The Midwest Division of the Paibec Corporation manufactures subassemblies that are used in the corporation’s final products. Lynn Hardt of Midwest’s Profit Planning Department has been assigned the task of determining whether a component, MTR–2000, should continue to be manufactured by Midwest or purchased from Marley Company, an outside supplier. MTR–2000 is part of a subassembly manufactured by Midwest.

Marley has submitted a bid to manufacture and supply the 32,000 units of MTR–2000 that Paibec will need for 20x1 at a unit price of $17.30. Marley has assured Paibec that the units will be delivered according to Paibec’s production specifications and needs. While the contract price of $17.30 is only applicable in 20x1, Marley is interested in entering into a long-term arrangement beyond 20x1.

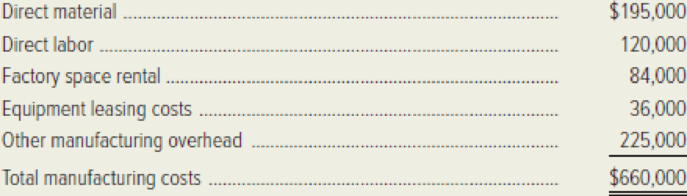

Hardt has gathered the following information regarding Midwest’s

Hardt has collected the following additional information related to manufacturing MTR–2000.

- Direct materials used in the production of MTR–2000 are expected to increase 8 percent in 20x1.

- Midwest’s direct-labor contract calls for a 5 percent increase in 20x1.

- The facilities used to manufacture MTR–2000 are rented under a month-to-month rental agreement. Thus, Midwest can withdraw from the rental agreement without any penalty. Midwest will have no need for this space if MTR–2000 is not manufactured.

- Equipment leasing costs represent special equipment that is used in the manufacture of MTR– 2000. This lease can be terminated by paying the equivalent of one month’s lease payment for each year left on the lease agreement. Midwest has two years left on the lease agreement, through the end of the year 20x2.

- Forty percent of the other manufacturing

overhead is considered variable. Variable overhead changes with the number of units produced, and this rate per unit is not expected to change in 20x1. The fixed manufacturing overhead costs are expected to be the same across a relevant range of zero to 50,000 units. Equipment other than the leased equipment can be used in Midwest’s other manufacturing operations.

John Porter, divisional manager of Midwest, stopped by Hardt’s office to voice his concern regarding the outsourcing of MTR–2000. Porter commented, “I am really concerned about outsourcing MTR– 2000. I have a son-in-law and a nephew, not to mention a member of our bowling team, who work on MTR–2000. They could lose their jobs if we buy that component from Marley. I really would appreciate anything you can do to make sure the cost analysis comes out right to show we should continue making MTR–2000. Corporate is not aware of the material increases and maybe you can leave out some of those fixed costs. I just think we should continue making MTR–2000!”

Required:

- a. Prepare an analysis of relevant costs that shows whether or not the Midwest Division of Paibec Corporation should make MTR–2000 or purchase it from Marley Company for 20x1.

- b. Based solely on the financial results, recommend whether the 32,000 units of MTR–2000 for 20x1 should be made by Midwest or purchased from Marley.

- 2. Identify and briefly discuss three qualitative factors that the Midwest Division and Paibec Corporation should consider before agreeing to purchase MTR–2000 from Marley Company.

- 3. By referring to the standards of ethical conduct for

managerial accountants given in Chapter 1, explain why Lynn Hardt would consider the request of John Porter to be unethical.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Managerial Accounting

- Provide correct answer this financial accounting questionarrow_forwardChapter 15 Homework 13 Saved Help Save & Exit Submit Part 1 of 2 0.83 points eBook Ask Required information Use the following information to answer questions. (Algo) [The following information applies to the questions displayed below.] Information on Kwon Manufacturing's activities for its first month of operations follows: a. Purchased $100,800 of raw materials on credit. b. Materials requisitions show the following materials used for the month. Job 201 Job 202 Total direct materials Indirect materials Total materials used $ 49,000 24,400 73,400 9,420 $ 82,820 c. Time tickets show the following labor used for the month. Print References Job 201 $ 40,000 Job 202 13,400 Total direct labor 53,400 25,000 $ 78,400 Indirect labor Total labor used d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory. f. Sold Job 201 for $166,160 on credit. g. Incurred the following actual other…arrow_forwardquesrion 2arrow_forward

- Anti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2, 173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes $76,000; Dividends $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capital (325 marks)arrow_forwardQS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forwardQuestion 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forward

- Question 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forwarddiscus extensivery source of bussines finances requaments not less than 4 pages font size 12 spacing 1.5 roman times references must be less thhan 5arrow_forwardCalculate stricklers cash conversion cycle?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education