EBK MANAGERIAL ACCOUNTING

5th Edition

ISBN: 8220103613811

Author: TIETZ

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.37AP

Ratio analysis over two years (Learning Objective 4)

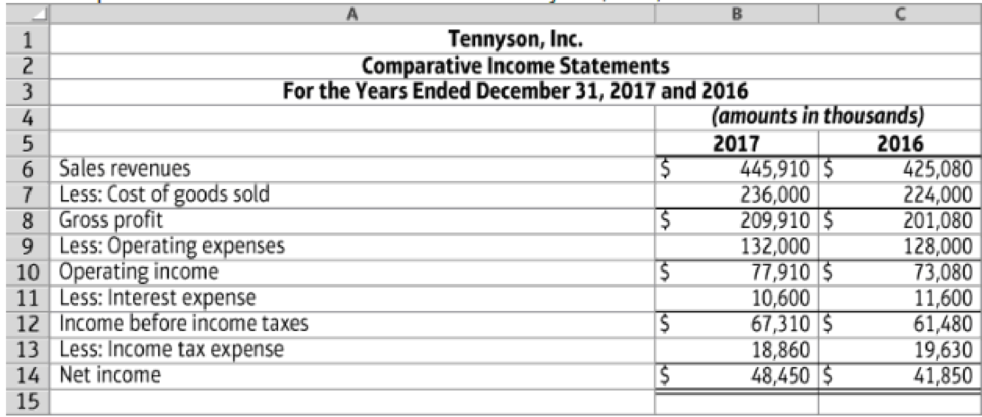

Comparative financial statement data of Tennyson, Inc., follow:

14.4-91 Full Alternative Text

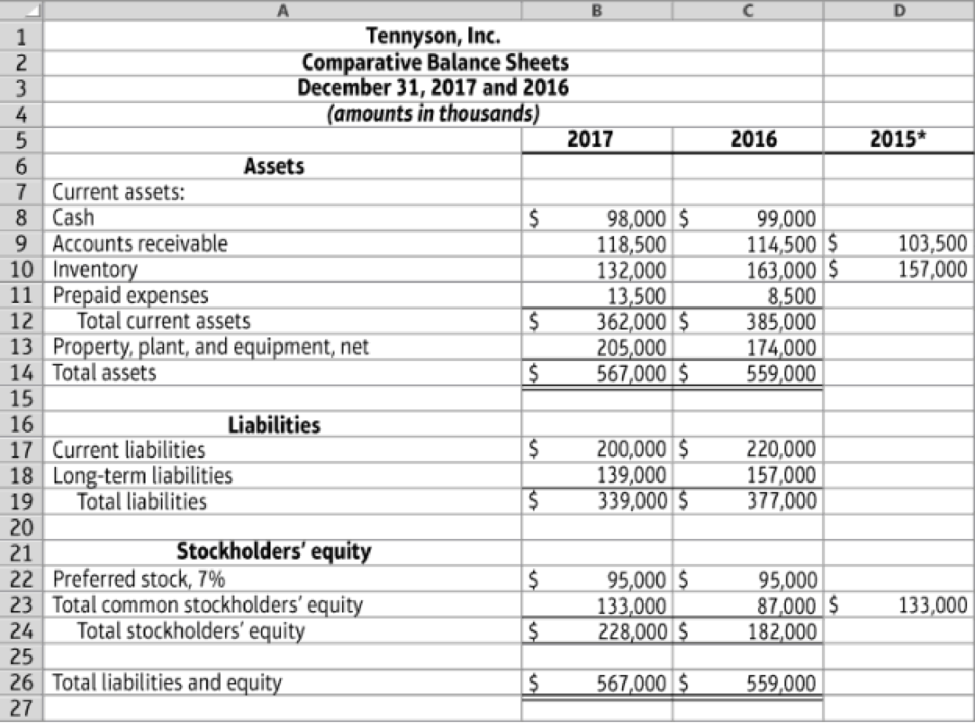

1. *Selected 2015 amounts

14.4-92 Full Alternative Text

- 1. Market price of Tennyson’s common stock: $43.51 at December 31,2017, and $31.36 at December 31, 2016

- 2. Common shares outstanding: 11,000,000 during 2017 and 11,000,000 during 2016

- 3. All sales are credit sales

Requirements

- 1. Compute the following ratios for 2017 and 2016:

- a.

Current ratio - b. Times-interest-earned ratio

- c. Inventory turnover

- d. Operating income percentage

- e. Return on common stockholders’ equity

- f. Earnings per share of common stock

- g. Price/earnings ratio

- 2. Decide (a) whether Tennyson’s ability to pay debts and to sell inventory improved or deteriorated during 2017 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you help me with accounting questions

Need help with this accounting questions

Get correct answer general accounting question

Chapter 14 Solutions

EBK MANAGERIAL ACCOUNTING

Ch. 14 - (Learning Objective 1) Which of the following...Ch. 14 - Prob. 2QCCh. 14 - Prob. 3QCCh. 14 - Prob. 4QCCh. 14 - (Learning Objective 3) Which of the following is...Ch. 14 - (Learning Objective 4) Working capital is defined...Ch. 14 - Prob. 7QCCh. 14 - Prob. 8QCCh. 14 - Prob. 9QCCh. 14 - Prob. 10QC

Ch. 14 - Prob. 14.1SECh. 14 - Find trend percentages (Learning Objective 1)...Ch. 14 - Prob. 14.3SECh. 14 - Prepare common-size income statements (Learning...Ch. 14 - Analyze common-size income statements (Learning...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Prob. 14.9SECh. 14 - Prob. 14.10SECh. 14 - Prob. 14.11SECh. 14 - Prob. 14.12AECh. 14 - Prob. 14.13AECh. 14 - Prob. 14.14AECh. 14 - Prob. 14.15AECh. 14 - Prob. 14.16AECh. 14 - Calculate ratios (Learning Objective 4) Kelleher...Ch. 14 - Prob. 14.18AECh. 14 - Prob. 14.19AECh. 14 - Prob. 14.20AECh. 14 - Prob. 14.21AECh. 14 - Classify company sustainability measurements into...Ch. 14 - Prob. 14.23BECh. 14 - Prob. 14.24BECh. 14 - Prob. 14.25BECh. 14 - Prob. 14.26BECh. 14 - Prob. 14.27BECh. 14 - Calculate ratios (Learning Objective 4) Ponderosa...Ch. 14 - Prob. 14.29BECh. 14 - Prob. 14.30BECh. 14 - Prob. 14.31BECh. 14 - Calculate ratios (Learning Objective 4) Thornton...Ch. 14 - Prob. 14.33BECh. 14 - Prob. 14.34APCh. 14 - Comprehensive analysis (Learning Objectives 2, 3, ...Ch. 14 - Prob. 14.36APCh. 14 - Ratio analysis over two years (Learning Objective...Ch. 14 - Prob. 14.38APCh. 14 - Prob. 14.39BPCh. 14 - Prob. 14.40BPCh. 14 - Prob. 14.41BPCh. 14 - Ratio analysis over two years (Learning Objective...Ch. 14 - Make an investment decision (Learning Objective 4)...Ch. 14 - Prob. 14.44SCCh. 14 - Discussion Questions 1. Describe horizontal...Ch. 14 - Prob. 14.47ACTCh. 14 - Using financial statement ratios to analyze...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the Hofstede Country Comparison ToolLinks to an external site., compare your nation to two other nations on Hofstede’s dimensions. Based on what you know about these national cultures and the cultural dimensions discussed in class, how do you interpret the accuracy of this information?arrow_forwardI need help with this solution for accountingarrow_forwardGeneral accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License