Bundle: College Accounting, Chapters 1-15, Loose-Leaf Version, 22nd + LMS Integrated for CengageNOWv2, 1 term Printed Access Card

22nd Edition

ISBN: 9781305930681

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

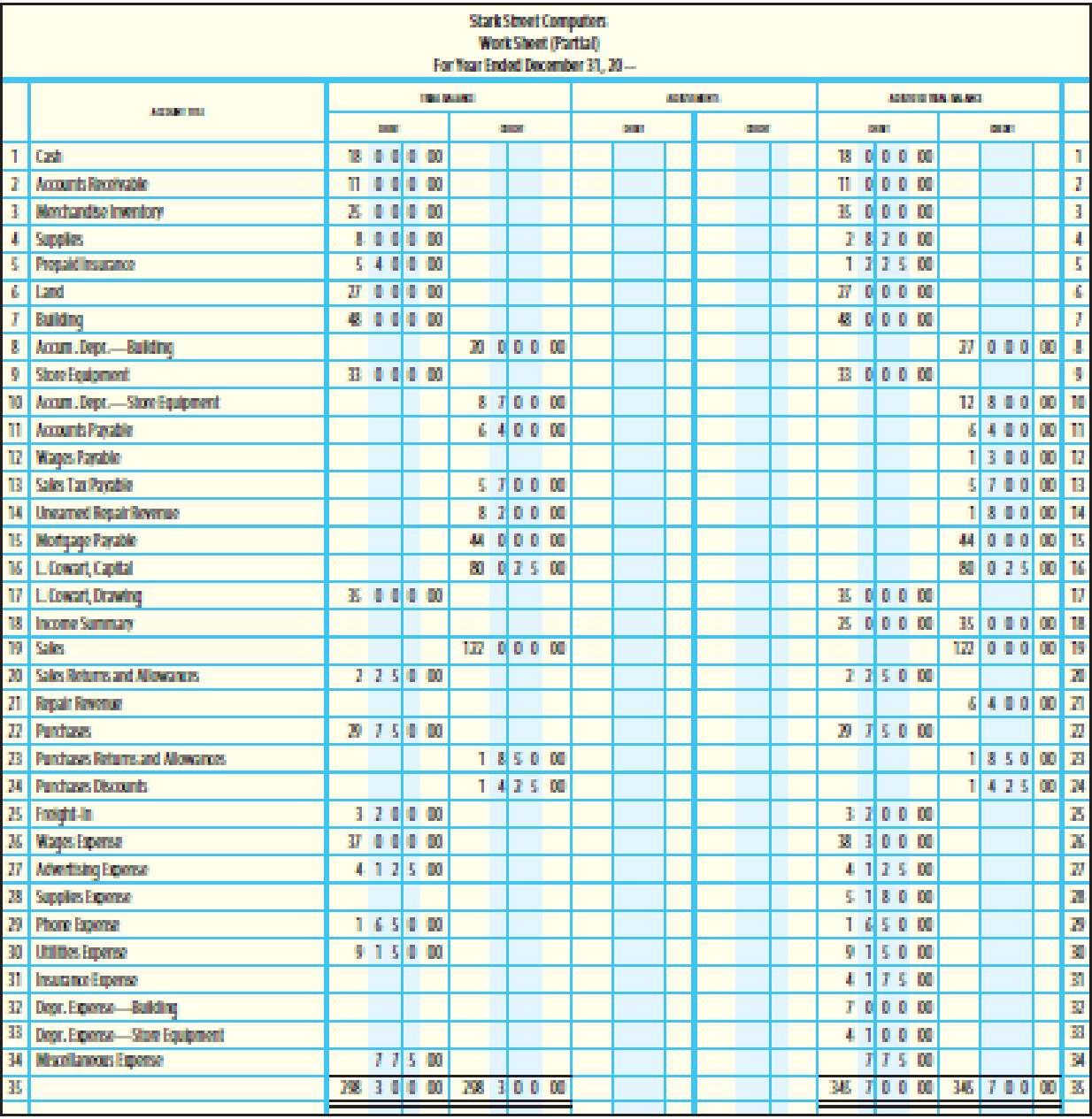

Chapter 14, Problem 11SPA

WORKING BACKWARD FROM ADJUSTED

REQUIRED

- 1. Determine the adjusting entries by analyzing the difference between the adjusted trial balance and the trial balance.

- 2. Journalize the adjusting entries in a general journal.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

At the beginning of the year, manufacturing overhead for the year was estimated to be $810,000. At the end of the year, actual direct labor hours for the year were 40,000 hours, the actual manufacturing overhead for the year was $780,000, and the manufacturing overhead for the year was overapplied by $30,000. If the predetermined overhead rate is based on direct labor hours, then the estimated direct labor hours at the beginning of the year used in the predetermined overhead rate must have been ____ hours. ANSWER

Compute the company's plantwide predetermined overhead rate for the year

Suppose in its 2022 annual report that Burger Haven Corporation reports beginning total assets of $32.80 billion, ending total assets of $35.40 billion, net sales of $25.60 billion, and net income of $5.20 billion. What is Burger Haven's return on assets and asset turnover? Need help

Chapter 14 Solutions

Bundle: College Accounting, Chapters 1-15, Loose-Leaf Version, 22nd + LMS Integrated for CengageNOWv2, 1 term Printed Access Card

Ch. 14 - Under the periodic inventory system, the beginning...Ch. 14 - Under the periodic inventory system, the ending...Ch. 14 - The cash received in advance before delivering a...Ch. 14 - Unearned revenue is adjusted into an expense...Ch. 14 - Sales Returns and Allowances is classified as a...Ch. 14 - Prob. 1MCCh. 14 - Prob. 2MCCh. 14 - Prob. 3MCCh. 14 - Prob. 4MCCh. 14 - Prob. 5MC

Ch. 14 - Prepare the cost of goods sold section for Josephs...Ch. 14 - The Venice Theatre sold and collected cash of...Ch. 14 - Prob. 3CECh. 14 - Using the partial work sheet provided below,...Ch. 14 - Prob. 5CECh. 14 - A firm is preparing to make adjusting entries at...Ch. 14 - Prob. 2RQCh. 14 - Prob. 3RQCh. 14 - What is an unearned revenue?Ch. 14 - Give three examples of unearned revenue.Ch. 14 - Prob. 6RQCh. 14 - Prob. 7RQCh. 14 - A firm is preparing to make adjusting entries at...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - ADJUSTMENT FOR UNEARNED REVENUES USING T ACCOUNTS...Ch. 14 - WORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY...Ch. 14 - DETERMINING THE BEGINNING AND ENDING INVENTORY...Ch. 14 - JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING...Ch. 14 - JOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY...Ch. 14 - Prob. 8SEACh. 14 - COMPLETION OF A WORK SHEET SHOWING A NET INCOME...Ch. 14 - COMPLETION OF A WORK SHEET SHOWING A NET LOSS The...Ch. 14 - WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO...Ch. 14 - Prob. 12SPACh. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - ADJUSTMENT FOR UNEARNED REVENUES USING T ACCOUNTS...Ch. 14 - WORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY...Ch. 14 - Prob. 5SEBCh. 14 - Prob. 6SEBCh. 14 - JOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY...Ch. 14 - JOURNALIZE ADJUSTING ENTRY FOR A MERCHANDISING...Ch. 14 - COMPLETION OF A WORK SHEET SHOWING A NET INCOME A...Ch. 14 - Prob. 10SPBCh. 14 - WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO...Ch. 14 - WORKING BACKWARD FROM THE INCOME STATEMENT AND...Ch. 14 - A friend of yours recently opened Abracadabra, a...Ch. 14 - Jason Tierro, an inventory clerk at Lexmar...Ch. 14 - John Neff owns and operates Waikiki Surf Shop. A...Ch. 14 - Block Foods, a retail grocery store, has agreed to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose in its 2022 annual report that Burger Haven Corporation reports beginning total assets of $32.80 billion, ending total assets of $35.40 billion, net sales of $25.60 billion, and net income of $5.20 billion. What is Burger Haven's return on assets and asset turnover? Accurate Answerarrow_forwardAccurate answerarrow_forwardThe current ratio of a company is 5:1, and its acid-test ratio is 2:1. If the inventories and prepaid items amount to $450,000, what is the amount of current liabilities? Answer this financial accounting problem. Ansarrow_forward

- Cullumber Company uses a job order cast system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,000, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102.480 and $132,720, respectively. The following additional events occurred during the month. 1 Purchased additional raw materials of $75,600 on account. 2 Incurred factory labor costs of $58,800. 3 Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardNet sales total $525,000. Beginning and ending accounts receivable are $42,000 and $46,000, respectively. Calculate days' sales in receivables.arrow_forwardDuring 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __. General Accountarrow_forward

- During 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __.arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardDetermine the amount to be paid in full settlement of each invoice, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Freight Paid Returns and Merchandise by Seller Freight Terms Allowances a. $9,400 $282 FOB Shipping Point, 1/10, net 30 $900 b. $8,600 $60 FOB Destination, 2/10, net 45 $1,900 a. $ b. $arrow_forward

- Travis Company purchased merchandise on account from a supplier for $13,200, terms 2/10, net 30 on December 26. Travis Company paid for the merchandise on December 31, within the discount period. Required: Under a perpetual inventory system, record the journal entries required for the above transactions. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY