Concept explainers

Comprehensive Problem 2:

Accounting Cycle with Subsidiary Ledgers, Part 1

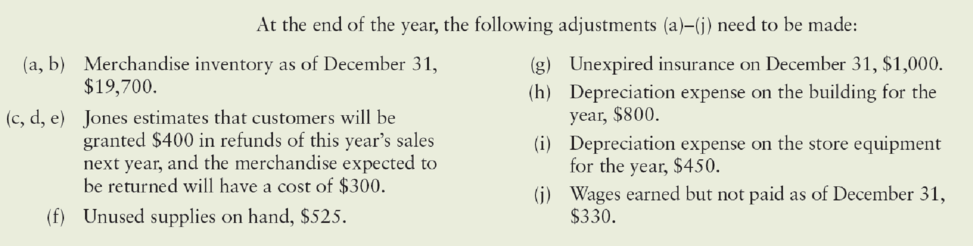

During the second half of December 20-1, TJ’s Specialty Shop engaged in the following transactions:

CengageNowv2 provides “Show Me How” videos for selected exercises and problems. Additional resources, such as Excel templates for completing selected exercises and problems, are available for download from the companion website at Cengage.com.

Dec. 16 Received payment from Lucy Greene on account, $1,960.

16 Sold merchandise on account to Kim Fields, $160, plus sales tax of $8.Sale No. 640.

17 Returned merchandise to Evans Essentials for credit, $150.

18 Issued Check No. 813 to Evans Essentials in payment of December 1 balance of $1,250, less the credit received on December 17.

19 Sold merchandise on account to Lucy Greene, $620, plus tax of $31. Sale No. 641.

22 Received payment from John Dempsey on account, $1,560.

23 Issued Check No. 814 for the purchase of supplies, $120. (Debit Supplies)

24 Purchased merchandise on account from West Wholesalers, $1,200.

Invoice No. 465, dated December 24, terms n/30.

26 Purchased merchandise on account from Nathen Co., $800.

Invoice No. 817, dated December 26, terms 2/10, n/30.

27 Issued Check No. 815 to KC Power & Light (Utilities Expense) for the month of December, $630.

27 Sold merchandise on account to John Dempsey, $2,020, plus tax of $101. Sale No. 642.

29 Received payment from Martha Boyle on account, $2,473.

29 Issued Check No. 816 in payment of wages (Wages Expense) for the two-week period ending December 28, $1,100.

30 Issued Check No. 817 to Meyers Trophy Shop for a cash purchase of merchandise, $200.

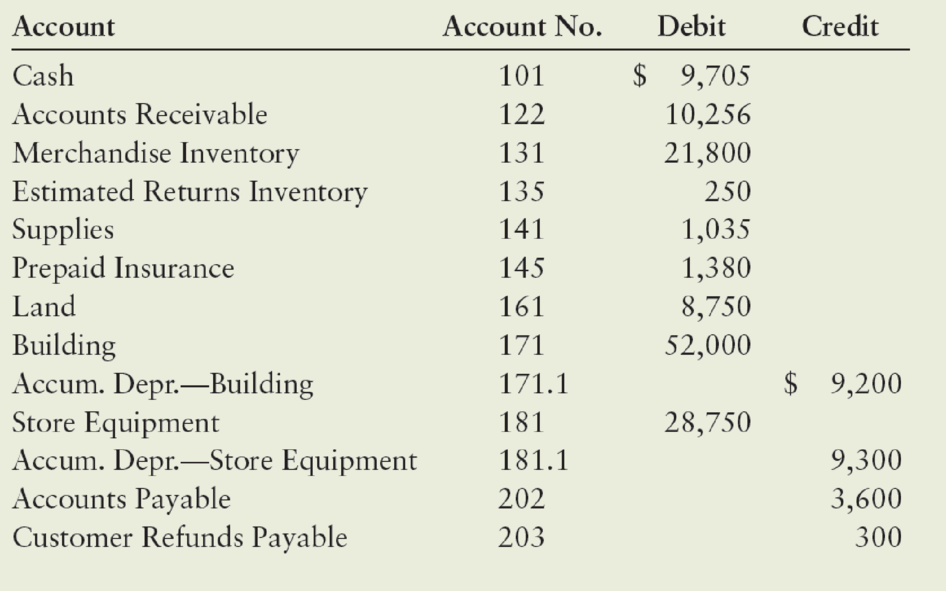

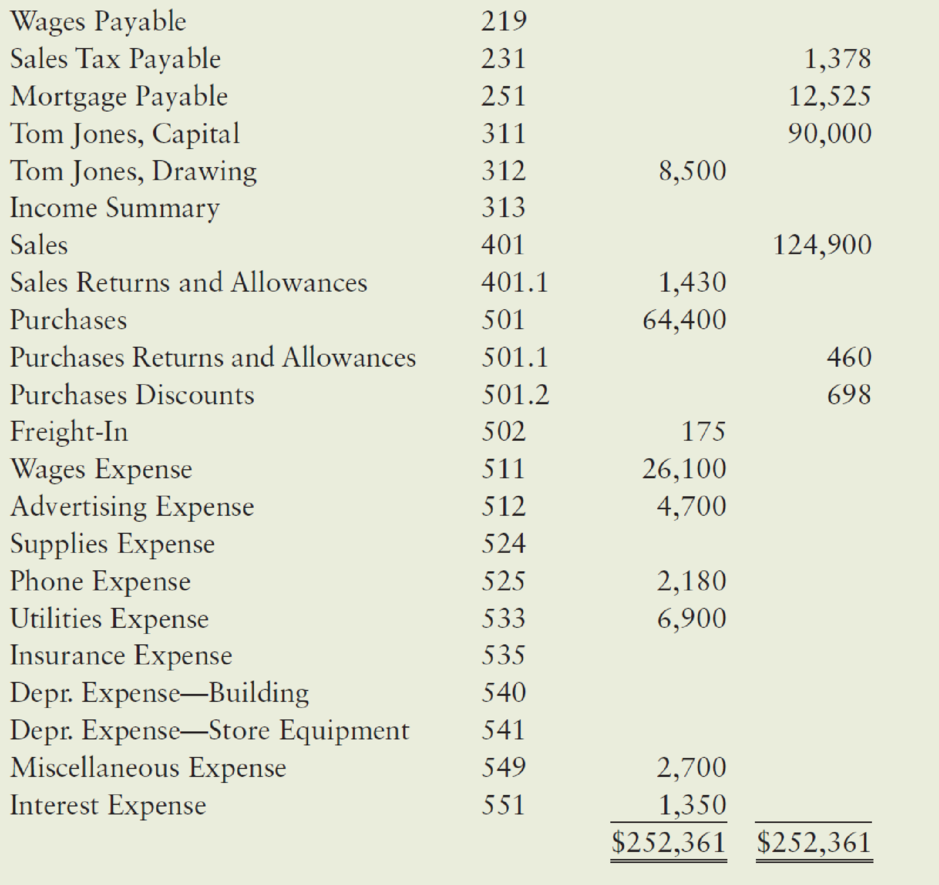

As of December 16, TJ’s account balances were as follows:

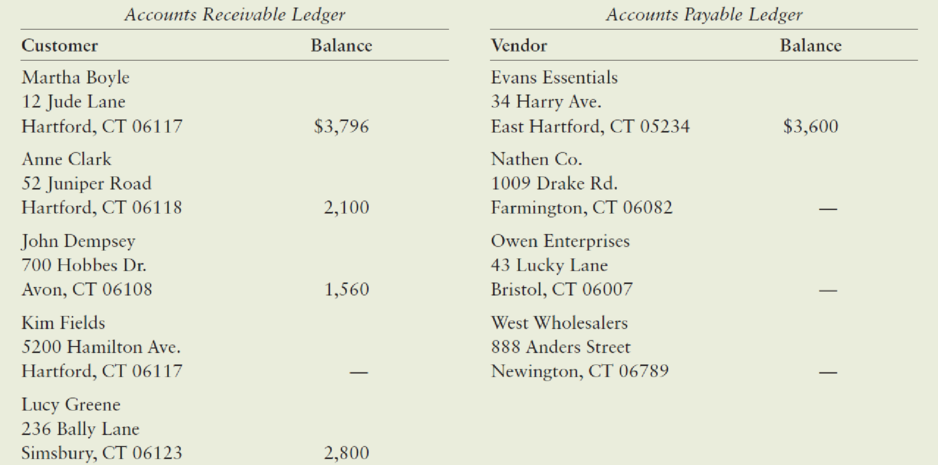

TJ’s also had the following subsidiary ledger balances as of December 16:

2. Enter transactions for the second half of December in the general journal. Post immediately to the

Trending nowThis is a popular solution!

Chapter 15 Solutions

College Accounting, Chapter 1-15 (Looseleaf) - With Access

- not use ai solve this question do fastarrow_forwardWhat is the gross profitarrow_forwardBeacon Corporation applies manufacturing overhead on the basis of direct labor hours. At the beginning of the most recent year, the company based its predetermined overhead rate on a total estimated overhead of $95,400 and 3,600 estimated direct labor hours. Actual manufacturing overhead for the year amounted to $98,800 and actual direct labor-hours were 3,500. The applied manufacturing overhead for the year was closest to __.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College