Sub part (a):

Effects of higher interest rate on households and firm behavior.

Sub part (a):

Explanation of Solution

If the Federal Reserve System rises the interest rates, then the borrowing of items become more costly. Therefore, households will reduce the purchase of durable goods such as auto mobiles and houses. So when the rate of interest rises, consumers spending on durable goods reduce.

In the case of firms, when the rate of interest rises, cost of capital becomes higher. Therefore firms will reduce the spending on investment. So when the rate of interest rises, investment will reduce.

Concept introduction:

Rate of interest: The rate of interest: The rate of interest refers to that percentage at which the money is borrowed or is taken as a loan. The amount to be paid as interest is calculated on this given percentage.

Sub part (b):

Effects of higher interest rate on bonds.

Sub part (b):

Explanation of Solution

When the rate of interest rises by the Federal Reserve, it will fall the existing values of fixed rate bonds. Because, in the case of fixed rate bonds, if the holder paying 7% for the next 10 years is become simply worth less if the potential buyers can now earn 8% by buying a new bond. That’s why, the higher interest rate would decrease the value of existing fixed rate bonds held by the public.

Concept introduction:

Bonds: Bond refers to the securities, which are traded in the public to raise the capital when needed. It is an investment with a fixed income, where an investor gives money to an entity or individual for a specified period of time at a fixed rate.

Sub part (c):

Wealth effect of higher interest rate on consumption.

Sub part (c):

Explanation of Solution

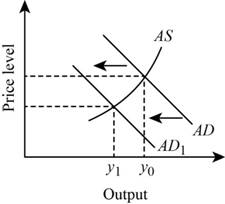

Figure 1 illustrates the changes in aggregative

In figure-1, vertical axis shows the output and the horizontal axis shows the

When the rate of interest rises, the cost of borrowing become higher. And also, the investment rate reduces because of the higher rate of capitals. These factors will reduce the wealth of an economy. When wealth reduces, consumers will spend less and they become worse off. In short, higher interest rate will reduce the spending of consumers. Therefore, the aggregative demand curve will shift the left wards. This is higher than the direct effect on investment.

Concept introduction:

Wealth effect: Wealth effect refers to the effect of a change in the price that has on the wealth of the individual.

Want to see more full solutions like this?

Chapter 15 Solutions

Principles of Macroeconomics, Student Value Edition Plus MyLab Economics with Pearson eText -- Access Card Package (12th Edition)

- Not use ai please letarrow_forwardQuestions from textbook: Santerre, Rexford, E., and Neun, Stephan P. Health Economics: Theories, Insights, and Industry Studies, 6th Edition, ISBN 13: 978-1-111-822729. Mason, OH: South-Western, Cengage Learning, 2013. 1. Suppose a health expenditure function is specified in the following manner: E = 500 + 0.2Y where E represents annual health care expenditures per capita and Y stands for income per capita. a. Using the slope of the health expenditure function, predict the change in per capita health care expenditures that would result from a $1,000 increase in per capita income. b. Compute the level of per capita health care spending when per capita income takes on the following dollar values: 0; 1,000; 2,000; 4,000; and 6,000. c. Using the resulting values for per capita health care spending in part B, graph the associated health care expenditure function. d. Assume that the fixed amount of health care spending decreases to $250. Graph the new and original health care functions on…arrow_forwardGraph shows the daily market price of jeans when the tax on sellers is set to zero per pair supposed the government institutes attacks of $20.30 per pair to be paid by the seller what is the quantity after taxarrow_forward

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning