Sustainability and budgeting (Learning Objective 1)

Liller Beverages manufactures its own soda pop bottles. The bottles are made from polyethylene terephthalate (PET), a lightweight yet strong plastic. The company uses as much PET recycled resin pellets in its bottles as it can, both because using recycled PET helps the company to meet its sustainability goals and because recycled PET is less expensive than virgin PET.

Liller is continuing to search for ways to reduce its costs and its impact on the environment. PET plastic is melted and blown over soda bottle molds to produce the bottles. One idea Liller’s engineers have suggested is to retrofit the soda bottle molds and change the plastic formulation slightly so that 25% less PET plastic is used for each bottle. The average kilograms of PET per soda bottle before any redesign is 0.004 kg. The cost of retrofitting the soda bottle molds will result in a one-time charge of $35,947, while the plastic reformulation will cause the average cost per kilogram of PET plastic to change from $4.00 to $4.30.

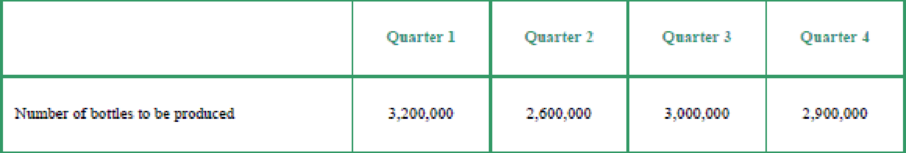

Liller’s management is analyzing whether the change to the bottle molds to reduce PET plastic usage should be made. Management expects the following number of soda bottles to be used in the upcoming year:

For the upcoming year, management expects the beginning inventory of PET to be 1,280 kilograms, while ending inventory is expected to be 1,690 kilograms. During the first three quarters of the year, management wants to keep the ending inventory of PET a1 the end of each quarter equal to 10% of the following quarter’s PET needs.

Requirements

- 1. Using the original data (before any redesign of soda bottles), prepare a direct materials budget to calculate the cost of PET purchases in each quarter for the upcoming year and for the year in total.

- 2. Assume that the company retrofits the soda bottle molds and changes the plastic formulation slightly so that less PET plastic is used in each bottle. Now prepare a direct materials budget to calculate the cost of PET purchases in each quarter for the upcoming year and for the year in total for this possible scenario.

- 3. Compare the cost of PET plastic for Requirement 1 (original data) and for Requirement 2 (making change to using less PET). What is the direct material cost savings from making the change to using less PET? Compare the total of those savings to the cost of retrofitting the soda bottle molds. Should the company make the change? Explain your rationale.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Managerial Accounting, Student Value Edition (5th Edition)

- Equityarrow_forwardGeneral accountingarrow_forwardCrane Company sponsors a defined benefit pension plan. The corporation's actuary provides the following information about t January 1, 2025 December 31, 2025 Vested benefit obligation $1,560 $2,010 Accumulated benefit obligation 2,010 2,820 Projected benefit obligation 2,260 3,630 Plan assets (fair value) 1,540 2,560 Settlement rate and expect rate of return 10% Pension asset/liability 720 ? Service cost for the year 2025 $400 Contributions (funding in 2025) 730 Benefits paid in 2025 200 (a)Compute the actual return on the plan assets in…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,