HORNGRENS COST ACCOUNTING W/ACCESS

16th Edition

ISBN: 9781323687604

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 15.20E

Support-department cost allocation, reciprocal method (continuation of 15-19). Refer to the data given in Exercise 15-19.

- 1. Allocate the two support departments’ costs to the two operating departments using the reciprocal method. Use (a) linear equations and (b) repeated iterations.

Required

- 2. Compare and explain differences in requirement 1 with those in requirement 1 of Exercise 15-19. Which method do you prefer? Why?

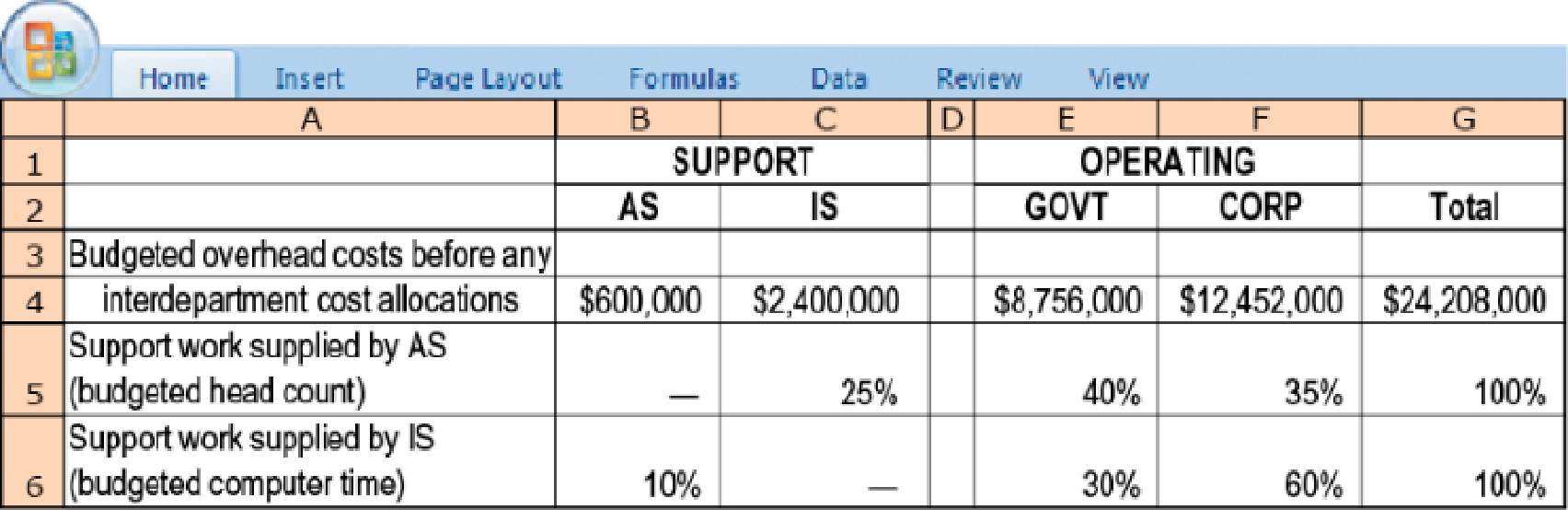

15-19 Support-department cost allocation; direct and step-down methods. Phoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments—administrative services (AS) and information systems (IS)—and two operating departments—government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2017, Phoenix’s cost records indicate the following:

- 1. Allocate the two support departments’ costs to the two operating departments using the following methods:

Required

- a. Direct method

- b. Step-down method (allocate AS first)

- c. Step-down method (allocate IS first)

- 2. Compare and explain differences in the support-department costs allocated to each operating department.

- 3. What approaches might be used to decide the sequence in which to allocate support departments when using the step-down method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

MCQ

Correct answer

Marin Company is a manufacturer of smartphones. Its controller resigned in October 2025. An inexperienced assistant

accountant has prepared the following income statement for the month of October 2025.

Marin Company

Income Statement

For the Month Ended October 31, 2025

Sales revenue

$998,400

Less: Operating expenses

Raw materials purchases

$337,920

Direct labor cost

243,200

Advertising expense

115,200

Selling and administrative salaries

96,000

Rent on factory facilities

76,800

Depreciation on sales equipment

57,600

Depreciation on factory equipment

39,680

Indirect labor cost

35,840

Utilities expense

15,360

Insurance expense

10,240

1,027,840

Net loss

$(29,440)

Prior to October 2025, the company had been profitable every month. The company's president is concerned about the

accuracy of the income statement. As her friend, you have been asked to review the income statement and make

necessary corrections. After examining other manufacturing cost data, you have acquired additional…

Chapter 15 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Ch. 15 - Prob. 15.1QCh. 15 - Describe how the dual-rate method is useful to...Ch. 15 - How do budgeted cost rates motivate the...Ch. 15 - Give examples of allocation bases used to allocate...Ch. 15 - Why might a manager prefer that budgeted rather...Ch. 15 - To ensure unbiased cost allocations, fixed costs...Ch. 15 - Prob. 15.7QCh. 15 - What is conceptually the most defensible method...Ch. 15 - Distinguish between two methods of allocating...Ch. 15 - What are the challenges of using the incremental...

Ch. 15 - Prob. 15.11QCh. 15 - What is one key way to reduce cost-allocation...Ch. 15 - Describe how companies are increasingly facing...Ch. 15 - Distinguish between the stand-alone and the...Ch. 15 - Identify and discuss arguments that individual...Ch. 15 - Single-rate versus dual-rate methods, support...Ch. 15 - Single-rate method, budgeted versus actual costs...Ch. 15 - Dual-rate method, budgeted versus actual costs and...Ch. 15 - Support-department cost allocation; direct and...Ch. 15 - Support-department cost allocation, reciprocal...Ch. 15 - Direct and step-down allocation. E-books, an...Ch. 15 - Reciprocal cost allocation (continuation of...Ch. 15 - Allocation of common costs. Evan and Brett are...Ch. 15 - Allocation of common costs. Gordon Grimes, a...Ch. 15 - Revenue allocation, bundled products. Couture Corp...Ch. 15 - Allocation of common costs. Jim Dandy Auto Sales...Ch. 15 - Single-rate, dual-rate, and practical capacity...Ch. 15 - Prob. 15.28PCh. 15 - Fixed-cost allocation. Central University...Ch. 15 - Allocating costs of support departments; step-down...Ch. 15 - Support-department cost allocations;...Ch. 15 - Common costs. Tate Inc. and Booth Inc. are two...Ch. 15 - Prob. 15.33PCh. 15 - Support-department cost allocations;...Ch. 15 - Revenue allocation, bundled products. Boca Resorts...Ch. 15 - Support-department cost allocations; direct,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide answerarrow_forwardMCQarrow_forwardExercise 3-12A (Algo) Conducting sensitivity analysis using a spreadsheet LO 3-5 Use the below table to answer the following questions. Selling Price$27.00 Variable 2,100 3,100 Fixed Cost Cost Sales Volume 4,100 Profitability 5,100 6,100 $25,700 8 $14,200 $33,200 $52,200 $71,200 $90,200 25,700 9 12,100 30,100 48,100 66,100 84,100 25,700 10 10,000 27,000 44,000 61,000 78,000 35,700 8 4,200 23,200 42,200 61,200 80,200 35,700 9 2,100 20,100 38,100 56,100 74,100 35,700 10 17,000 34,000 51,000 68,000 45,700 8 (5,800) 13,200 32,200 51,200 70,200 45,700 9 (7,900) 10,100 28,100 46,100 64,100 45,700 10 (10,000) 7,000 24,000 41,000 58,000 Required a. Determine the sales volume, fixed cost, and variable cost per unit at the break-even point. b. Determine the expected profit if Rundle projects the following data for Delatine: sales, 4,100 bottles; fixed cost, $25,700; and variable cost per unit, $10. c. Rundle is considering new circumstances that would change the conditions described in…arrow_forward

- The following balance sheet for the Hubbard Corporation was prepared by the company: HUBBARD CORPORATION Balance Sheet At December 31, 2024 Assets Buildings Land Cash Accounts receivable (net) Inventory Machinery Patent (net) Investment in equity securities Total assets Accounts payable $ 763,000 289,000 73,000 146,000 266,000 293,000 113,000 86,000 Liabilities and Shareholders' Equity Accumulated depreciation Notes payable Appreciation of inventory Common stock (authorized and issued 113,000 shares of no par stock) $ 2,029,000 $ 228,000 268,000 526,000 93,000 452,000 Retained earnings 462,000 Total liabilities and shareholders' equity $ 2,029,000 Additional information: 1. The buildings, land, and machinery are all stated at cost except for a parcel of land that the company is holding for future sale. The land originally cost $63,000 but, due to a significant increase in market value, is listed at $146,000. The increase in the land account was credited to retained earnings. 2. The…arrow_forwardProvide correct answer this general accounting questionarrow_forwardPlease answer the financial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License