Bundle: Managerial Accounting, 15th + Cengagenowv2, 1 Term Printed Access Card

15th Edition

ISBN: 9781337955386

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 7E

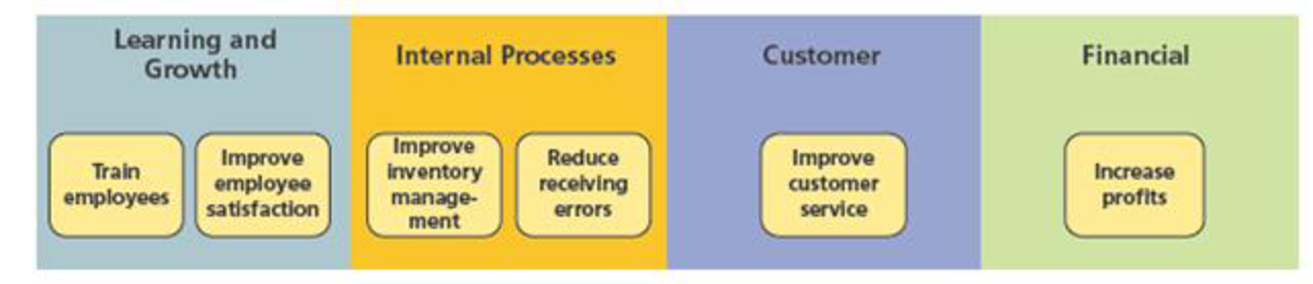

Grand Grocery developed a balanced scored with six strategic objectives under the standard four performance perspectives, as follows:

a. Draw a strategy map that shows how these strategic objectives likely influence each other.

b. Describe, in words, the relationships illustrated by the strategy map.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the dividend yield if your annual dividend income is 255 on these financial accounting question?

Please provide answer this financial accounting question not use ai

What is the value of the depreciation tax shield?

Chapter 14 Solutions

Bundle: Managerial Accounting, 15th + Cengagenowv2, 1 Term Printed Access Card

Ch. 14 - How does a strategic performance measurement...Ch. 14 - What is the difference between a leading indicator...Ch. 14 - Prob. 3DQCh. 14 - Prob. 4DQCh. 14 - What do strategy maps show, and how do they add...Ch. 14 - Prob. 6DQCh. 14 - Prob. 7DQCh. 14 - Prob. 8DQCh. 14 - How is sustainability distinguishable from...Ch. 14 - How can the balanced scorecard be used to address...

Ch. 14 - 72 Inc. has developed a balanced scorecard with...Ch. 14 - Bluetiful Inc. has the following strategic...Ch. 14 - Moses Moonrocks Inc. has developed a balanced...Ch. 14 - Prob. 4BECh. 14 - Lonnies Shipping Co. is considering switching to...Ch. 14 - Henrys Cafe is a local restaurant that is growing...Ch. 14 - American Express Company is a major financial...Ch. 14 - Eat-n-Run Inc. owns and operates 10 food trucks...Ch. 14 - Prob. 4ECh. 14 - Prob. 5ECh. 14 - The following is the balanced scorecard for Smith...Ch. 14 - Grand Grocery developed a balanced scored with six...Ch. 14 - Coulson and Company is a large retail business...Ch. 14 - Rizzo Goal Inc. produces and sells hockey...Ch. 14 - Silver Lining Inc. has a balanced scorecard with a...Ch. 14 - Two departments within Cougar Gear Inc. are...Ch. 14 - Sunny Nights Inc. is completely powered by the...Ch. 14 - Instructions 1. Label each element of the balanced...Ch. 14 - Strategic initiatives and CSR Get Hitched Inc. is...Ch. 14 - Prob. 3PACh. 14 - Instructions 1. Based on the balanced scorecard...Ch. 14 - Strategic initiatives and CSR Blue Skies Inc. is a...Ch. 14 - Eye Swear Inc. has a balanced scorecard that...Ch. 14 - Den-Tex Company is evaluating a proposal to...Ch. 14 - Analyze CSR initiatives at Boxwood Company Boxwood...Ch. 14 - Analyze CSR initiatives at Green Manufacturing...Ch. 14 - Prob. 1TIFCh. 14 - Blake McKenzie Tax Services is a company serving...Ch. 14 - Young Manufacturing Company is a startup...Ch. 14 - The fundamental concept behind strategic...Ch. 14 - Which of the following statements regarding the...Ch. 14 - The balanced scorecard provides an action plan for...Ch. 14 - Which of the following statements best describes...Ch. 14 - A sign of the successful implementation of a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve general account queryarrow_forwardDunbar Corporation can either purchase an asset for $38,000, which will have no value after 13 years, or lease the same for 13 years with an annual lease payment of $4,458, due at the end of each year. The company's cost of debt is 8%. The IRS classifies the lease as a non-tax-oriented lease. What is the net advantage of leasing? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardDunbar Corporation can either purchase an asset for $38,000, which will have no value after 13 years, or lease the same for 13 years with an annual lease payment of $4,458, due at the end of each year. The company's cost of debt is 8%. The IRS classifies the lease as a non-tax-oriented lease. What is the net advantage of leasing? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent.[Cost Account]arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Why do we need accounting?; Author: EconClips;https://www.youtube.com/watch?v=weCXE2wIl90;License: Standard Youtube License