Block Foods, a retail grocery store, has agreed to purchase all of its merchandise from Square Wholesalers. In return. Block receives a special discount on purchases. Over recent months, Square noticed that purchases by Block had been falling off. At first, Square simply thought that business might be down for Block and was hopeful that their purchases would pick up. When business with Block did not return to a normal level, Square requested financial statements from Block. Squares records indicate that Block purchased $300,000 worth of merchandise during 20-1, the most recent year.

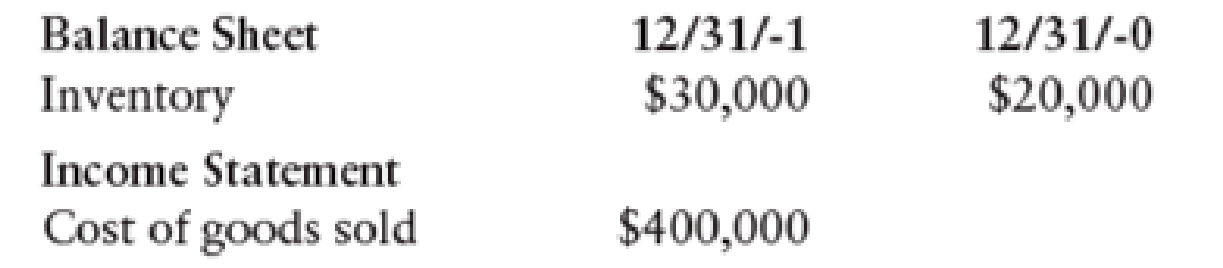

Selected information taken from Block's financial statements is as follows:

REQUIRED

Compute net purchases made by Block during 20-1. Does it appear that Block violated the agreement?

Trending nowThis is a popular solution!

Chapter 14 Solutions

College Accounting, Chapter 1-15 (Looseleaf)

- 1: Blaine Philips files as married filing jointly on his tax return and earned weekly gross pay of $385. He does not make any retirement plan contributions. Blaine checked box 2c on Form W-4 and did not enter any information in steps 3-4 of the form. Federal income tax withholding = $ 2: Chloe Fineman files as single on her tax return and earned weekly gross pay of $920. For each period she makes a 401(k) contribution of 6% of gross pay. Chloe entered $12,000 on line 4a of Form W-4 and did not enter any information in steps 2 and 3 of the form. Federal income tax withholding = $ 3: Maria Moore files as married filing jointly on her tax return and earned weekly gross pay of $790. For each period she makes a flexible spending account contribution of 3% of gross pay. Maria checked box 2c on Form W-4, entered $500 in step 3 of the form, and did not enter any information in step 4 of the form. Federal income tax withholding = $ Tentative Federal Income Tax Withholding = $arrow_forwardNeed helparrow_forwardWhat is the PIE ratio now ? Accountingarrow_forward

- Nonearrow_forwardSuppose that Treyton Manufacturing has annual sales of $6.30 million, cost of goods sold of $3.20 million, average inventories of $1,500,000, and average accounts receivable of $600,000. Assuming that all of Treyton's sales are on credit, what will be the firm's operating cycle?arrow_forwardAccounting questionarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT