 15.2BE: Lease classification LO151, LO152 Corinth Co. leased nonspecialized equipment to Athens Corporation... Problem 15.3BE: Lessee and lessor; calculate interest; finance/sales-type lease LO152 A finance lease agreement... Problem 15.4BE: Finance lease; lessee; balance sheet effects LO152 (Note: Brief Exercises 4, 5, and 6 are three... Problem 15.5BE: Finance lease; lessee; income statement effects LO152 A lease agreement that qualifies as a finance... Problem 15.6BE: Sales-type lease; lessor; income statement effects LO153 A lease agreement that qualifies as a... Problem 15.7BE Problem 15.8BE: Operating lease LO154 (Note: Brief Exercises 8 and 9 are two variations of the same basic... Problem 15.9BE: Operating lease LO154 At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT... Problem 15.10BE: Short-term lease LO155 King Cones leased ice cream-making equipment from Ace Leasing. Ace earns... Problem 15.11BE: Uncertain lease term LO156 Java Hut leased a specialty expresso machine for a 10-year noncancelable... Problem 15.12BE: Uncertain lease payments LO156 On January 1, Espinoza Moving and Storage leased a truck for a... Problem 15.13BE: Purchase option; lessor; sales-type lease LO152, LO153, LO156 Ace Leasing acquires equipment and... Problem 15.14BE: Residual value; sales-type lease LO152, LO153, LO156 On January 1, James Industries leased... Problem 15.15BE: Guarantee d residual value LO156 On January 1, Garcia Supply leased a truck for a four-year period,... Problem 15.16BE: Lessors initial direct costs; sales-type lease LO153, LO157 Bryant leased equipment that had a... Problem 15.17BE: Nonlease payments LO152, LO157 On January 1, 2018, Jasperse Corporation leased equipment under a... Problem 15.1E: Lease classification LO151 Each of the four independent situations below describes a lease... Problem 15.2E: Finance lease; calculate lease payments LO152 American Food Services, Inc. leased a packaging... Problem 15.3E: Finance lease; lessee; balance sheet and income statement effects LO152 (Note: Exercises 3, 4, and... Problem 15.4E Problem 15.5E: Sales-type lease; lessor; balance sheet and income statement effects LO153 On June 30, 2018,... Problem 15.6E: Finance lease; lessee LO152 (Note: Exercises 6, 7, and 8 are three variations of the same basic... Problem 15.7E: Sales-type lease with no selling profit; lessor LO152 Edison Leasing leased high-tech electronic... Problem 15.8E: Sales-type lease with selling profit; lessor; calculate lease payments LO153 Manufacturers Southern... Problem 15.9E Problem 15.10E: Lessor calculation of annual lease payments; lessee calculation of asset and liability LO152 (Note:... Problem 15.11E: Lessee and lessor; sales-type lease with selling profit LO152, LO153 Eye Deal Optometry leased... Problem 15.12E: Lessee; finance lease; effect on financial statements LO152 (Note: Exercises 12, 13, 14, and 25 are... Problem 15.13E: Lessee; operating lease; effect on financial statements LO154 At January 1, 2018, Caf Med leased... Problem 15.14E: Lessor; operating lease; effect on financial statements LO154 At January 1, 2018, Caf Med leased... Problem 15.15E: Sales-type lease; lessor; income statement effects LO153 King Company leased equipment from Mann... Problem 15.16E: Lessee; operating lease LO154 Grichuk Power leased high-tech electronic equipment from Kolten... Problem 15.17E: Lessee a nd lessor; operating lease LO154 On January 1, 2018, Nath-Langstrom Services, Inc. a... Problem 15.18E: Short-term lease LO155 Chance Enterprises leased equipment from Third Bank Leasing on January 1,... Problem 15.19E: Lessee; renewal option LO152, LO156 Natick Industries leased high-tech instruments from Framingham... Problem 15.20E: Variable lease payments LO152, LO156 On January 1, 2018, Wetick Optometrists leased diagnostic... Problem 15.21E: Lessee; variable lease payments LO152, LO156 On January 1, 2018, QuickStream Communications leased... Problem 15.22E: Lessee; variable lease payments LO152, LO156 On January 1, 2018, Taco King leased retail space from... Problem 15.23E: Lessee; renewal options LO152, LO156 On January 1, 2018, Ricks Pawn Shop leased a truck from Corey... Problem 15.24E: Calculation of annual lease payments; residual value LO152, LO156 Each of the four independent... Problem 15.25E: Lessor; sales-type lease; residual value effect on financial statements LO152, LO156 At January 1,... Problem 15.26E: Lease concepts; finance/sales-type leases; guaranteed and unguaranteed residual value LO152, LO156... Problem 15.27E: Lessee; lessee guaranteed residual value LO152, LO156 On January 1, 2018, Maywood Hydraulics leased... Problem 15.28E: Calculation of annual lease payments; purchase option LO152, LO156 For each of the three... Problem 15.29E: Finance lease; purchase options; lessee LO152, LO156 Federated Fabrications leased a tooling... Problem 15.30E: Purchase option; lessor; sales-type lease; no selling profit LO152, LO156 Universal Leasing leases... Problem 15.31E: Nonlease payments; lessor and lessee LO152, LO157 On January 1, 2018, NRC Credit Corporation leased... Problem 15.32E: Lessors initial direct costs; sales-type lease LO152, LO157 Terms of a lease agreement and related... Problem 15.33E: Lessors initial direct costs; sales-type lease LO153, LO157 The lease agreement and related facts... Problem 15.34E: Lessors initial direct costs; operating lease LO154, LO157 The following relate to an operating... Problem 15.35E Problem 15.36E Problem 15.37E Problem 15.38E: Sale-leaseback Appendix 15 To raise operating funds, Signal Aviation sold an airplane on January 1,... Problem 15.39E: Sale-leaseback; operating lease Appendix 15 To raise operating funds, National Distribution Center... Problem 15.1P Problem 15.2P: Finance lease LO152 At the beginning of 2018, VHF Industries acquired a machine with a fair value... Problem 15.3P: Lease amortization schedule LO152 On January 1, 2018, Majestic Mantles leased a lathe from... Problem 15.4P: Finance /sales-type lease; lessee and lessor LO151, LO152, LO153 Rand Medical manufactures... Problem 15.5P: Lessee; operating lease; advance payment; leasehold improvement LO154 On January 1, 2018, Winn Heat... Problem 15.6P: Operating lease; scheduled rent increases LO154 On January 1, 2018, Sweetwater Furniture Company... Problem 15.7P: Lease amortization schedule LO152, LO156 On January 1, 2018, National Insulation Corporation (NIC)... Problem 15.8P: Reassessment of lease term LO152, LO154, LO156 On January 1, 2018, Ricks Pawn Shop leased a truck... Problem 15.9P: Lease concepts; sales-type leases; guaranteed and unguaranteed residual value LO152, LO156 Each of... Problem 15.10P Problem 15.11P: Change in lease term; operating lease; lessor LO154, LO156 Universal Leasing leases electronic... Problem 15.12P: Lessee; renewal option LO152, LO156 High Time Tours leased rock-climbing equipment from Adventures... Problem 15.13P: Lessee and lessor; lessee guaranteed residual value LO152, LO156 On January 1, 2018, Allied... Problem 15.14P: Lessee and lessor; lessor; sales-type lease with selling profit; residual value LO152, LO153 Newton... Problem 15.15P: Nonlease payments; lessor and lessee LO152, LO157 On January 1, 2018, Lesco Leasing leased... Problem 15.16P: Lessors initial direct costs; operating and sales-type leases LO152, LO153, LO154, LO157 Terms of a... Problem 15.17P: Nonlease costs; lessor and lessee LO152, LO157 Branif Leasing leases mechanical equipment to... Problem 15.18P: Lessee-guaranteed residual value; unguaranteed residual value; nonlease costs; different interest... Problem 15.19P: Initial direct costs; sales-type lease LO152, LO157 Bidwell Leasing purchased a single-engine plane... Problem 15.20P: Initial dire ct costs; sales-type lease with a selling profit LO153, LO157 (Note: This problem is a... Problem 15.21P: Guaranteed residual value; sales-type lease LO152, LO155, LO156 (Note: Problems 21, 22, and 23 are... Problem 15.22P: Unguaranteed residual value; nonlease payments; sales-type lease LO152, LO156, LO157 Rhone-Metro... Problem 15.23P: Purchase option reasonably certain to be exercised before lease term ends; nonlease payments;... Problem 15.24P: Lessee and lessor; lessee guaranteed residual value LO152, LO157 On January 1, 2018, Nguyen... Problem 15.25P Problem 15.26P Problem 15.27P: Modification of a lease LO152, LO153, LO156 On January 1, 2018, Worchester Construction leased... Problem 15.28P: Finance lease; lessee; financial statement effects LO152, LO158 (Note: Problems 28, 29, and 30 are... Problem 15.29P Problem 15.30P: Sales-type lease; lessor; financial statement effects LO153, LO158 NutraLabs, Inc. leased a protein... Problem 15.31P Problem 15.1BYP: Research Case 151 FASB codification; locate and extract relevant information and authoritative... Problem 15.3BYP: Ethics Case 153 Leasehold improvements LO153 American Movieplex, a large movie theater chain,... Problem 15.4BYP: Analysis Case 154 Lease concepts; Walmart LO151 through LO154 Real World Financials Walmart Stores,... Problem 15.5BYP: Communication Case 155 Wheres the gain? Appendix General Tools is seeking ways to maintain and... Problem 15.7BYP Problem 1CCTC Problem 1CCIFRS format_list_bulleted

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning