Horngren's Financial & Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780133866292

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.45BP

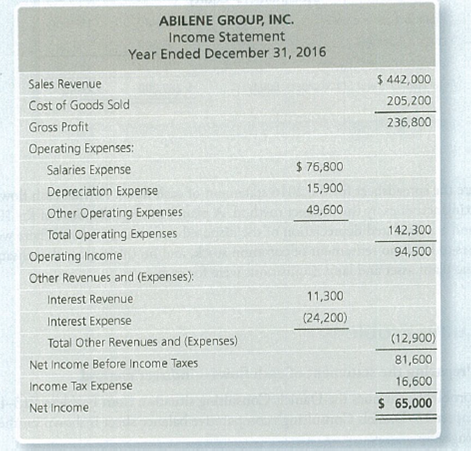

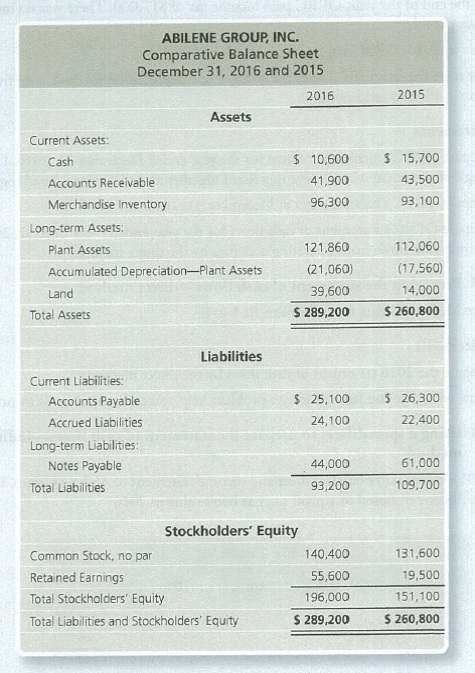

Using a spreadsheet to prepare the statement of

The 2016 comparative

Prepare the spreadsheet for the 2016 statement of cash flows. Format cash flows from operating activities by the indirect method. A plant asset was disposed of for $0. The cost and

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Compute the correct cost of goods sold for 2022

correct answer please

Financial accounting question

Chapter 14 Solutions

Horngren's Financial & Managerial Accounting (5th Edition)

Ch. 14 - The purposes of the statement of cash flows are to...Ch. 14 - The main categories of cash flow activities are a....Ch. 14 - Operating activities are most closely related to...Ch. 14 - Which item does not appear on a statement of cash...Ch. 14 - Leather Shop earned net income of 57,000 after...Ch. 14 - The Plant Assets account and Accumulated...Ch. 14 - Mountain Water Corp. issued common stock of 28,000...Ch. 14 - Prob. 8QCCh. 14 - Prob. 9AQCCh. 14 - If accrued liabilities increased during the year,...

Ch. 14 - Prob. 1RQCh. 14 - How does the statement of cash flows help users of...Ch. 14 - Describe the three basic types of cash flow...Ch. 14 - What types of transactions are reported in the...Ch. 14 - Prob. 5RQCh. 14 - Prob. 6RQCh. 14 - Explain why depreciation expense, depletion...Ch. 14 - Prob. 8RQCh. 14 - If current assets other than cash increase, what...Ch. 14 - If current liabilities increase, what is the...Ch. 14 - Prob. 11RQCh. 14 - Prob. 12RQCh. 14 - Prob. 13RQCh. 14 - Prob. 14RQCh. 14 - Prob. 15ARQCh. 14 - Prob. 16BRQCh. 14 - Describing the purposes of the statement of cash...Ch. 14 - Prob. 14.2SECh. 14 - Classifying items on the indirect statement of...Ch. 14 - Computing cash flows from operating...Ch. 14 - Prob. 14.5SECh. 14 - Prob. 14.6SECh. 14 - Prob. 14.7SECh. 14 - Prob. 14.8SECh. 14 - Prob. 14.9SECh. 14 - Prob. 14.10SECh. 14 - Preparing a statement of cash flows using the...Ch. 14 - Prob. 14.12SECh. 14 - Preparing the direct method statement of cash...Ch. 14 - Prob. 14.14SECh. 14 - Prob. 14.15SECh. 14 - Classifying cash flow items Consider the following...Ch. 14 - Prob. 14.17ECh. 14 - Prob. 14.18ECh. 14 - Prob. 14.19ECh. 14 - Prob. 14.20ECh. 14 - Prob. 14.21ECh. 14 - Prob. 14.22ECh. 14 - Prob. 14.23ECh. 14 - Prob. 14.24ECh. 14 - Prob. 14.25ECh. 14 - Prob. 14.26ECh. 14 - Prob. 14.27ECh. 14 - Prob. 14.28ECh. 14 - Prob. 14.29ECh. 14 - Prob. 14.30ECh. 14 - Using a spreadsheet to prepare the statement of...Ch. 14 - Prob. 14.32APCh. 14 - Prob. 14.33APCh. 14 - Prob. 14.34APCh. 14 - Prob. 14.35APCh. 14 - Preparing the statement of cash flows----direct...Ch. 14 - Prob. 14.37APCh. 14 - Prob. 14.38APCh. 14 - Prob. 14.39BPCh. 14 - Prob. 14.40BPCh. 14 - Prob. 14.41BPCh. 14 - Prob. 14.42BPCh. 14 - Prob. 14.43BPCh. 14 - Prob. 14.44BPCh. 14 - Using a spreadsheet to prepare the statement of...Ch. 14 - Prob. 14.46CPCh. 14 - Prob. 14.1CTDCCh. 14 - Moss Exports is having a bad year. Net income is...Ch. 14 - Details about a company's cash flows appear in a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Find the rate of return on this investment for donnearrow_forwardIngram Enterprises has variable expenses equal to 65% of sales. At a $500,000 sales level, the degree of operating leverage is 4.5. If sales increase by $50,000, what will be the new degree of operating leverage? Need answerarrow_forwardGeneral Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License