EBK HORNGREN'S COST ACCOUNTING

16th Edition

ISBN: 9780134475950

Author: Datar

Publisher: PEARSON CO

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.17MCQ

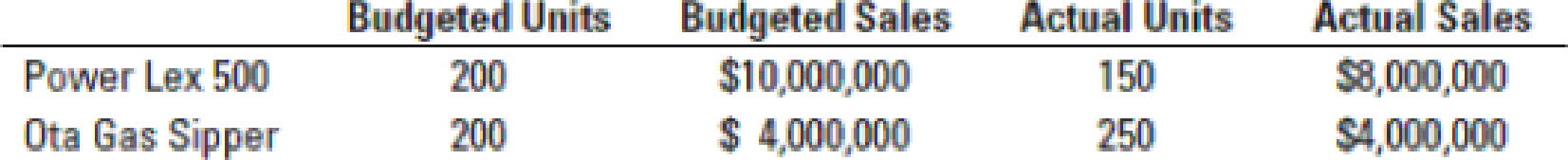

Sales-volume, sales-mix, and sales-quantity variance. Lexota, Inc., an auto manufacturer, reported the following budgeted and actual sales of its vehicles during September, Year 2:

The budgeted contribution margin is 20% for both vehicle types. Which of the following statements is true concerning the sales variances for Lexota, Inc. for September, Year 2?

- a. The sales-volume variance for the company is favorable.

- b. The sales-quantity variance for the company is unfavorable.

- c. The budgeted variable cost for each vehicle type is the same.

- d. The sales-mix variance for the company is unfavorable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

In analyzing company operations, the controller of the Carson Corporation found a $250,000 favorable flexible budget revenue variance. The variance was

calculated by comparing the actual results with the flexible budget. This variance can be wholly explained by: (CMA adapted)

Multiple Choice

О

the total flexible budget variance.

О

the total static budget variance.

О

changes in unit selling prices.

changes in the number of units sold.

Required:

Compute the individual product and total sales volume variances for August.

Compute the individual product and total sales quantity variances for August.

Compute the individual and total sales mix variances for August.

1. What raw materials cost would be included in the company’s planning budget for March?

2. What raw materials cost would be included in the company’s flexible budget for March?

3. What is the materials price variance for March? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.). Input all amounts as positive values.)

Chapter 14 Solutions

EBK HORNGREN'S COST ACCOUNTING

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marten Company has a cost-benefit policy to investigate any variance that is greater than 1,000 or 10% of budget, whichever is larger. Actual results for the previous month indicate the following: The company should investigate: a. neither the materials variance nor the labor variance. b. the materials variance only. c. the labor variance only. d. both the materials variance and the labor variance.arrow_forwardSulert, Inc., produces and sells gel-filled ice packs. Sulerts performance report for April follows: Required: 1. Calculate the contribution margin variance and the contribution margin volume variance. 2. Calculate the market share variance and the market size variance. (CMA adapted)arrow_forwardAt the end of the current fiscal year, the trial balance of Big Apple Inc. revealed the following debit (unfavorable) balances: Flexible-Budget Variance — $2,000 Production–Volume Variance — $75,000 What conclusions can be drawn from these two variances?arrow_forward

- Lavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near Montreal. The following table provides estimates concerning the company's costs: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent For Actual cars washed Revenue Expenses: Administrative expenses $ 0.03 For example, electricity costs should be $1,200 per month plus $0.09 per car washed. The company expects to wash 8,100 cars in August and to collect an average of $6.70 per car washed. The actual operating results for August are as follows: Lavage Rapide Income Statement the Month Ended August 31 Cleaning supplies. Electricity Maintenance Wages and salaries Depreciation Rent Fixed Cost Cost per per Month Car Washed $0.40 $ 0.09 $0.15 $0.30 Administrative expenses Total expense Net operating incom $1,200 $4,700 $ 8,200 $1,900 $ 1,600 8,200 $ 56,370 3,740 1,899 1,455 7,490 8,200 2,100 1,743 26,627 $ 29,74)arrow_forwardLavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near Montreal. The following table provides estimates concerning the company's costs: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Administrative expenses Rent Actual cars washed. For example, electricity costs should be $1,300 per month plus $0.09 per car washed. The company expects to wash 8,000 cars August and to collect an average of $6.90 per car washed. The actual operating results for August are as follows: Lavage Rapide Income Statement For the Month Ended August 31 Revenue Expenses: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Fixed Cost Cost per Car per Month Washed $ 1,300 $4,100 $ 8,000 $ 1,800 $ 1,700 Administrative expenses Total expense Net operating income 8,100 $ 57,300 $ 0.80 $ 0.09 $0.20 $ 0.30 6,900 1,990 1,840 6,860 8,000 2,000 1,840 29,430 $ 27,870 $ 0.03arrow_forwardCampbell Industries has gathered the following information about the actual sales revenues and expenses for its pharmaceuticals segment for the most recent year. E (Click the icon to view the actual data.) Prepare a segment margin performance report for the pharmaceutical segment. Calculate a variance and a variance percentage for each line in the report. Round to the nearest hundredth for the variance percentages (for example, if your answer is 16.2384%, round it to 16.24%). Budgeted data for the same time period for the pharmaceutical segment are as follows (all data are in millions): E (Click the icon to view the budgeted data.) Begin by preparing the performance report through the contribution margin line. Next, complete the report through the segment margin line, and then, finally, complete the report through the operating income line. (Enter the variances as positive numbers. Round the variance percentages to the nearest hundredth percent, X.XX%.) Performance Report Data table…arrow_forward

- In analyzing company operations, the controller of the Carson Corporation found a $250,000 favorable flexible budget revenue variance. The variance was calculated by comparing the actual results with the flexible budget. This variance can be wholly explained by:arrow_forwardPrepare a profit variance analysis. (Indicate the effect of each variance by selecting “F” for favorable, or “U” for unfavorable. If there is no effect, do not select either option.)arrow_forwardFrom the foregoing information, compute the following variances and indicate whether they are favorable (F) or unfavorable (U). State why each of the variances occurred. Material price variance and Material usage variance Direct labour rate variance and Direct labour efficiency variance Variable overhead spending variance and Variable overhead efficiency variancearrow_forward

- Dickinsen Company gathered the following data for December: Planned Actual Sales price per unit Number of units of sales $5.80 x 820,000 $4,756,000 $6.00 x 805,000 $4,830,000 Total sales a. Compute the revenue price variance. b. Compute the revenue volume variance. c. Compute the total revenue variance.arrow_forwardPrepare a sales activity variance analysis. (Indicate the effect of each variance by selecting “F” for favorable, or “U” for unfavorable. If there is not effect, do not select either option.)arrow_forwardQuilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold 7,300 pounds of oysters in August. The company's flexible budget for August appears below: Quilcene Oysteria Flexible Budget Actual pounds (q) Revenue ($4.15q) Expenses: Packing supplies ($0.35q) Oyster bed maintenance ($3,100) Wages and salaries ($2,500 + $0.35q) Shipping ($0.60q) Utilities ($1,210) For the Month Ended August 31 Other ($400 + $0.019) Total expenses Net operating income Actual pounds Revenue The actual results for August were as follows: Expenses: Quilcene Oysteria Income Statement For the Month Ended August 31 Packing supplies Oyster bed maintenance Wages and salaries Shipping Utilities Other Total expenses Net operating income 7,300 $ 30,295 2,555 3,100 5,055 4,380 1,210 473 16,773 $ 13,522 7,300 $ 26,600 2,725 2,960 5,465 4,110 1,020 1,093 17,373 $ 9,227arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY