Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

7th Edition

ISBN: 9781337384285

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 32BEB

During 20X2, Evans Company had the following transactions:

- a. Cash dividends of $6,000 were paid.

- b. Equipment was sold for $2,880. It had an original cost of $10,800 and a book value of $5,400. The loss is included in operating expenses.

- c. Land with a fair market value of $15,000 was acquired by issuing common stock with a par value of $3,600.

- d. One thousand shares of

preferred stock (no par) were sold for $4.20 per share.

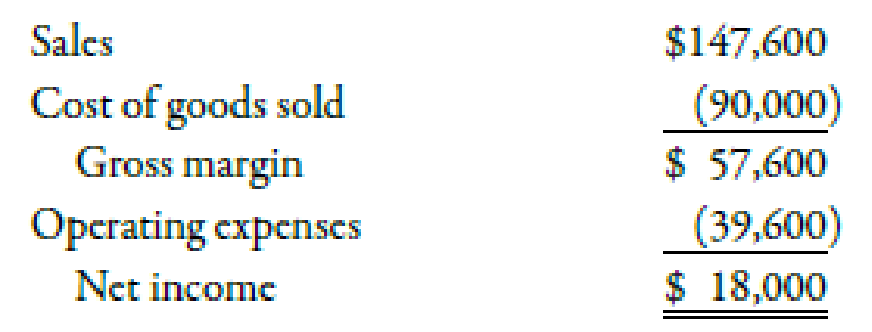

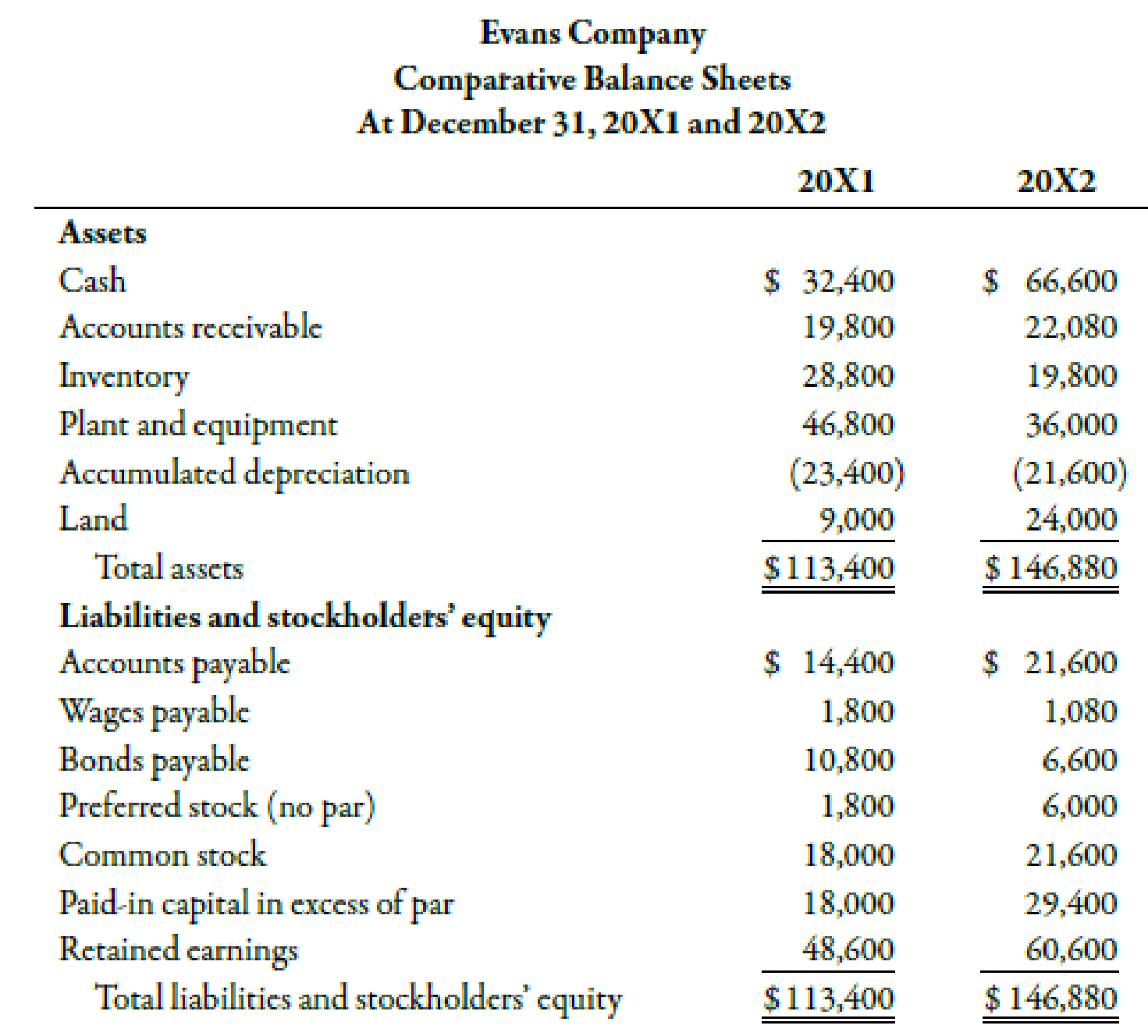

Evans provided the following income statement (for 20X2) and comparative balance sheets:

Required:

Prepare a worksheet for Evans Company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

i want to correct answer

The result Would be a higher pretex income of

4 PTS

Chapter 14 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

Ch. 14 - Prob. 1DQCh. 14 - Prob. 2DQCh. 14 - Of the three categories on the statement of cash...Ch. 14 - Prob. 4DQCh. 14 - Why is it better to report the noncash investing...Ch. 14 - Prob. 6DQCh. 14 - Prob. 7DQCh. 14 - Explain how a company can report a loss and still...Ch. 14 - In computing the periods net operating cash flows,...Ch. 14 - Prob. 10DQ

Ch. 14 - In computing the periods net operating cash flows,...Ch. 14 - Explain the reasoning for including the payment of...Ch. 14 - What are the advantages in using worksheets when...Ch. 14 - Prob. 14DQCh. 14 - Cash inflows from operating activities come from...Ch. 14 - Prob. 2MCQCh. 14 - Prob. 3MCQCh. 14 - Sources of cash include a. profitable operations....Ch. 14 - Uses of cash include a. cash dividends. b. the...Ch. 14 - Prob. 6MCQCh. 14 - Prob. 7MCQCh. 14 - Which of the following adjustments to net income...Ch. 14 - An increase in accounts receivable is deducted...Ch. 14 - An increase in inventories is deducted from net...Ch. 14 - The gain on sale of equipment is deducted from net...Ch. 14 - Which of the following is an investing activity?...Ch. 14 - Which of the following is a financing activity? a....Ch. 14 - Prob. 14MCQCh. 14 - A worksheet approach to preparing the statement of...Ch. 14 - In a completed worksheet, a. the debit column...Ch. 14 - Prob. 17BEACh. 14 - Prob. 18BEACh. 14 - Prob. 19BEACh. 14 - Prob. 20BEACh. 14 - Swasey Company earned net income of 1,800,000 in...Ch. 14 - Prob. 22BEACh. 14 - Prob. 23BEACh. 14 - During 20X2, Norton Company had the following...Ch. 14 - Prob. 25BEBCh. 14 - Prob. 26BEBCh. 14 - Roberts Company provided the following partial...Ch. 14 - Prob. 28BEBCh. 14 - Prob. 29BEBCh. 14 - Prob. 30BEBCh. 14 - Prob. 31BEBCh. 14 - During 20X2, Evans Company had the following...Ch. 14 - Stillwater Designs is a private company and...Ch. 14 - Prob. 34ECh. 14 - Jarem Company showed 189,000 in prepaid rent on...Ch. 14 - During the year, Hepworth Company earned a net...Ch. 14 - During 20X1, Craig Company had the following...Ch. 14 - Tidwell Company experienced the following during...Ch. 14 - Prob. 39ECh. 14 - Oliver Company provided the following information...Ch. 14 - Prob. 41ECh. 14 - Prob. 42ECh. 14 - Prob. 43ECh. 14 - Solpoder Corporation has the following comparative...Ch. 14 - Solpoder Corporation has the following comparative...Ch. 14 - The following financial statements were provided...Ch. 14 - Prob. 47PCh. 14 - Prob. 48PCh. 14 - Booth Manufacturing has provided the following...Ch. 14 - The following balance sheets and income statement...Ch. 14 - The following balance sheets and income statement...Ch. 14 - Balance sheets for Brierwold Corporation follow:...Ch. 14 - Balance sheets for Brierwold Corporation follow:...Ch. 14 - Prob. 54PCh. 14 - Prob. 55PCh. 14 - The following balance sheets were taken from the...Ch. 14 - The following balance sheets were taken from the...Ch. 14 - The comparative balance sheets and income...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- MCQarrow_forwardUse the Motor Vehicle Taxable Benefit table below to answer questions 1 and 2. Motor Vehicles: Annual Taxable Benefit Original cost of motor vehicle Age of MV – up to 5 years old Age of MV – Over 5 years old (up to 50% private use) (over 50% private use) (up to 50% private use) (over 50% private use) Up to $300,000 $40,000 $48,000 $30,000 $36,000 Up to $700,000 $50,000 $60,000 $40,000 $48,000 Up to $1,000,000 $75,000 $80,000 $60,000 $65,000 Up to $1,500,000 $90,000 $100,000 $72,000 $80,000 Over $1,500,000 $120,000 $140,000 $98,000 $100,00 1. Melissa Hines earned an annual salary of $1,050,000 and her employer paid $50,000 per month to an independent landlord for rental of her apartment. She was given a company vehicle that was bought 8 years earlier for $1,100,000. It is estimated that Ms. Hines private usage of the vehicle is 40%. What would be her total emoluments for the year?…arrow_forwardThe appropriate adjusting journal entry to be made at the end of the period would bearrow_forward

- please give me true answerarrow_forwardSwift solution ins. Report the following financial information please solve this question financial accountingarrow_forwardJeffery Thomas works at Wingman Ltd. He is provided with a motor vehicle that was bought for $1,850,000 and is less than 3 years old. It is estimated that Jeffery uses the vehicle for 70% private use. He receives a salary for the month of September of $80,000 and earned $35,000 as commission. Calculate his gross income for the month of September. A. $115,000 B. $123,333 C. $126,667 D. $125,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License