Principles of Managerial Finance, Student Value Edition Plus MyLab Finance with Pearson eText - Access Card Package (15th Edition) (Pearson Series in Finance)

15th Edition

ISBN: 9780134830209

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.7P

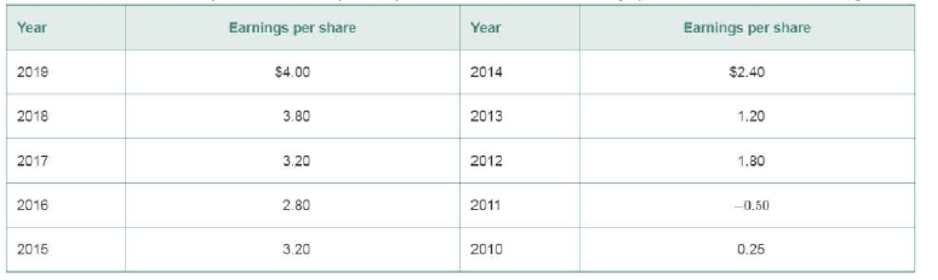

Alternative dividend policies Over the past 10 years, a firm has had the earnings per share shown in the following table.

- a. If the firm’s dividend policy were based on a constant payout ratio of 40% for all years with positive earnings and 0% otherwise, what would be the annual dividend for each year?

- b. If the firm had a dividend payout of $1.00 per share, increasing by $0.10 per share whenever the dividend payout fell below 50% for 2 consecutive years, what annual dividend would the firm pay each year?

- c. If the firm’s policy were to pay $0.50 per share each period except when earnings per share exceed $3.00, when an extra dividend equal to 80% of earnings beyond $3.00 would be paid, what annual dividend would the firm pay each year?

- d. Discuss the pros and cons of each dividend policy described in parts a through c.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You plan to retire in 10 years with $385,337. You plan to make X withdrawals of $59,856 per year. The expected return is 17.26 percent

per year and the first regular withdrawal is expected in 10 years. What is X?

Input instructions: Round your answer to at least 2 decimal places.

My answer keeps having an x for incorrect what is the correct answer

You plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per

year and the first regular withdrawal is expected in 4 years. What is X?

Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do

not enter .0986 or 9.86%). Round your answer to at least 2 decimal places.

percent

Chapter 14 Solutions

Principles of Managerial Finance, Student Value Edition Plus MyLab Finance with Pearson eText - Access Card Package (15th Edition) (Pearson Series in Finance)

Ch. 14.1 - What two ways can firms distribute cash to...Ch. 14.1 - Why do rapidly growing firms generally pay no...Ch. 14.1 - The dividend payout ratio equals dividends paid...Ch. 14.2 - Prob. 14.4RQCh. 14.2 - Prob. 14.5RQCh. 14.2 - What benefit is available to participants in a...Ch. 14.3 - Does following the residual theory of dividends...Ch. 14.3 - Contrast the basic arguments about dividend policy...Ch. 14.4 - Prob. 14.9RQCh. 14.5 - Describe a constant-payout-ratio dividend policy,...

Ch. 14.6 - Why do firms issue stock dividends? Comment on the...Ch. 14.6 - Compare a stock split with a stock dividend.Ch. 14 - Prob. 1ORCh. 14 - Prob. 14.1STPCh. 14 - Prob. 14.1WUECh. 14 - Prob. 14.2WUECh. 14 - Prob. 14.3WUECh. 14 - Prob. 14.4WUECh. 14 - Prob. 14.5WUECh. 14 - Dividend payment procedures At the quarterly...Ch. 14 - Prob. 14.2PCh. 14 - Prob. 14.3PCh. 14 - Dividend constraints The Howe Companys...Ch. 14 - Prob. 14.5PCh. 14 - Low-regular-and-extra dividend policy Bennett Farm...Ch. 14 - Alternative dividend policies Over the past 10...Ch. 14 - Alternative dividend policies Given the earnings...Ch. 14 - Stock dividend: Firm Columbia Paper has the...Ch. 14 - Cash versus stock dividend Milwaukee Tool has the...Ch. 14 - Stock dividend: Investor Sarah Warren currently...Ch. 14 - Stock dividend: Investor Security Data Company has...Ch. 14 - Stock split: Firm Growth Industries current...Ch. 14 - Prob. 14.14PCh. 14 - Stock split versus stock dividend: Firm Mammoth...Ch. 14 - Prob. 14.16PCh. 14 - Prob. 14.17PCh. 14 - Prob. 14.18PCh. 14 - Prob. 14.19P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Answers wrongarrow_forwardYou plan to retire in 6 years with $1,124,632. You plan to make X withdrawals of $148,046 per year. The expected return is 10.81 percent per year and the first regular withdrawal is expected in 7 years. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardEquipment is worth $206,286. It is expected to produce regular cash flows of $13,729 per year for 25 years and a special cash flow of $10,100 in 25 years. The cost of capital is X percent per year and the first regular cash flow will be produced in 1 year. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardSays its incorrectarrow_forwardFor EnPro, Please find the following values using the pdf (value line) provided . Please no excle. When finding R, use the formula: Risk Free Rate + Beta * (Market Rate – Risk Free Rate) The Risk Free Rate will always be 0.016 and the Market Rate will always be 0.136 for this problem. (For R, I got 17.2%, If I'm wrong can you please explain how) On Value Line: DPO = All Div'ds to Net Profit On Value Line: ROE = Return on Shr. Equity On Value Line: P/E = Avg Ann'l P/E ratio* The first 4 results should be rated to the year 2025 (r, Average DPO, Growth rate, Average P/E) r= _ Average DPO= _ Growth rate= _ Average P/E= _ 2026 EPS= _ 2027 EPS= _ 2028 EPS= _ 2026 dividend= _ 2027 dividend= _ 2028 dividend= _ 2028 price= _ 2028 total cash flow Intrinsic value= _arrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per month. Your first payment to River Media would be in 1 month. What is X? Input instructions: Round your answer to the nearest dollar. 59arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $14,000 for 6 years at an interest rate of 1.50 percent per quarter. Your first payment to Gray Media would be in 3 months. Island Media would let you make monthly payments of $X for 4 years at an interest rate of 1.35 percent per month. Your first payment to Island Media would be today. What is X? Input instructions: Round your answer to the nearest dollar. 99arrow_forwardYou plan to retire in 7 years with $X. You plan to withdraw $54,100 per year for 15 years. The expected return is 13.19 percent per year and the first regular withdrawal is expected in 7 years. What is X? Input instructions: Round your answer to the nearest dollar. SAarrow_forward

- You plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar. $ 59arrow_forwardYou just borrowed $203,584. You plan to repay this loan by making regular quarterly payments of X for 69 quarters and a special payment of $56,000 in 7 quarters. The interest rate on the loan is 1.94 percent per quarter and your first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forwardI got 1.62 but it's wrong why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Dividend disocunt model (DDM); Author: Edspira;https://www.youtube.com/watch?v=TlH3_iOHX3s;License: Standard YouTube License, CC-BY