EBK MANAGERIAL ACCOUNTING: THE CORNERST

7th Edition

ISBN: 9781337516150

Author: Heitger

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 32BEB

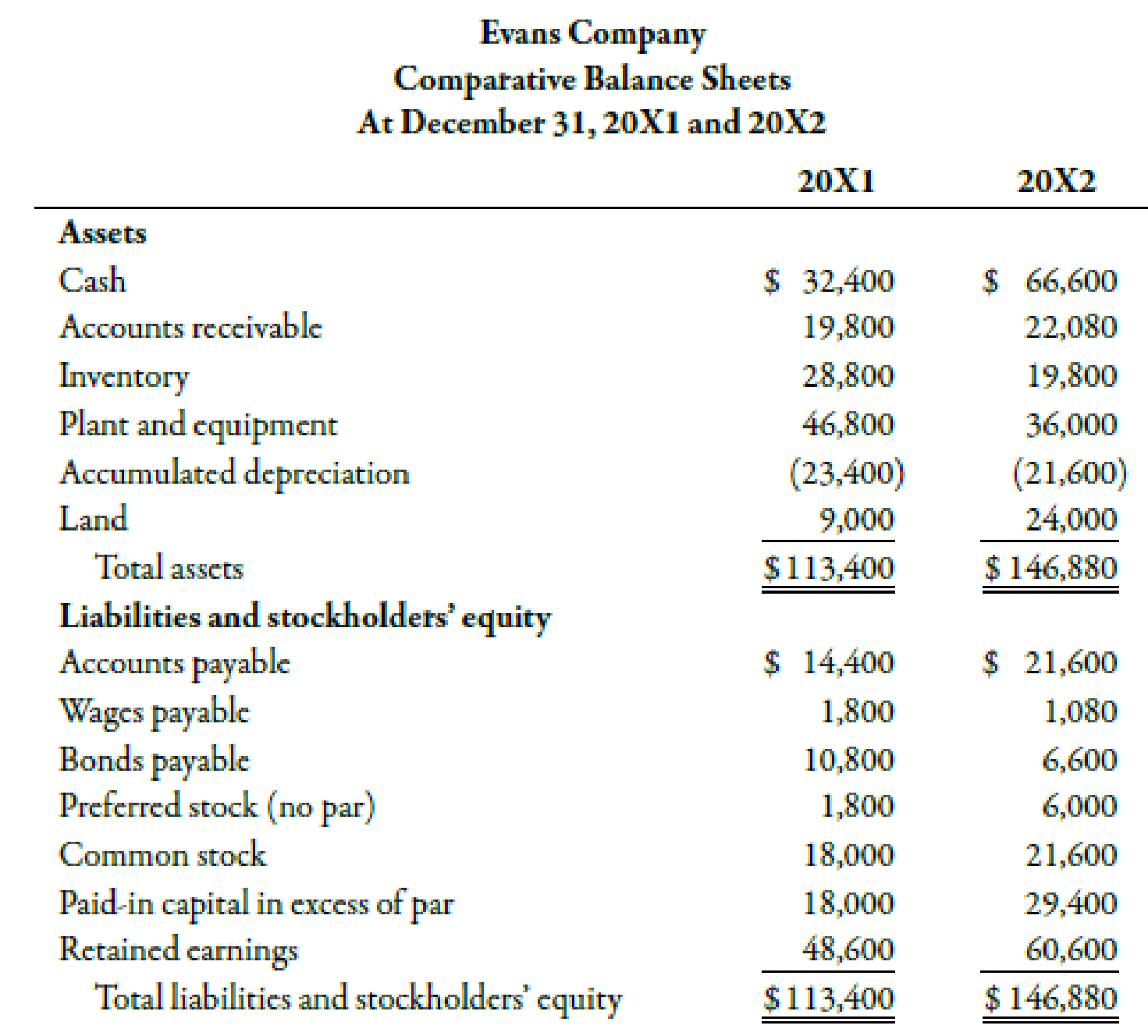

During 20X2, Evans Company had the following transactions:

- a. Cash dividends of $6,000 were paid.

- b. Equipment was sold for $2,880. It had an original cost of $10,800 and a book value of $5,400. The loss is included in operating expenses.

- c. Land with a fair market value of $15,000 was acquired by issuing common stock with a par value of $3,600.

- d. One thousand shares of

preferred stock (no par) were sold for $4.20 per share.

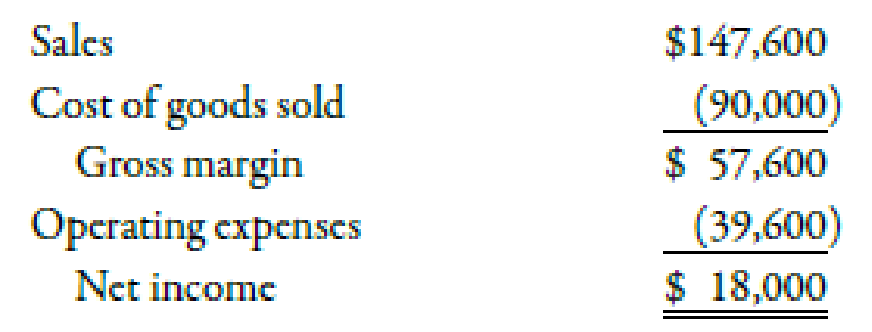

Evans provided the following income statement (for 20X2) and comparative

Required:

Prepare a worksheet for Evans Company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Cost of goods sold for the year is?

?!

How much is the 2020 depreciation expense?

Chapter 14 Solutions

EBK MANAGERIAL ACCOUNTING: THE CORNERST

Ch. 14 - Prob. 1DQCh. 14 - Prob. 2DQCh. 14 - Of the three categories on the statement of cash...Ch. 14 - Prob. 4DQCh. 14 - Why is it better to report the noncash investing...Ch. 14 - Prob. 6DQCh. 14 - Prob. 7DQCh. 14 - Explain how a company can report a loss and still...Ch. 14 - In computing the periods net operating cash flows,...Ch. 14 - Prob. 10DQ

Ch. 14 - In computing the periods net operating cash flows,...Ch. 14 - Explain the reasoning for including the payment of...Ch. 14 - What are the advantages in using worksheets when...Ch. 14 - Prob. 14DQCh. 14 - Cash inflows from operating activities come from...Ch. 14 - Prob. 2MCQCh. 14 - Prob. 3MCQCh. 14 - Sources of cash include a. profitable operations....Ch. 14 - Uses of cash include a. cash dividends. b. the...Ch. 14 - Prob. 6MCQCh. 14 - Prob. 7MCQCh. 14 - Which of the following adjustments to net income...Ch. 14 - An increase in accounts receivable is deducted...Ch. 14 - An increase in inventories is deducted from net...Ch. 14 - The gain on sale of equipment is deducted from net...Ch. 14 - Which of the following is an investing activity?...Ch. 14 - Which of the following is a financing activity? a....Ch. 14 - Prob. 14MCQCh. 14 - A worksheet approach to preparing the statement of...Ch. 14 - In a completed worksheet, a. the debit column...Ch. 14 - Prob. 17BEACh. 14 - Prob. 18BEACh. 14 - Prob. 19BEACh. 14 - Prob. 20BEACh. 14 - Swasey Company earned net income of 1,800,000 in...Ch. 14 - Prob. 22BEACh. 14 - Prob. 23BEACh. 14 - During 20X2, Norton Company had the following...Ch. 14 - Prob. 25BEBCh. 14 - Prob. 26BEBCh. 14 - Roberts Company provided the following partial...Ch. 14 - Prob. 28BEBCh. 14 - Prob. 29BEBCh. 14 - Prob. 30BEBCh. 14 - Prob. 31BEBCh. 14 - During 20X2, Evans Company had the following...Ch. 14 - Stillwater Designs is a private company and...Ch. 14 - Prob. 34ECh. 14 - Jarem Company showed 189,000 in prepaid rent on...Ch. 14 - During the year, Hepworth Company earned a net...Ch. 14 - During 20X1, Craig Company had the following...Ch. 14 - Tidwell Company experienced the following during...Ch. 14 - Prob. 39ECh. 14 - Oliver Company provided the following information...Ch. 14 - Prob. 41ECh. 14 - Prob. 42ECh. 14 - Prob. 43ECh. 14 - Solpoder Corporation has the following comparative...Ch. 14 - Solpoder Corporation has the following comparative...Ch. 14 - The following financial statements were provided...Ch. 14 - Prob. 47PCh. 14 - Prob. 48PCh. 14 - Booth Manufacturing has provided the following...Ch. 14 - The following balance sheets and income statement...Ch. 14 - The following balance sheets and income statement...Ch. 14 - Balance sheets for Brierwold Corporation follow:...Ch. 14 - Balance sheets for Brierwold Corporation follow:...Ch. 14 - Prob. 54PCh. 14 - Prob. 55PCh. 14 - The following balance sheets were taken from the...Ch. 14 - The following balance sheets were taken from the...Ch. 14 - The comparative balance sheets and income...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cost of goods sold is?arrow_forwardGT Industries purchased a truck on January 1, 2019. GT paid $30,000 for the truck. The truck is expected to have a $3,000 residual value and a 6-year life. GT has a December 31 fiscal year-end. Using the straight-line method, how much is the 2020 depreciation expense? provide answerarrow_forwardEnd informationarrow_forward

- What is the firm's ROAarrow_forwardDuring its first year of operations, Saboori Manufacturing paid $13,200 for direct materials and $11,500 for production workers' wages. Lease payments and utilities on the production facilities amounted to $10,400, while general, selling, and administrative expenses totaled $5,200. The company produced 6,200 units and sold 4,000 units at a price of $8.50 per unit. What is Saboori Manufacturing's cost of goods sold for the year?arrow_forwardhow much should be recorded on December 31 for the gain loss?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License