Concept explainers

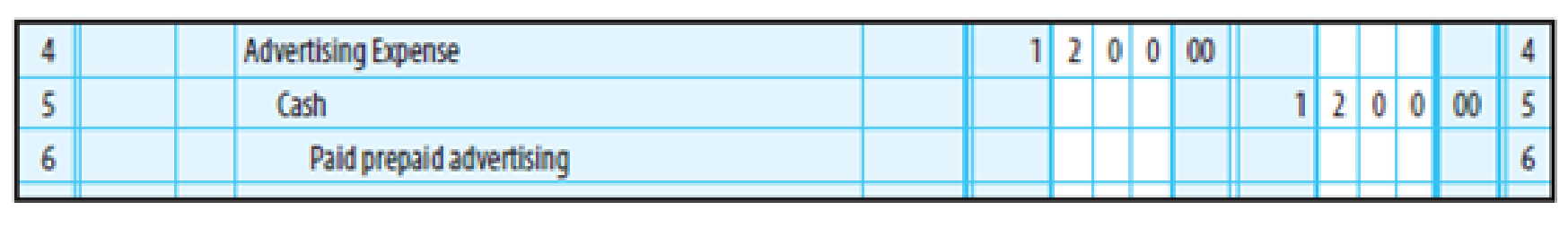

EXPENSE METHOD OF ACCOUNTING FOR PREPAID EXPENSES Davidson’s Food Mart paid $1,200 in advance to the local newspaper for advertisements that will appear monthly. The following entry was made:

At the end of the year, December 31, 20--, Davidson received notification that advertisements costing $800 had been run. Prepare the

Prepare the adjusting entry.

Explanation of Solution

The expense method of accounting for prepaid expenses:

In expense method of accounting for prepaid supplies, prepaid expenses and other prepaid items are recorded as purchases during its purchase.

Adjustment entries:

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Record the adjusting entries under prepaid expenses method:

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| December 31 | Prepaid advertising | 400 | |

| Advertising expense | 400 | ||

| (To record amount of prepaid advertising ) |

Table (1)

- Prepaid advertising is a current asset and it is increased. Therefore, debit prepaid advertising account by $400.

- Advertising expense is a component of stockholders’ equity and it is increased. Therefore, credit advertising expense account by $400.

Want to see more full solutions like this?

Chapter 14A Solutions

Study Guide for Working Papers for Heintz/Parry's College Accounting, Chapters 16-27, 23rd

- Anderson Technologies has 40,000,000 shares outstanding with a current market PPS of $30.25. If the firm has total assets of $750M, total liabilities of $250M, and net income of $480M, it would have a P/E of _ and a Market-to-Book ratio of _. Question 5arrow_forwardKindly help me with accounting questionsarrow_forwardWhat is the dollar amount of interest accounting questionarrow_forward

- In the current year, Palmer Industries incurred $180,000 in actual manufacturing overhead cost. The Manufacturing Overhead account showed that overhead was overapplied in the amount of $9,000 for the year. If the predetermined overhead rate was $10.00 per direct labor-hour, how many hours were worked during the year? ANSWER?arrow_forwardWhat is the cost of goods manufactured for 2023 ??arrow_forwardAt the beginning of the year, manufacturing overhead for the year was estimated to be $315,840. At the end of the year, actual direct labor-hours for the year were 25,800 hours, the actual manufacturing overhead for the year was $308,700, and manufacturing overhead for the year was overapplied by $14,500. If the predetermined overhead rate is based on direct labor-hours, then what must have been the estimated direct labor-hours at the beginning of the year used in the predetermined overhead rate?arrow_forward

- At the beginning of the year, manufacturing overhead for the year was estimated to be $800,000. At the end of the year, actual labor hours for the year were 40,000 hours, the actual manufacturing overhead for the year was $775,000, and the manufacturing overhead for the year was overapplied by $25,000. If the predetermined overhead rate is based on direct labor hours, then the estimated labor hours at the beginning of the year used in the predetermined overhead rate must have been ___ Hours.arrow_forwardMason Corporation issued its own $15,000, 120-day, non-interest-bearing note to a bank. The only payment Mason will ever make to the bank will be for $15,000 at the maturity date of the loan, as the bank discounts the note at 8%. The proceeds to Mason are: Ans.arrow_forwardThe future earnings, dividends, and common stock price of Square Technologies Inc. are expected to grow at a rate of 5% per year. The company’s common stock is currently selling for $30 per share and its last dividend was $4. What is the company’s cost of common equity? If the firm’s beta is 1.25, the risk-free rate is 6%, and the market rate of return is 14%, what will be the cost of common equity using the CAPM approach? If you have equal confidence in the inputs used for the two approaches, what is your estimate of the company’s cost of common equity? Berger Paints Corporation has a target capital structure of 35% debt and 65% common equity. Its before tax cost of debt is 9% and the marginal tax rate is 30%. The company’s stock is currently selling at $23 per share and the last dividend was $3. If dividends are expected to grow at a constant rate of 5%, what is the company’s cost of common equity and WACC?arrow_forward

- Gale Corporation owns 15% of the common stock of Troy Enterprises and uses the fair-value method to account for this investment. Troy reported net income of $140,000 for 2022 and paid dividends of $80,000 on November 1, 2022. How much income should Gale recognize on this investment in 2022? Nonearrow_forwardPlease help me with part Barrow_forwardGale Corporation owns 15% of the common stock of Troy Enterprises and uses the fair-value method to account for this investment. Troy reported net income of $140,000 for 2022 and paid dividends of $80,000 on November 1, 2022. How much income should Gale recognize on this investment in 2022?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning