Working Papers for Warren/Reeve/Duchac's Corporate Financial Accounting, 14th

14th Edition

ISBN: 9781305878839

Author: Carl Warren, Jonathan Duchac, James M. Reeve

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.2ADM

Deere: Profitability analysis

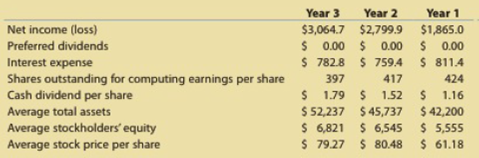

Deere & Company manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere's credit division loans money to customers to finance the purchase of their farm and construction equipment.

The following information is available for three recent years (in millions except per-share amounts):

- 1. Calculate the following ratios for each year (round ratios and percentages to one decimal place, except for per-share amounts):

- A. Return on total assets

- B. Return on stockholders’ equity

- C. Earnings per share

- D. Dividend yield

- E. Price-earnings ratio

- 2. Based on these data, evaluate Deere s profitability.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

At September 1, 2010, Kern Enterprises reported a cash balance

of $45,000. During the month, Kern collected cash of $15,000

and made disbursements of $25,000. At September 31, 2010,

what is the cash balance?

A. $25,000 credit

B. $35,000 credit

C. $60,000 debit

D. $35,000 debit

Falmouth Pools manufactures swimming pool equipment. Falmouth estimates total manufacturing overhead costs next year to be $1,500,000. Falmouth also estimates it will use 18,750 direct labor hours and incur $1,250,000 of direct labor cost next year. In addition, the machines are expected to be run for 50,000 hours.

Please provide correct answer general accounting question

Chapter 14 Solutions

Working Papers for Warren/Reeve/Duchac's Corporate Financial Accounting, 14th

Ch. 14 - Briefly explain the difference between liquidity,...Ch. 14 - What is the advantage of using comparative...Ch. 14 - Prob. 3DQCh. 14 - How would the current and quick ratios of a...Ch. 14 - Prob. 5DQCh. 14 - What do the following data, taken from a...Ch. 14 - A. How does the rate earned on total assets differ...Ch. 14 - Kroger, a grocery store, recently had a...Ch. 14 - Prob. 9DQCh. 14 - Prob. 10DQ

Ch. 14 - Horizontal analysis The comparative accounts...Ch. 14 - Vertical analysis Income statement information for...Ch. 14 - Current position analysis The following items are...Ch. 14 - Accounts receivable analysis A company reports the...Ch. 14 - Inventory analysis A company reports the...Ch. 14 - Prob. 14.6BECh. 14 - Prob. 14.7BECh. 14 - Asset turnover A company reports the following:...Ch. 14 - Prob. 14.9BECh. 14 - Common stockholders' profitability analysis A...Ch. 14 - Earnings per share and price-earnings ratio A...Ch. 14 - Vertical analysis of income statement Revenue and...Ch. 14 - Prob. 14.2EXCh. 14 - Common-sized income statement Revenue and expense...Ch. 14 - Vertical analysis of balance sheet Balance shed...Ch. 14 - Horizontal analysis of the income statement Income...Ch. 14 - Current position analysis The following data were...Ch. 14 - Prob. 14.7EXCh. 14 - Current position analysis The bond indenture for...Ch. 14 - Accounts receivable analysis The following data...Ch. 14 - Accounts receivable analysis Xavier Stores Company...Ch. 14 - Inventory analysis The following data were...Ch. 14 - Inventory analysis QT, Inc. and Elppa Computers,...Ch. 14 - Ratio of liabilities to stockholders' equity and...Ch. 14 - Prob. 14.14EXCh. 14 - Ratio of liabilities to stockholders' equity and...Ch. 14 - Prob. 14.16EXCh. 14 - Profitability ratios The following selected data...Ch. 14 - Profitability ratios Ralph Lauren Corporation...Ch. 14 - Six measures of solvency or profitability The...Ch. 14 - Five measures of solvency or profitability The...Ch. 14 - Earnings per share, price-earnings ratio, dividend...Ch. 14 - Prob. 14.22EXCh. 14 - Earnings per share, discontinued operations The...Ch. 14 - Prob. 14.24EXCh. 14 - Unusual items Explain whether Colston Company...Ch. 14 - Comprehensive Income Anson Industries, Inc....Ch. 14 - Horizontal analysis of income statement For 20V2,...Ch. 14 - Prob. 14.2APRCh. 14 - Prob. 14.3APRCh. 14 - Measures of liquidity, solvency, and profitability...Ch. 14 - Solvency and profitability trend analysis Addai...Ch. 14 - Horizontal analysis of income statement For 20Y2,...Ch. 14 - Prob. 14.2BPRCh. 14 - Effect of transactions on current position...Ch. 14 - Measures of liquidity, solvency and profitability...Ch. 14 - Solvency and profitability trend analysis Crosby...Ch. 14 - Financial Statement Analysis The financial...Ch. 14 - Prob. 14.1ADMCh. 14 - Deere: Profitability analysis Deere Company...Ch. 14 - Marriott and Hyatt: Solvency and profitability...Ch. 14 - Prob. 14.1TIFCh. 14 - Prob. 14.3TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Given answer financial accounting questionarrow_forwardSweeten Corporation had sales of $1,050,000. The beginning accounts receivable balance was $80,000, and the ending accounts receivable balance was $250,000. How much is the cash collected from customers for this reporting period? a. $880,000 b. $1,220,000 c. $980,000 d. $1,150,000arrow_forwardWhat is the direct labor time variance?arrow_forward

- Correct option? General accountingarrow_forwardCrestwood Furniture applied $1,000,000 of overhead based on direct labor hours but decided to shift to an activity-based costing system. If the total estimated direct labor hours were 50,000, compute the traditional overhead rate per labor hour.arrow_forwardNot use chart gpt solution given correct answer general accounting questionarrow_forward

- the amount of cash collected from customers during 2023.arrow_forwardQ25. 1. Calculate the manufacturing cost of Job 308. 2. How much will the City of Adams Adamspay for this playground equipment?PG Industries manufactures custom-designed playground equipment for schools and city parks. PG expected to incur $784,700 of manufacturing overhead cost, 41,300 direct labor hours, and $1,239,000 of direct labor cost during the year (the cost of direct labor is $30 per hour). The company allocates manufacturing overhead on the basis of direct labor hours. During June, PG completed Job 308. The job used 180 direct labor hours and required $15,100 of direct materials. The City of Adams has contracted to purchase the playground equipment at a price of 26% over manufacturing cost.arrow_forwardwhat is the correct option ? general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License