Concept explainers

Comprehensive Problem 2:

Accounting Cycle with Subsidiary Ledgers, Part 1

During the second half of December 20-1, TJ’s Specialty Shop engaged in the following transactions:

CengageNowv2 provides “Show Me How” videos for selected exercises and problems. Additional resources, such as Excel templates for completing selected exercises and problems, are available for download from the companion website at Cengage.com.

Dec. 16 Received payment from Lucy Greene on account, $1,960.

16 Sold merchandise on account to Kim Fields, $160, plus sales tax of $8. Sale No. 640.

17 Returned merchandise to Evans Essentials for credit, $150.

18 Issued Check No. 813 to Evans Essentials in payment of December 1 balance of $1,250, less the credit received on December 17.

19 Sold merchandise on account to Lucy Greene, $620, plus tax of $31. Sale No. 641.

22 Received payment from John Dempsey on account, $1,560.

23 Issued Check No. 814 for the purchase of supplies, $120. (Debit Supplies)

24 Purchased merchandise on account from West Wholesalers, $1,200.

Invoice No. 465, dated December 24, terms n/30.

26 Purchased merchandise on account from Nathen Co., $800.

Invoice No. 817, dated December 26, terms 2/10, n/30.

27 Issued Check No. 815 to KC Power & Light (Utilities Expense) for the month of December, $630.

27 Sold merchandise on account to John Dempsey, $2,020, plus tax of $101. Sale No. 642.

29 Received payment from Martha Boyle on account, $2,473.

29 Issued Check No. 816 in payment of wages (Wages Expense) for the two-week period ending December 28, $1,100.

30 Issued Check No. 817 to Meyers Trophy Shop for a cash purchase of merchandise, $200.

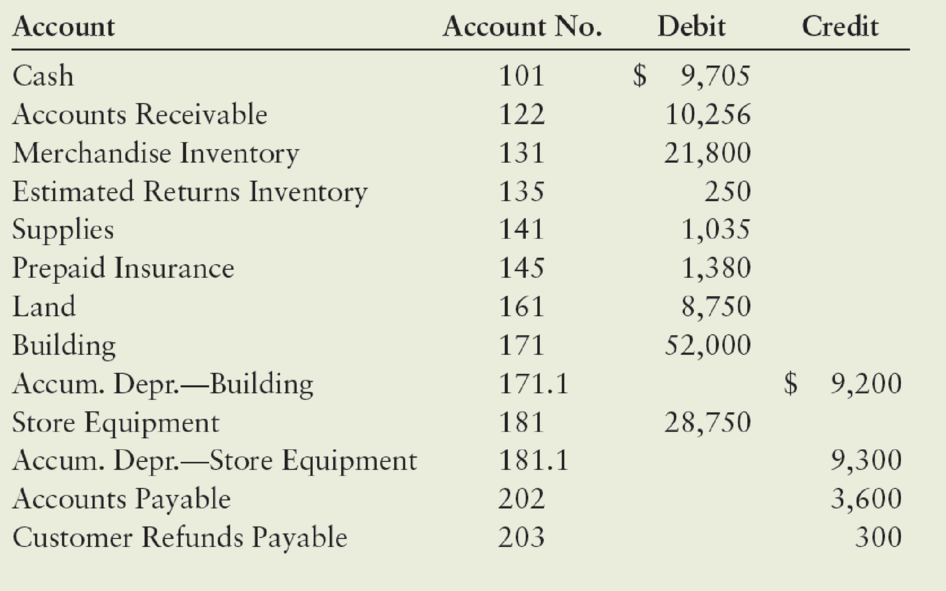

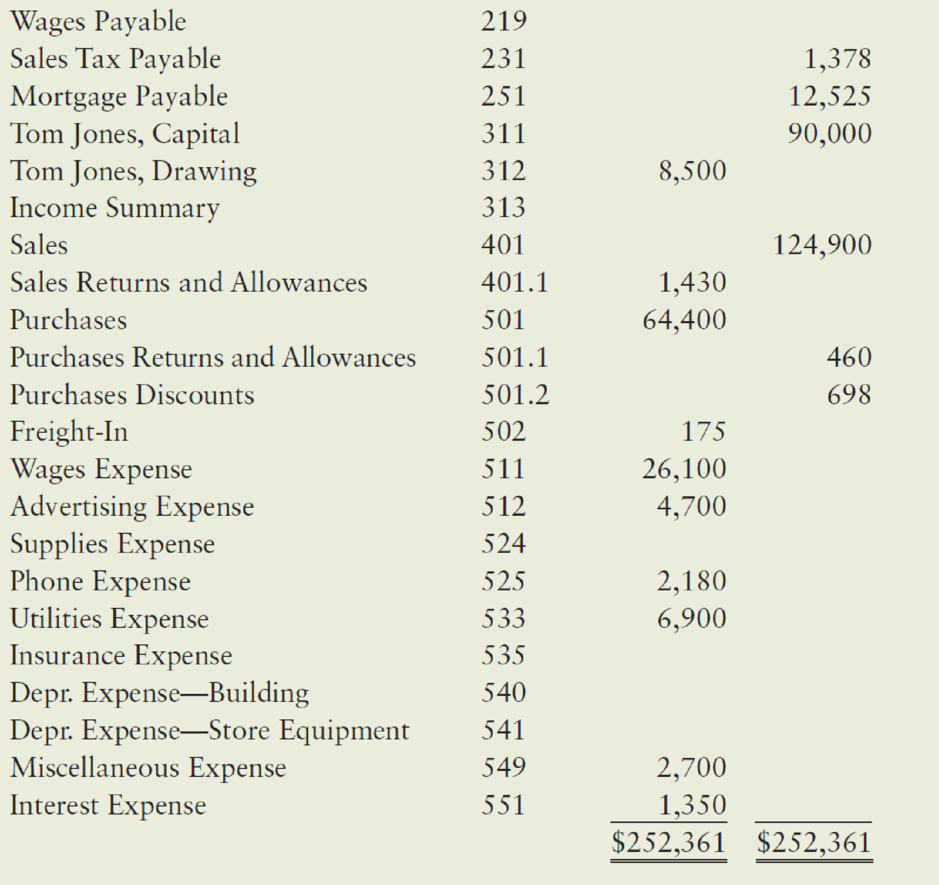

As of December 16, TJ’s account balances were as follows:

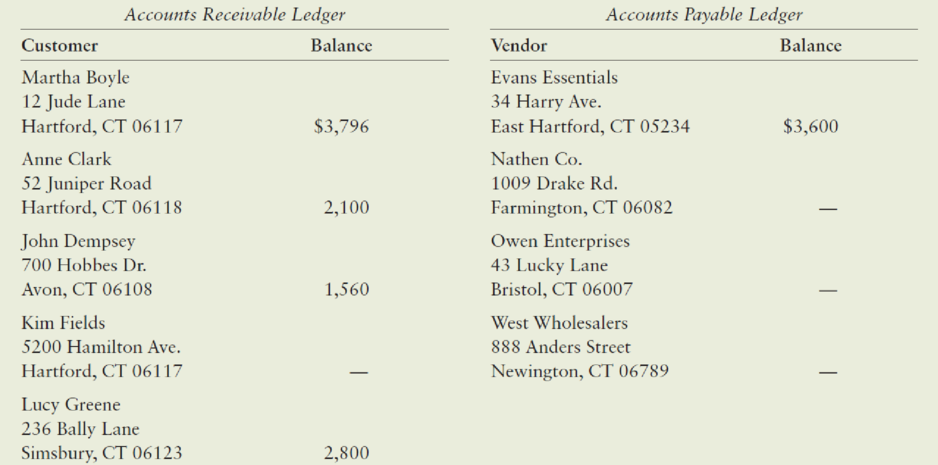

TJ’s also had the following subsidiary ledger balances as of December 16:

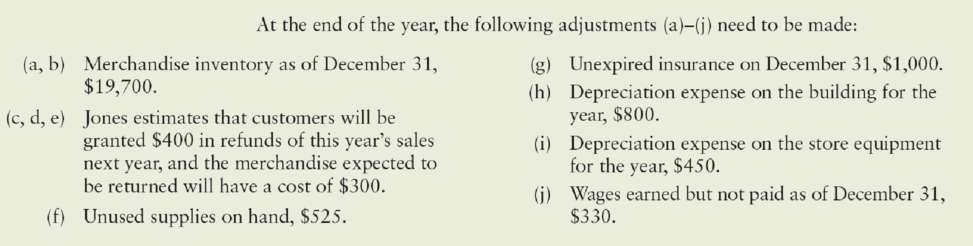

3. Post from the journal to the general ledger.

Trending nowThis is a popular solution!

Chapter 15 Solutions

College Accounting - Study Guide / Working Papers 1-15

- What is the company's cost of goods manufactured for the year of this general accounting question?arrow_forwardExercise 2 Make an Excel spreadsheet to compute gross wages due each employee under federal wage-hour law. See notes below. Ryan is normally paid $1,000 for a 40-hour workweek. One week, he works 46 hours. 2.Latisha is normally paid $1,200 for a 40-hour workweek. One Monday she is out sick but receives 8 hours sick pay. She then works 40 hours Tuesday–Friday. 3. Al is normally paid $500 for a 40-hour workweek. One week, he works 45 hours. 4. Lee is normally paid $1,500 for a 40-hour workweek. To make up for leaving early one Friday, he works 44 hours this week.arrow_forwardHello tutor please provide this question solution general accountingarrow_forward

- Get accurate answer of this financial accounting questionarrow_forwardThe cost of goods sold isarrow_forwardRequired information [The following information applies to the questions displayed below.] Kitimat Company manufactures winter hats that sell for $42 per unit. The following information pertains to the company's first year of operations in which it produced 40,100 units and sold 37,600 units. Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses 16 $ 16 $ $ 1 $ 2 $401,000 $247,000 9. What would have been the company's variable costing operating income if it had produced and sold 37,600 units?arrow_forward

- Required information [The following information applies to the questions displayed below.] Kitimat Company manufactures winter hats that sell for $42 per unit. The following information pertains to the company's first year of operations in which it produced 40,100 units and sold 37,600 units. Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses $ 16 LA LA LA LA $ $ 6612 $401,000 $247,000 4. What is the company's operating income under variable costing?arrow_forwardDo fast answer of this general accounting questionarrow_forwardUsing the high-low method, estimate a cost formula for power cost. ??arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College