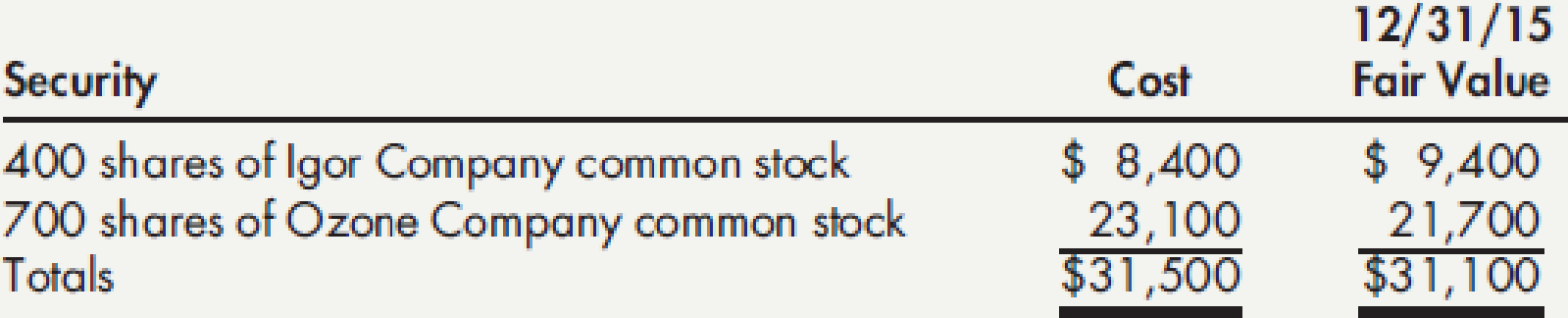

Available-for-Sale Securities Holly Company invests its excess cash in marketable securities. At the beginning of 2016, it had the following portfolio of investments in available-for-sale securities:

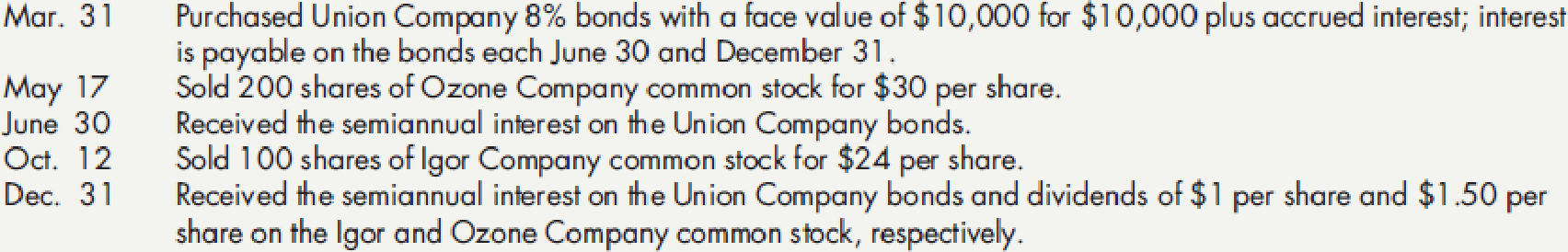

During 2016, the following transactions occurred:

The December 31 closing market prices were as follows: Igor Company common stock, $25 per share; Ozone Company common stock, $31 per share; Union Company 8% bonds, 101.

Required:

- 1. Prepare journal entries to record the preceding information.

- 2. Show what is reported on Holly’s 2016 income statement.

- 3. Assuming the investment in Igor Company stock is considered to be a current asset and the remaining investments are noncurrent, show how all the items are reported on Holly’s December 31, 2016,

balance sheet . - 4. If GAAP required that unrealized holding gains and losses on available-for-sale securities be included in income, how much would Holly recognize in 2016?

1.

Prepare the journal entries to record the available-for-sale securities transactions.

Explanation of Solution

Investment: It refers to the process of using the currently held excess cash to earn profitable returns in future. The investments can be made in equity securities such as shares or debt securities such as bonds.

Available for sale securities: these are the securities which are not intended to be sold in the near future and there is no intension to hold the securities till their maturity.

Record the purchase of 8% bonds on March 31, 2016.

On March 31, 2016, Company H purchased 8%, bond with a par value of $10,000 for $10,000 plus accrued interest for 3 months from March 31 to June 30.

Determine the amount of interest income paid by Company H.

| Date | Account Title and Explanation | Debit | Credit |

| March 31, 2016 | Investment in Available-for-sale Securities | $10,000 | |

| Interest income | $200 | ||

| Cash | $10,200 | ||

| (To record the purchase of 8% bond from Company U) |

Table (1)

- Investment in available-for-sale securities is an asset. It is increased. Therefore, debit the investment in available-for-sale securities account.

- Interest income is decreasing here, because Company H paid the accrued interest to purchase the bond. Therefore, it is debited.

- Cash is an asset and decreased. Therefore, credit the cash account.

Record the sale of Company O’s 200 share for $30 per share on May 17.

Step 1: Determine the cash received from sale of 200 shares.

Step 2: Determine the purchase price of 200 shares of Company O.

Step 3: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| May 17, 2016 | Cash | $6,000 | |

| Loss on sale of Available-for-sale securities (Balancing figure) | $600 | ||

| Investment in Available-for-sale securities | $6,600 | ||

| (To record the realized loss on sale of 200 shares of Company O) |

Table (2)

- Cash is an asset and increased. Therefore, debit the cash account.

- Loss on sale of available-for-sale securities is a loss. It decreases the equity. Therefore, it is debited.

- Investment in available-for-sale securities is an asset. It is decreased here due to sale. Therefore, credit the investment in available-for-sale securities account.

On May 17, 2016, reverse the cumulative unrealized loss for 200 shares that had accumulated at the end of December 31, 2015.

Company O’s 700 shares is purchased for $23,100, whose fair value as at December 31, 2015 is recorded as $21,700. Hence, the difference of $1,400

| Date | Account Title and Explanation | Debit | Credit |

| May 17, 2016 | Allowance for change in fair value of investment | $400 | |

| Unrealized holding gain/loss: Available-for-sale securities | $400 | ||

| (To record the allowance adjustment and reverse the unrealized loss on holding the Securities) |

Table (3)

Record the receipt of semiannual interest on Company U’s bond on June 30, 2016.

Step 1: Calculate the amount of interest income.

Step 2: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| June 30, 2016 | Cash | $400 | |

| Interest income | $400 | ||

| (To record the receipt of semi-annual interest on Company U's bond) |

Table (4)

- Cash is an asset and increased. Therefore, debit the cash account.

- Interest income is revenue; it increases the equity. Therefore, it is credited.

Record the sale of Company I’s 100 share for $24 per share on October 12.

Step 1: Determine the cash received from sale of 100 shares.

Step 2: Determine the purchase price of 100 shares of Company I.

Step 3: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| October 12, 2016 | Cash | $2,400 | |

|

Gain on sale of Available-for-sale securities (Balancing figure) | $300 | ||

| Investment in Trading Securities | $2,100 | ||

| (To record the realized gain on sale of 100 shares of Company I) |

Table (5)

- Cash is an asset and increased. Therefore, debit the cash account.

- Gain on sale of available-for-sale securities is an income. It increases the equity. Therefore, it is credited.

- Investment in available-for-sale securities is an asset. It is decreased here due to sale. Therefore, credit the investment in available-for-sale securities account.

On October 12, 2016, reverse the cumulative unrealized gain for 100 shares that had accumulated at the end of December 31, 2015.

Company I’s 400 shares is purchased for $8,400, whose fair value as at December 31, 2015 is recorded as $9,400. Hence, the difference of $1,000

| Date | Account Title and Explanation | Debit | Credit |

| October 12, 2016 | Unrealized holding gain/loss: Available-for-sale securities | $250 | |

|

Allowance for change in fair value of investment | $250 | ||

| (To reverse the allowance and the unrealized gain on holding the Securities) |

Table (6)

Record the semiannual interest income received from Company U’s bond, and dividend income received for Company I and Company O on December 31, 2016.

Step 1: Determine the amount of interest income earned from Company O.

Step 2: Determine the amount of dividend income recieived from Company I.

Step 3: Determine the amount of dividend income recieived from Company O.

Step 4: Determine the total amount of dividend income recieived from both the Company.

Step 5: Record the entry.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2016 | Cash (Balancing figure) | $1,450 | |

| Interest income | $400 | ||

| Dividend income | $1,050 | ||

| (To record the receipt of semi-annual interest on Company U's bond and dividend income from Company I and Company O) |

Table (7)

Determine the fair value of the investment as at December 31, 2016.

Determine the net amount of unrealized gain or loss on available-for-sale securities.

| Investment | Cost (a) | Fair value at December 31, 2016 (b) | Cumulative change in fair value |

| 300 shares of Company I | $6,300 | $7,500 | $1,200 |

| 500 shares of Company O | $16,500 | $15,500 | ($1,000) |

| $10,000 face value of Company U's 8% bond | $10,000 | $10,100 | $100 |

| Total | $32,800 | $33,100 | $300 |

Table (8)

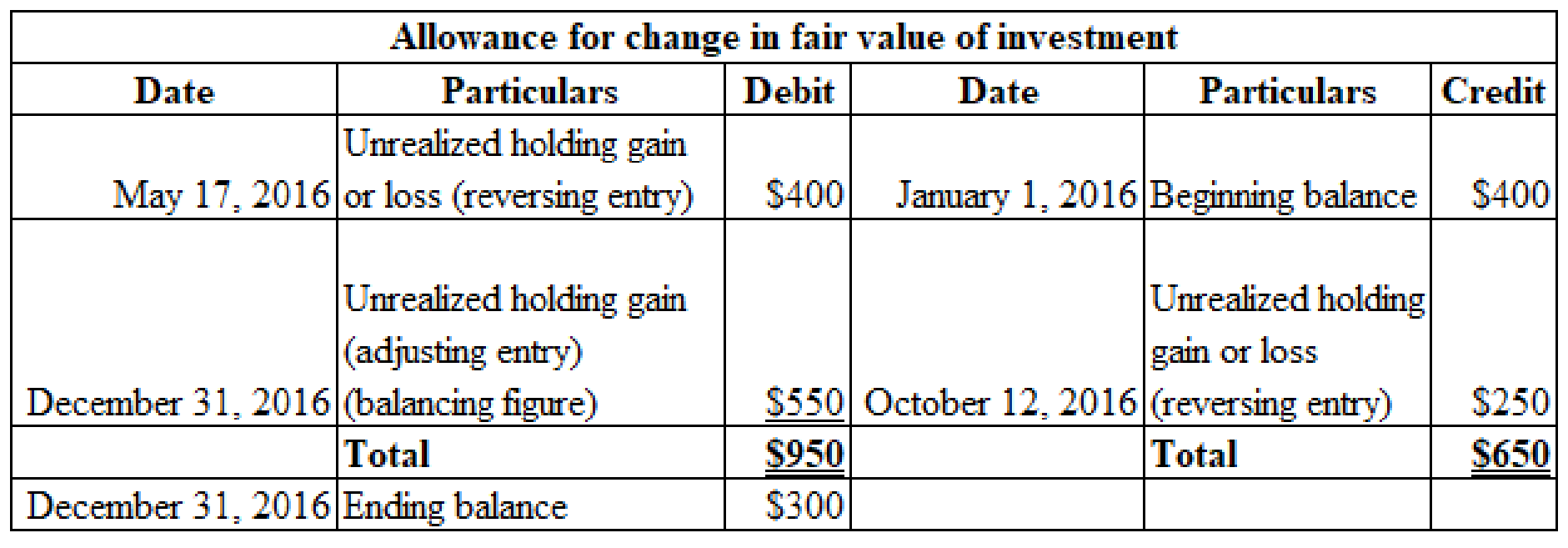

Determine the amount of allowance to be adjusted to have $300 debit balance in allowance account at the end of the year 2016, using T-account.

Credit balance in allowance account on January 1, 2016 is $400

Table (9)

Record the adjusting entry at the end of the year 2016.

| Date | Account Title and Explanation | Debit | Credit |

| December 31, 2016 | Allowance for change in fair value of investment | $550 | |

|

Unrealized holding gain/loss: Available-for- sale securities | $500 | ||

| (To record the allowance adjustment and the gain unrealized loss on holding the Securities) |

Table (10)

- Unrealized holding gain increases the equity. Therefore, it is credited.

- Allowance is a contra asset. It is decreased. Therefore, it is debited.

2.

Show how Company H would report its available-for-sale securities at its income statement for the year ended December 31, 2016.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Show how Company H would report its available-for-sale securities at its income statement for the year ended December 31, 2016.

| Company H | |

| Income Statement (Partial) | |

| For The Year Ended December 31, 2016 | |

| Particulars | Amount |

| Interest income | $600 |

| Dividend income | $1,050 |

| Loss on sale of available-for-sale securities | -$600 |

| Gain on sale of available-for-sale securities | $300 |

Table (11)

3.

Show how Company H would report its available-for-sale securities at its balance sheet at December 31, 2016.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Show how Company H would report its available-for-sale securities at its balance sheet at December 31, 2016.

| Company H | |

| Balance sheet Statement (Partial) | |

| As at December 31, 2016 | |

| Assets | Amount |

| Current assets: | |

| Investment in available-for-sale securities (at cost) | $6,300 |

| Add: Allowance for change in fair value of investment | $1,200 |

| Investment in available-for-sale securities (at fair value) | $7,500 |

| Noncurrent assets: | |

| Investment in available-for-sale securities (at cost) | $26,500 |

| Less: Allowance for change in fair value of investment | -$900 |

| Investment in available-for-sale securities (at fair value) | $25,600 |

| Shareholders' equity: | |

| Accumulated other comprehensive income | |

|

Unrealized holding gain: Available-for-sale securities | $300 |

Table (12)

4.

Determine the amount of income would be recognized by Company H, if the unrealized holding gains and losses on available-for-sale securities are included income.

Explanation of Solution

If GAAP (Generally Accepted Accounting Principles) requires to include unrealized holding gains and losses on available-for-sale securities in income, then Company H would recognize $700 as unrealized holding gain in income statement.

Note:

$700 arrived from the difference between -$400 and +$300. -$400 is an unrealized loss of the portfolio as on December 31, 2015.

Want to see more full solutions like this?

Chapter 13 Solutions

Bundle: Intermediate Accounting: Reporting and Analysis, 2017 Update, Loose-Leaf Version, 2nd + CengageNOWv2, 2 terms Printed Access Card

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

- 4 POINTSarrow_forwardSmith Corporation uses direct labor hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor hours were 24,500 hours, and the total estimated manufacturing overhead was $490,000. At the end of the year, actual direct labor hours for the year were 24,200 hours, and the actual manufacturing overhead for the year was $495,000. Overhead at the end of the year was: a. $16,500 overapplied b. $14,800 underapplied c. $11,000 underapplied d. $10,500 underappliedarrow_forwardThe Blue Jay Corporation has annual sales of $5,200, total debt of $1,500, total equity of $2,800, and a profit margin of 8 percent. What is the return on assets? a. 8.50 percent b. 10.55 percent c. 9.67 percent d. 7.89 percent e. 12.22 percent.Answer this questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning