Financial & Managerial Accounting

13th Edition

ISBN: 9781285866307

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.13EX

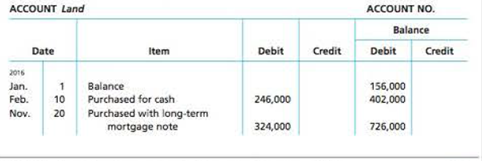

Reporting land acquisition for cash and mortgage note on statement of

On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows:

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Anti-Pandemic Pharma Co. Ltd. reports the following information in

its income statement:

Sales = $5,250,000.

Costs = $2, 173,000.

Other expenses = $187,400.

Depreciation expense = $79,000.

Interest expense= $53,555.

Taxes = $76,000.

Dividends = $69,000.

$136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed.

a) Compute the cash flow from assets

b) Compute the net change in working capital

Provide Correct Answer of this Question General Accounting Solution

Don't use ai solution please given true answer general accounting question

Chapter 14 Solutions

Financial & Managerial Accounting

Ch. 14 - Prob. 1DQCh. 14 - Prob. 2DQCh. 14 - A corporation issued 2,000,000 of common stock in...Ch. 14 - A retail business, using the accrual method of...Ch. 14 - If salaries payable was 100,000 at the beginning...Ch. 14 - Prob. 6DQCh. 14 - A corporation issued 2,000,000 of 20-year bonds...Ch. 14 - Fully depreciated equipment costing 50,000 was...Ch. 14 - Prob. 9DQCh. 14 - Name five common major classes of operating cash...

Ch. 14 - Prob. 14.1APECh. 14 - Classifying cash flows Identify whether each of...Ch. 14 - Prob. 14.2APECh. 14 - Prob. 14.2BPECh. 14 - Prob. 14.3APECh. 14 - Prob. 14.3BPECh. 14 - Prob. 14.4APECh. 14 - Prob. 14.4BPECh. 14 - Land transactions on the statement of cash flows...Ch. 14 - Land transactions on the statement of cash flows...Ch. 14 - Prob. 14.6APECh. 14 - Prob. 14.6BPECh. 14 - Prob. 14.7APECh. 14 - Prob. 14.7BPECh. 14 - Prob. 14.8APECh. 14 - Prob. 14.8BPECh. 14 - Prob. 14.1EXCh. 14 - Prob. 14.2EXCh. 14 - Classifying cash flows Identify the type of cash...Ch. 14 - Prob. 14.4EXCh. 14 - Prob. 14.5EXCh. 14 - Prob. 14.6EXCh. 14 - Prob. 14.7EXCh. 14 - Determining cash payments to stockholders The...Ch. 14 - Prob. 14.9EXCh. 14 - Reporting changes in equipment on statement of...Ch. 14 - Prob. 14.11EXCh. 14 - Prob. 14.12EXCh. 14 - Reporting land acquisition for cash and mortgage...Ch. 14 - Prob. 14.14EXCh. 14 - Prob. 14.15EXCh. 14 - Prob. 14.16EXCh. 14 - Prob. 14.17EXCh. 14 - Prob. 14.18EXCh. 14 - Prob. 14.19EXCh. 14 - Prob. 14.20EXCh. 14 - Prob. 14.21EXCh. 14 - Cash flows from operating activities direct method...Ch. 14 - Prob. 14.23EXCh. 14 - Prob. 14.24EXCh. 14 - Prob. 14.25EXCh. 14 - Prob. 14.26EXCh. 14 - Prob. 14.1APRCh. 14 - Statement of cash flowsindirect method The...Ch. 14 - Prob. 14.3APRCh. 14 - Prob. 14.4APRCh. 14 - Statement of cash flowsdirect method applied to PR...Ch. 14 - Prob. 14.1BPRCh. 14 - Prob. 14.2BPRCh. 14 - Prob. 14.3BPRCh. 14 - Prob. 14.4BPRCh. 14 - Statement of cash flowsdirect method applied to PR...Ch. 14 - Prob. 14.1CPCh. 14 - Prob. 14.2CPCh. 14 - Analysis of statement of cash flows Dillip Lachgar...Ch. 14 - Prob. 14.4CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please see an attachment for details general accounting questionarrow_forwardA retail company reports the following financial data: • Revenue: $1,200,000 • Expenses: $800,000 • Net income: $400,000 • Assets: $900,000 • Liabilities: $200,000 • Average equity: $700,000 What is the company's return on equity (ROE) in percentage terms, rounded to two decimal places?arrow_forwardEfford plc has the following equity capital at the year end. (Click here to view the financial data.) In addition, the company has 400,000 £1 8% preference shares in issue. The board of directors wishes to eliminate the company's reserves. It has decided to make an immediate 1-for-2 bonus issue of ordinary shares. Following the issue, an annual dividend will be paid to shareholders. What will be the required: 1. Transfer from revenue reserves to effect the bonus issue. £50,000 (Type an integer.) 2. Dividend per ordinary share. (Expressed as £ per share) £ 0.10 per share (Round to two decimal places as needed.) Data table £ Ordinary shares of £0.50 each 200,000 Share premium 50,000 General reserve 80,000 62,000 Retained profits 392.000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License