Concept explainers

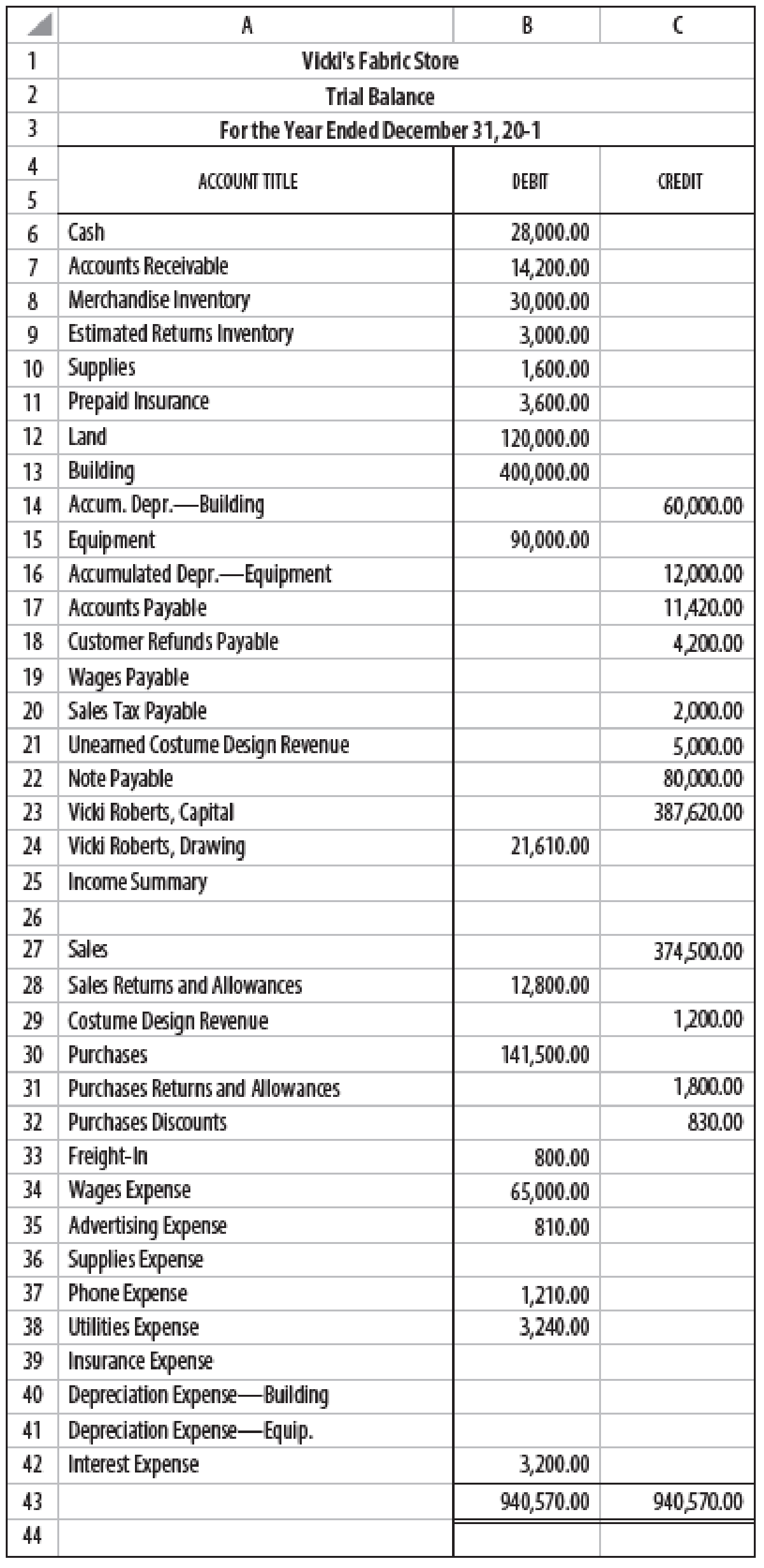

END-OF-PERIOD SPREADSHEET, ADJUSTING, CLOSING, AND REVERSING ENTRIES Vicki’s Fabric Store shows the

At the end of the year, the following adjustments need to be made:

(a, b) Merchandise inventory as of December 31, $31,600.

(c, d, e) Vicki estimates that customers will be granted $2,500 in refunds of this year’s sales next year and the merchandise expected to be returned will have a cost of $1,800.

(f) Unused supplies on hand, $350.

(g) Insurance expired, $2,400.

(h)

(i) Depreciation expense for the year on equipment, $4,000.

(j) Wages earned but not paid (Wages Payable), $520.

(k) Unearned revenue on December 31, 20-1, $1,200.

PROBLEM 15-10A CONT.

REQUIRED

- 1. Prepare an end-of-period spreadsheet.

- 2. Prepare

adjusting entries and post adjusting entries to an Income Summary T account. - 3. Prepare closing entries and post to a Capital T account. There were no additional investments this year.

- 4. Prepare a post-closing trial balance.

- 5. Prepare reversing entry(ies).

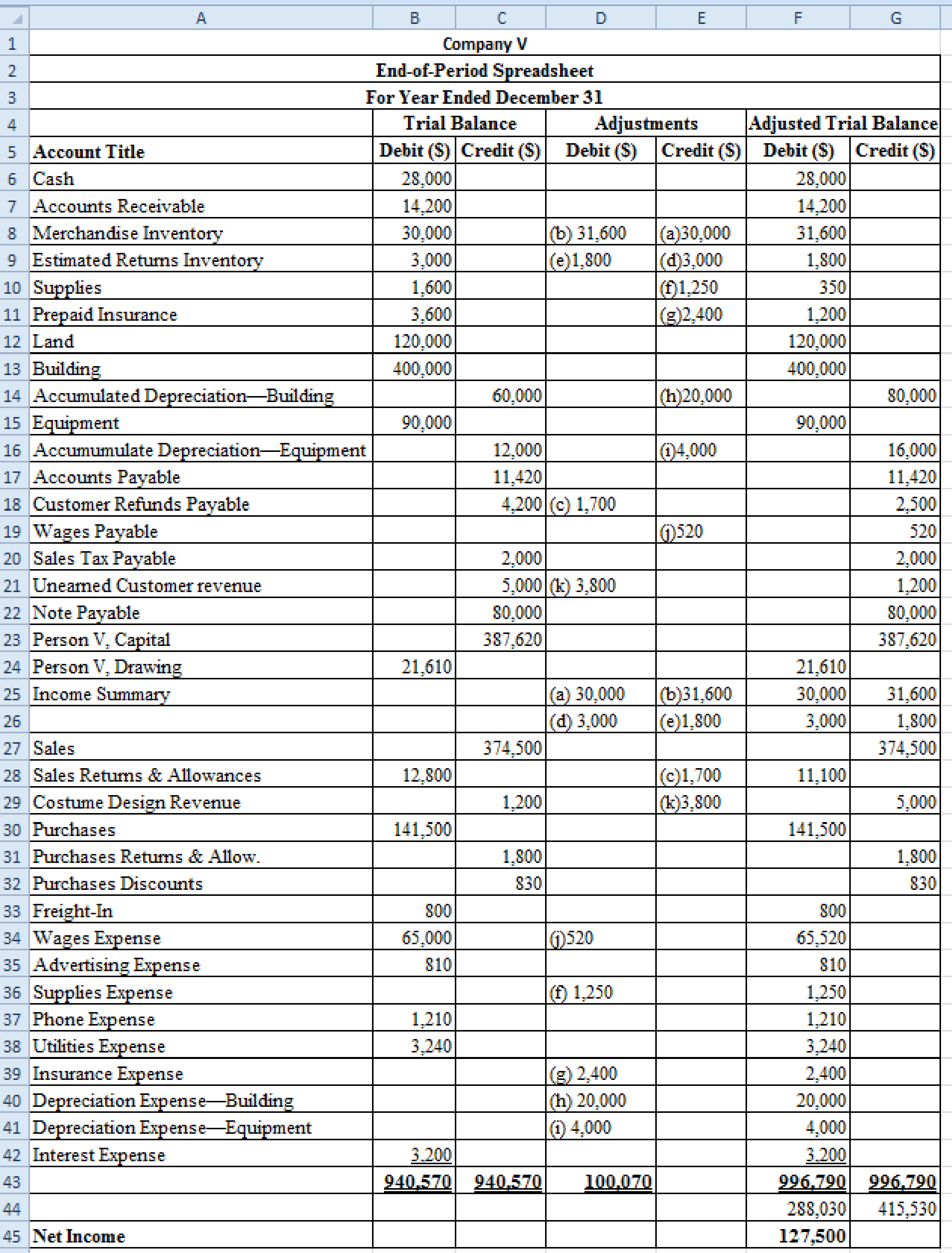

1.

Prepare an end of period spreadsheet.

Explanation of Solution

Prepare an end of period spreadsheet.

Figure (1)

2.

Prepare adjusting entries and post adjusting entries to an income summary T- Account.

Explanation of Solution

Adjustment entries:

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Prepare adjusting entries and post adjusting entries:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| Adjusting Entries | |||

| December 31 | Income Summary | 30,000 | |

| Merchandise Inventory | 30,000 | ||

| December 31 | Merchandise Inventory | 31,600 | |

| Income Summary | 31,600 | ||

| December 31 | Sales Returns and Allowances | 1,700 | |

| Customer Refunds Payable | 1,700 | ||

| December 31 | Income Summary | 3,000 | |

| Estimated Returns Inventory | 3,000 | ||

| December 31 | Estimated Returns Inventory | 1,800 | |

| Income Summary | 1,800 | ||

| December 31 | Supplies Expense | 1,250 | |

| Supplies | 1,250 | ||

| December 31 | Insurance Expense | 2,400 | |

| Prepaid Insurance | 2,400 | ||

| December 31 | Depreciation Expense - Building | 20,000 | |

| Accumulated Depreciation - Building | 20,000 | ||

| December 31 | Depreciation. Expense - Equipment | 4,000 | |

| Accumulated Depreciation - Equipment | 4,000 | ||

| December 31 | Wages Expense | 520 | |

| Wages Payable | 520 | ||

| December 31 | Unearned Costume Design Revenue | 3,800 | |

| Costume Design Revenue | 3,800 |

Table (1)

3.

Prepare closing entries and post to a Capital T- account.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries:

| General Journal | ||||

| Date | Account Titles and Explanation | Debit ($) | Credit ($) | |

| Closing Entries | ||||

| December 31 | Sales | 374,500 | ||

| Costume Design Revenue | 5,000 | |||

| Purchases Returns & Allowances | 1,800 | |||

| Purchases Discounts | 830 | |||

| Income Summary | 382,130 | |||

| December 31 | Income Summary | 255,030 | ||

| Sales Returns & Allowances | 11,100 | |||

| Purchases | 141,500 | |||

| Freight-In | 800 | |||

| Wages Expense | 65,520 | |||

| Advertising Expense | 810 | |||

| Supplies Expense | 1,250 | |||

| Phone Expense | 1,210 | |||

| Utilities Expense | 3,240 | |||

| Insurance Expense | 2,400 | |||

| Depreciation Expense - Building | 20,000 | |||

| Depreciation Expense- Equipment | 4,000 | |||

| Interest Expense | 3,200 | |||

| December 31 | Income Summary | 127,500 | ||

| Person V, Capital | 127,500 | |||

| December 31 | Person V, Capital | 21,610 | ||

| Person V, Drawing | 21,610 | |||

Table (2)

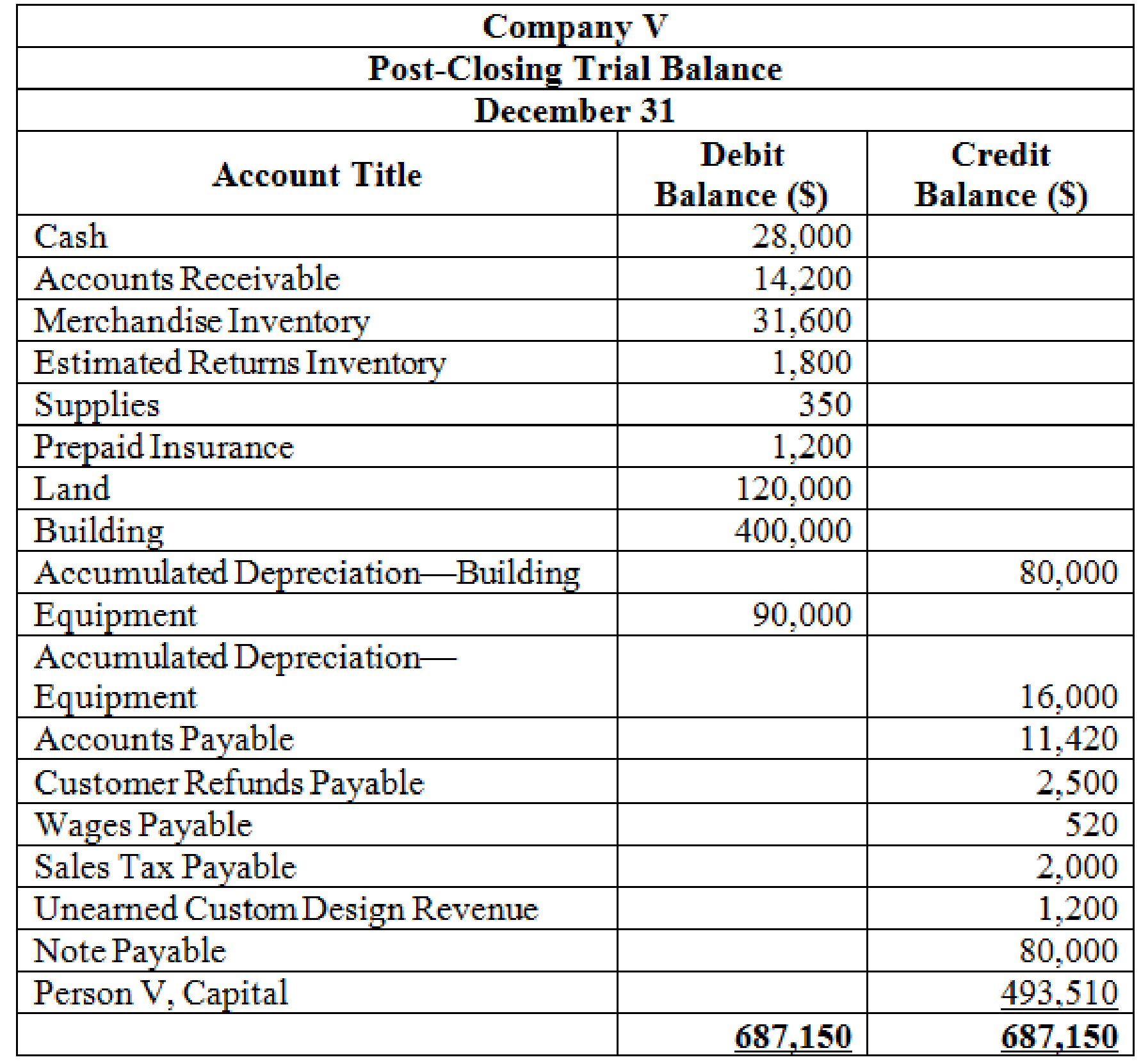

4.

Prepare a post-closing trail balance.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare post-closing trial balance:

Table (3)

5.

Prepare reversing entry.

Explanation of Solution

Reversing entries:

Several Adjusting entries are needed to update all the balances in the financial statements in order to project true financial information and to maintain the records according to accrual basis principle. Some of these adjusting entries must be reversed at the beginning of a next accounting period to simplify the recording of transactions. Reversing entry is the opposite of adjusting entry.

Prepare reversing entries:

| Reversing Entry | |||

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| January 1 | Wages Payable | 520 | |

| Wages Expense | 520 |

Table (4)

Want to see more full solutions like this?

Chapter 15 Solutions

College Accounting, Chapters 1-15

- The following data were taken from the records of Splish Brothers Company for the fiscal year ended June 30, 2025. Raw Materials Inventory 7/1/24 $58,100 Accounts Receivable $28,000 Raw Materials Inventory 6/30/25 46,600 Factory Insurance 4,800 Finished Goods Inventory 7/1/24 Finished Goods Inventory 6/30/25 99,700 Factory Machinery Depreciation 17,100 21,900 Factory Utilities 29,400 Work in Process Inventory 7/1/24 21,200 Office Utilities Expense 9,350 Work in Process Inventory 6/30/25 29,400 Sales Revenue 560,500 Direct Labor 147,550 Sales Discounts 4,700 Indirect Labor 25,360 Factory Manager's Salary 63,400 Factory Property Taxes 9,910 Factory Repairs 2,500 Raw Materials Purchases 97,300 Cash 39,200 SPLISH BROTHERS COMPANY Income Statement (Partial) $arrow_forwardNo AIarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7.In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Assume that a pair of 8" Bean Boots are ordered on December 3, 2015. The order price is $109. The sales tax rate in the state in which the boots are order is 7%. L.L. Bean ships the boots on January 29, 2016. Assume same-day shipping for the sake of simplicity. On what day would L.L. Bean recognize the…arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage