Managerial Accounting: Tools for Business Decision Making

7th Edition

ISBN: 9781119034681

Author: Weygandt

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.1AP

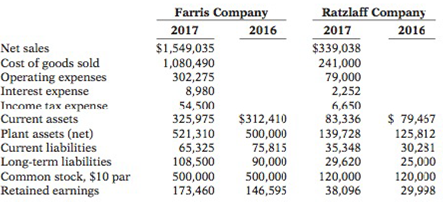

Comparative statement data for Farris Company and Ratzlaff Company, two competitors, appear below. All balance sheet data are as of December 31, 2017, and December 31, 2016.

Instructions

(a) Prepare a vertical analysis of the 2017 income statement data for Farris Company and Ratzlaff Company in columnar form.

(b) _______ Comment on the relative profitability of the companies by computing the return on assets and the return on common stockholders’ equity for both companies.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cash flow cycle

Abc

None

Chapter 14 Solutions

Managerial Accounting: Tools for Business Decision Making

Ch. 14 - (a) Jose Ramirez believes that the analysis of...Ch. 14 - (a) Distinguish among the following bases of...Ch. 14 - Prob. 3QCh. 14 - Prob. 4QCh. 14 - Prob. 5QCh. 14 - Prob. 6QCh. 14 - Prob. 7QCh. 14 - What do the following classes of ratios measure?...Ch. 14 - What is the difference between the current ratio...Ch. 14 - Hizar Company, a retail store, has an accounts...

Ch. 14 - Which ratios should be used to help answer the...Ch. 14 - The price-earnings ratio of General Motors...Ch. 14 - What is the formula for computing the payout...Ch. 14 - Holding all other factors constant, indicate...Ch. 14 - Prob. 15QCh. 14 - Prob. 16QCh. 14 - Prob. 17QCh. 14 - Prob. 18QCh. 14 - Prob. 19QCh. 14 - Why is it important to report discontinued...Ch. 14 - You are considering investing in Wingert...Ch. 14 - Prob. 22QCh. 14 - Prob. 23QCh. 14 - You recently received a letter from your Uncle...Ch. 14 - Prob. 14.2BECh. 14 - Using the following data from the comparative...Ch. 14 - Using the same data presented above in BE14-3 for...Ch. 14 - Net income was 500,000 in 2016, 450,000 in 2017,...Ch. 14 - Prob. 14.6BECh. 14 - Prob. 14.7BECh. 14 - Prob. 14.8BECh. 14 - Prob. 14.9BECh. 14 - Prob. 14.10BECh. 14 - The following data are taken from the financial...Ch. 14 - Prob. 14.12BECh. 14 - Prob. 14.13BECh. 14 - Prob. 14.14BECh. 14 - On June 30. Holloway Corporation discontinued its...Ch. 14 - Prob. 14.1DICh. 14 - Prob. 14.2DICh. 14 - In its proposed 2017 income statement. Hrabik...Ch. 14 - Financial information for Kurzen Inc. is presented...Ch. 14 - Operating data for Navarro Corporation are...Ch. 14 - The comparative condensed balance sheets of Gurley...Ch. 14 - The comparative condensed income statements of...Ch. 14 - Suppose Nordstrom, Inc., which operates department...Ch. 14 - Keener Incorporated had the following transactions...Ch. 14 - Frizell Company has the following comparative...Ch. 14 - Prob. 14.8ECh. 14 - Prob. 14.9ECh. 14 - Prob. 14.10ECh. 14 - Wiemers Corporations comparative balance sheets...Ch. 14 - Prob. 14.12ECh. 14 - Prob. 14.13ECh. 14 - Comparative statement data for Farris Company and...Ch. 14 - The comparative statements of Painter Tool Company...Ch. 14 - Prob. 14.3APCh. 14 - Financial information for Messersmith Company is...Ch. 14 - Prob. 14.5APCh. 14 - Prob. 14.6APCh. 14 - Prob. 14.7APCh. 14 - Prob. 14.8APCh. 14 - Prob. 14.9APCh. 14 - Financial Reporting Problem: Apple Inc. Your...Ch. 14 - PepsiCos financial statements are presented at...Ch. 14 - Prob. 14.3BYPCh. 14 - As the CPA for Gandara Manufacturing Inc., you...Ch. 14 - The Management Discussion and Analysis section of...Ch. 14 - Prob. 14.6BYPCh. 14 - Dave Schonhardt, president of Schonhardt...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Find Cost account answerarrow_forwardHurwitz, LLC sells a parcel of waterfront land and a residential condo building with an adjusted tax basis of $100,000 and 50,000, respectively for $500,000. The original purchase price Hurwitz, LLC allocated to the building was $600,000. Hurwitz LLC has deducted $550,000 in depreciation expense. Hurwitz, LLC's realized gain on this transaction is $350,000. If Hurwitz LLC takes back a note as part of the proceeds, what is Hurwitz LLC's gross profit percentage? A. 83.33% B. 71.43% C. 70% D. 50% E. 30%arrow_forwardprovide answer of this Financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License