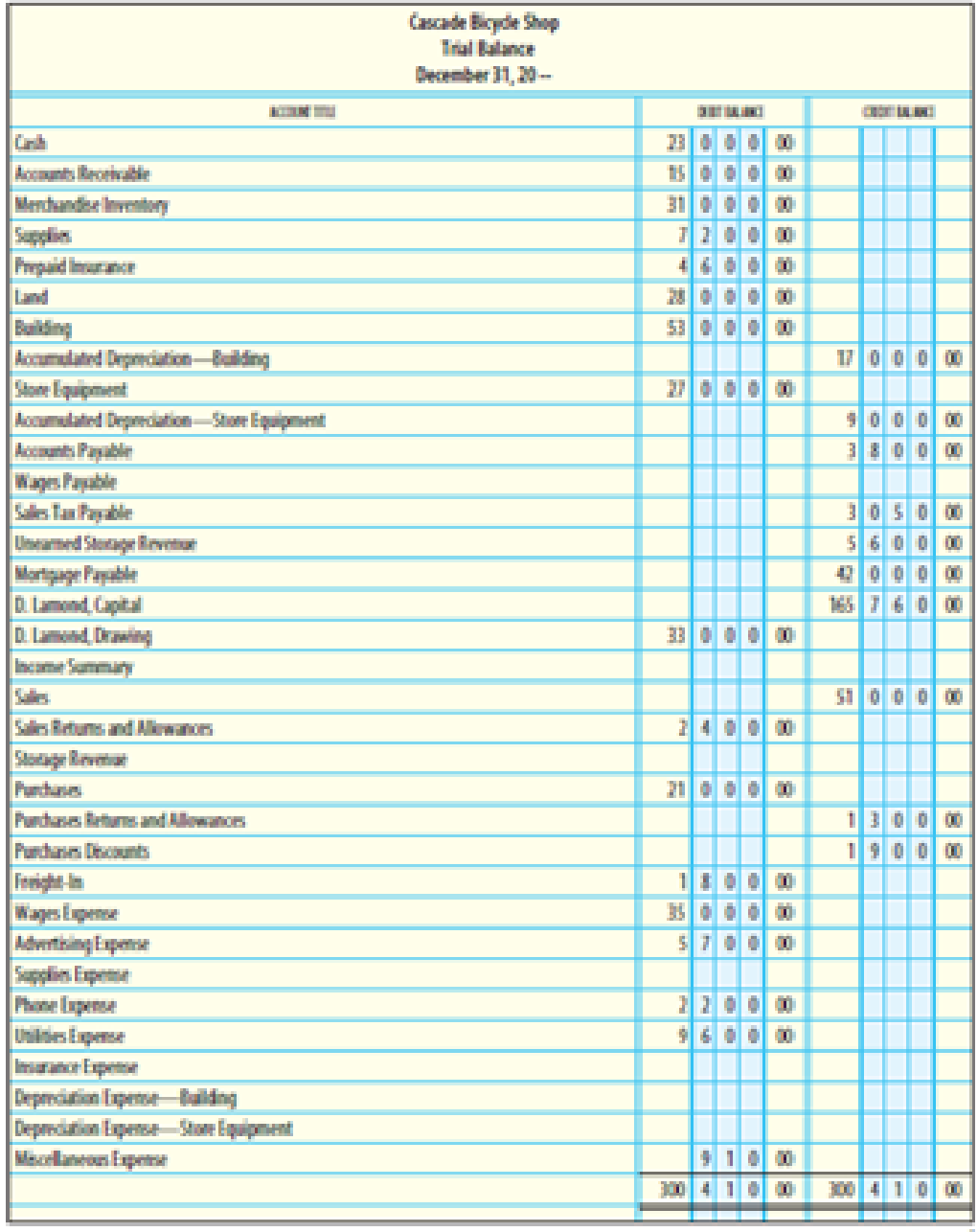

COMPLETION OF A WORK SHEET SHOWING A NET LOSS The

(a and b) Merchandise inventory costing $22,000 is on hand as of December 31, 20--. (The periodic inventory system is used.)

(c) Supplies remaining at the end of the year, $2,400.

(d) Unexpired insurance on December 31, $1,750.

(e)

(f) Depreciation expense on the store equipment for 20--, $3,600.

(g) Unearned storage revenue as of December 31, $1,950.

(h) Wages earned but not paid as of December 31, $750.

REQUIRED

- 1. Complete the Adjustments columns, identifying each adjustment with its corresponding letter.

- 2. Complete the work sheet.

- 3. Enter the adjustments in the general journal.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Bundle: College Accounting, Chapters 1-9, Loose-Leaf Version, 22nd + LMS Integrated for CengageNOWv2, 2 terms Printed Access Card for Heintz/Parry's College Accounting, Chapters 1-27, 22nd

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage