Concept explainers

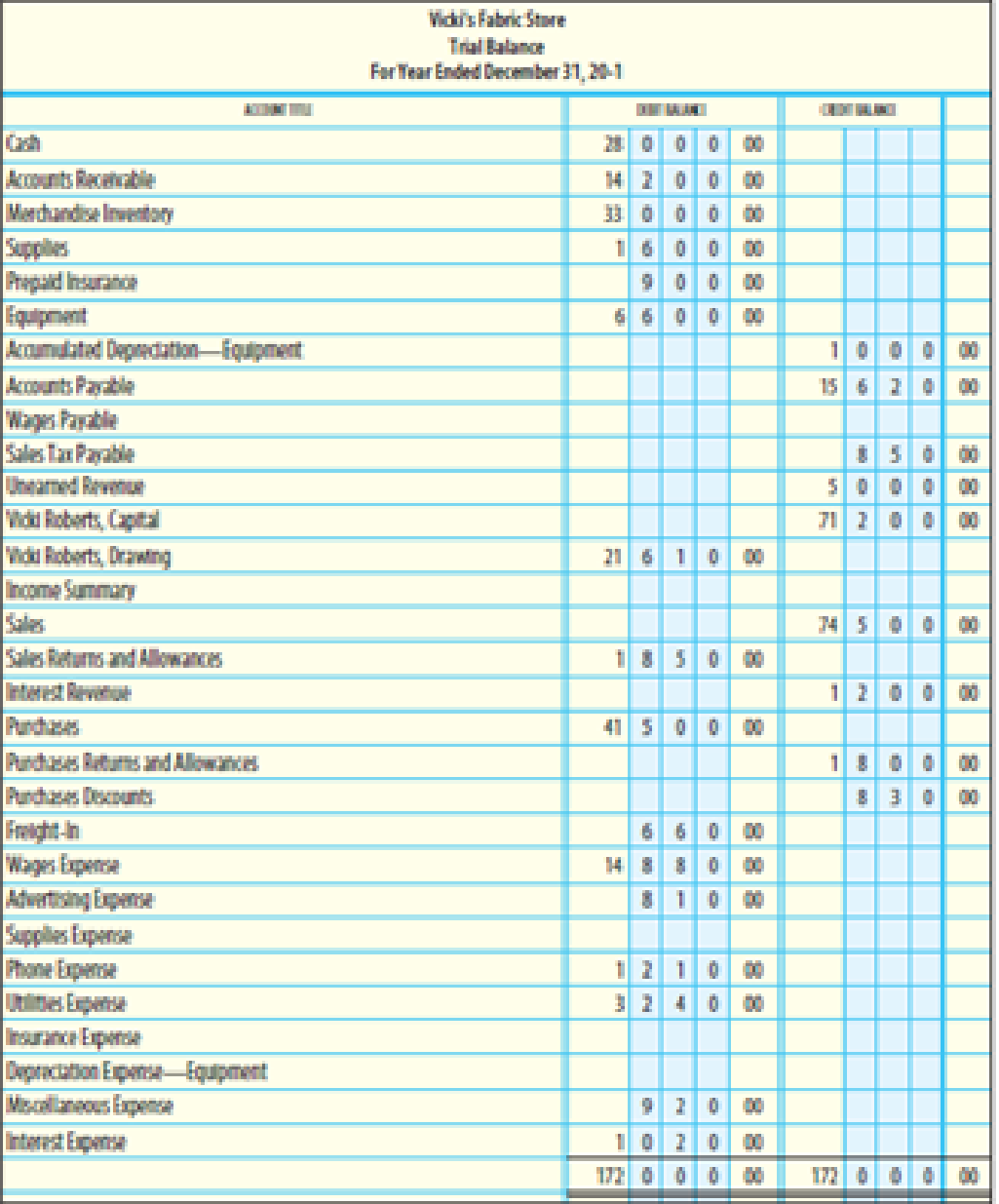

WORK SHEET, ADJUSTING, CLOSING, AND REVERSING ENTRIES Vicki’s Fabric Store shows the

At the end of the year, the following adjustments need to be made:

(a and b) Merchandise inventory as of December 31, $31,600.

(c) Unused supplies on hand, $1,150.

(d) Insurance expired, $350.

(e)

(f) Wages earned but not paid (Wages Payable), $520.

(g) Unearned revenue on December 31, 20-1, $1,200.

REQUIRED

- 1. Prepare a work sheet.

- 2. Prepare

adjusting entries . - 3. Prepare closing entries.

- 4. Prepare a post-closing trial balance.

- 5. Prepare reversing entry(ies).

1.

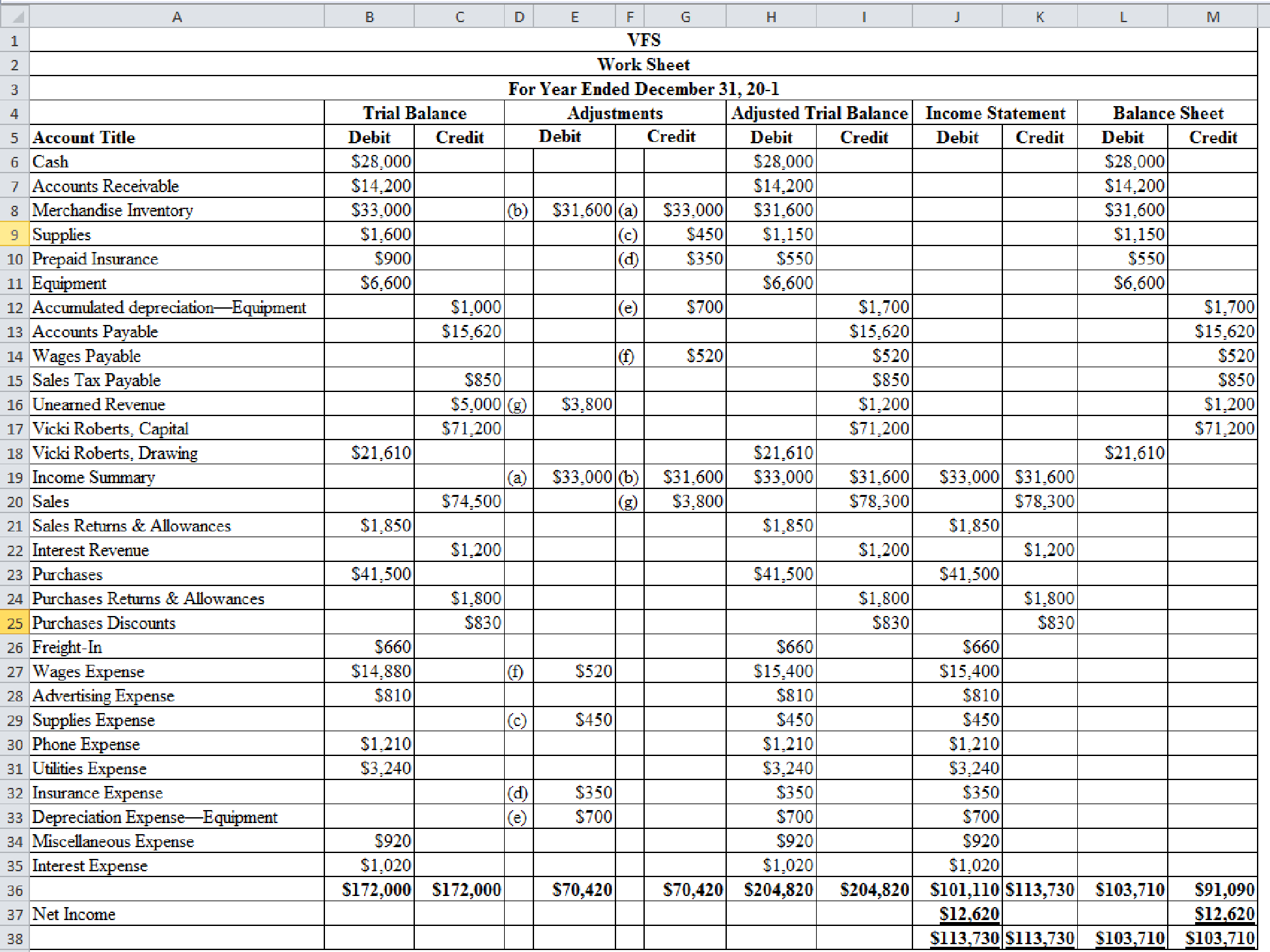

Prepare a worksheet of VFS.

Explanation of Solution

Prepare a worksheet of VFC.

Figure (1)

2.

Prepare adjusting entries.

Explanation of Solution

Adjustment entries:

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Prepare adjusting entries of VFS.

| Date | Account titles and Explanation | Debit | Credit | |

| 20-1 | ||||

| December 31 | (a) | Income Summary | $33,000 | |

| Merchandise Inventory | $33,000 | |||

| December 31 | (b) | Merchandise Inventory | $31,600 | |

| Income Summary | $31,600 | |||

| December 31 | (c) | Supplies Expense | $450 | |

| Supplies | $450 | |||

| December 31 | (d) | Insurance Expense | $350 | |

| Prepaid Insurance | $350 | |||

| December 31 | (e) | Depreciation expense - Equipment | $700 | |

| Accumulated depreciation - Equipment | $700 | |||

| December 31 | (f) | Wages Expense | $520 | |

| Wages Payable | $520 | |||

| December 31 | (g) | Unearned Revenue | $3,800 | |

| Sales | $3,800 |

Table (1)

3.

Prepare closing entries.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries of VFS.

| Date | Account titles and Explanation | Debit | Credit |

| 20-1 | Closing Entries | ||

| December 31 | Sales | $78,300 | |

| Interest Revenue | $1,200 | ||

| Purchases Returns & Allowances | $1,800 | ||

| Purchases Discounts | $830 | ||

| Income Summary | $82,130 | ||

| December 31 | Income Summary | $68,110 | |

| Sales Returns & Allowances | $1,850 | ||

| Purchases | $41,500 | ||

| Freight-In | $660 | ||

| Wages Expense | $15,400 | ||

| Advertising Expense | $810 | ||

| Supplies Expense | $450 | ||

| Phone Expense | $1,210 | ||

| Utilities Expense | $3,240 | ||

| Insurance Expense | $350 | ||

| Depreciation Exp. - Equipment | $700 | ||

| Miscellaneous Expense | $920 | ||

| Interest Expense | $1,020 | ||

| December 31 | Income Summary | $12,620 | |

| VRS's Capital | $12,620 | ||

| December 31 | VRS's Capital | $21,610 | |

| VRS's Drawing | $21,610 |

Table (2)

4.

Prepare post-closing trail balance.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post-closing trail balance of VFS.

| VFS | ||

| Post-Closing Trial Balance | ||

| December 31, 20-1 | ||

| Account Title | Debit | Credit |

| Cash | $28,000 | |

| Accounts Receivable | $14,200 | |

| Merchandise Inventory | $31,600 | |

| Supplies | $1,150 | |

| Prepaid Insurance | $550 | |

| Equipment | $6,600 | |

| Accumulated Depreciation—Equipment | $1,700 | |

| Accounts Payable | $15,620 | |

| Wages Payable | $520 | |

| Sales Tax Payable | $850 | |

| Unearned Revenue | $1,200 | |

| Vicki Roberts, Capital | $62,210 | |

| Total | $82,100 | $82,100 |

Table (3)

5.

Prepare reversing entry.

Explanation of Solution

Reversing entries:

Several Adjusting entries are needed to update all the balances in the financial statements in order to project true financial information and to maintain the records according to accrual basis principle. Some of these adjusting entries must be reversed at the beginning of a next accounting period to simplify the recording of transactions. Reversing entry is the opposite of adjusting entry.

Prepare reversing entry of VFS.

| Date | Account titles and Explanation | Debit | Credit |

| 20-2 | Reversing Entry | ||

| January 1 | Wages Payable | $520 | |

| Wages Expense | $520 |

Table (4)

Want to see more full solutions like this?

Chapter 15 Solutions

Bundle: College Accounting, Chapters 1-9, Loose-Leaf Version, 22nd + LMS Integrated for CengageNOWv2, 2 terms Printed Access Card for Heintz/Parry's College Accounting, Chapters 1-27, 22nd

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College