Concept explainers

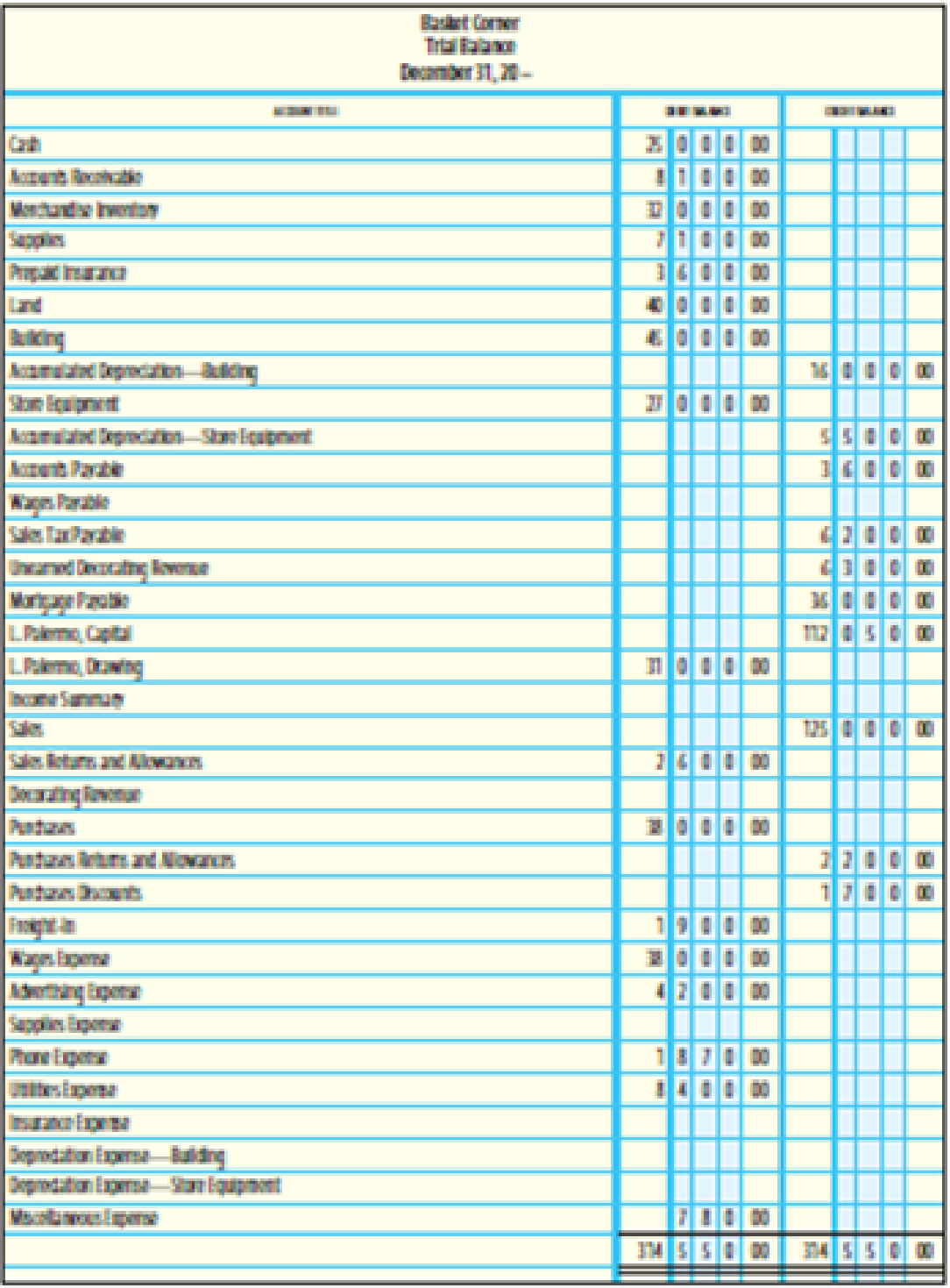

COMPLETION OF A WORK SHEET SHOWING A NET INCOME A

(a and b) Merchandise inventory costing $24,000 is on hand as of December 31, 20--.

(The periodic inventory system is used.)

(c) Supplies remaining at the end of the year; $2,100.

(d) Unexpired insurance on December 31, $2,600.

(e)

(f) Depreciation expense on the store equipment for 20--, $3,800.

(g) Unearned decorating revenue as of December 31, $1,650.

(h) Wages earned but not paid as of December 31, $750.

REQUIRED

- 1. Complete the Adjustments columns, identifying each adjustment with its corresponding letter.

- 2. Complete the work sheet.

- 3. Enter the adjustments in a general journal.

Trending nowThis is a popular solution!

Chapter 14 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

- Question: A companys total liabilities are $247,000, and its equity is $987,000. What are the total assets?arrow_forwardWhat is ROA?arrow_forwardThe status and garden decorations in the warehouse belonging to Woodman's Flowers and Gift are considered which of the following? a. Equity. b. Expenses. c. Profits. d. Assets.arrow_forward

- Provide correct answer general Accountingarrow_forwardThe Boxwood Company sells blankets for $60 each. It has no beginning inventory on May 1. Assuming that the company uses the perpetual inventory system, determine the ending inventory value for the month of May using the FIFO inventory cost method. a. $494 b. $502 c. $422 d. $520 The following was taken from the inventory records during May. Date Product Z Units Cost May 3 Purchase 5 $ 30 May 10 Sale 3 May 17 Purchase 10 $ 34 May 20 Sale 6 May 23 Sale 3 May 30 Purchase 10 $ 40arrow_forwardPlease solve the accounting problemarrow_forward

- Jones company reported a pretax book solve this question general Accountingarrow_forwardThe following information is available for October for Norton Company. Beginning inventory Net purchases Net sales Percentage markup on cost $ 4,00,000 12,00,000 24,00,000 66.67% A fire destroyed Norton's October 31 inventory, leaving undamaged inventory with a cost of $24,000. Using the gross profit method, the estimated ending inventory destroyed by fire is: a. $136,000. b. $616,000. c. $640,000. d. $800,000.arrow_forwardWhat is the profit margin ratio?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage