GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

4th Edition

ISBN: 9781260087376

Author: M. David Haddock Jr. Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

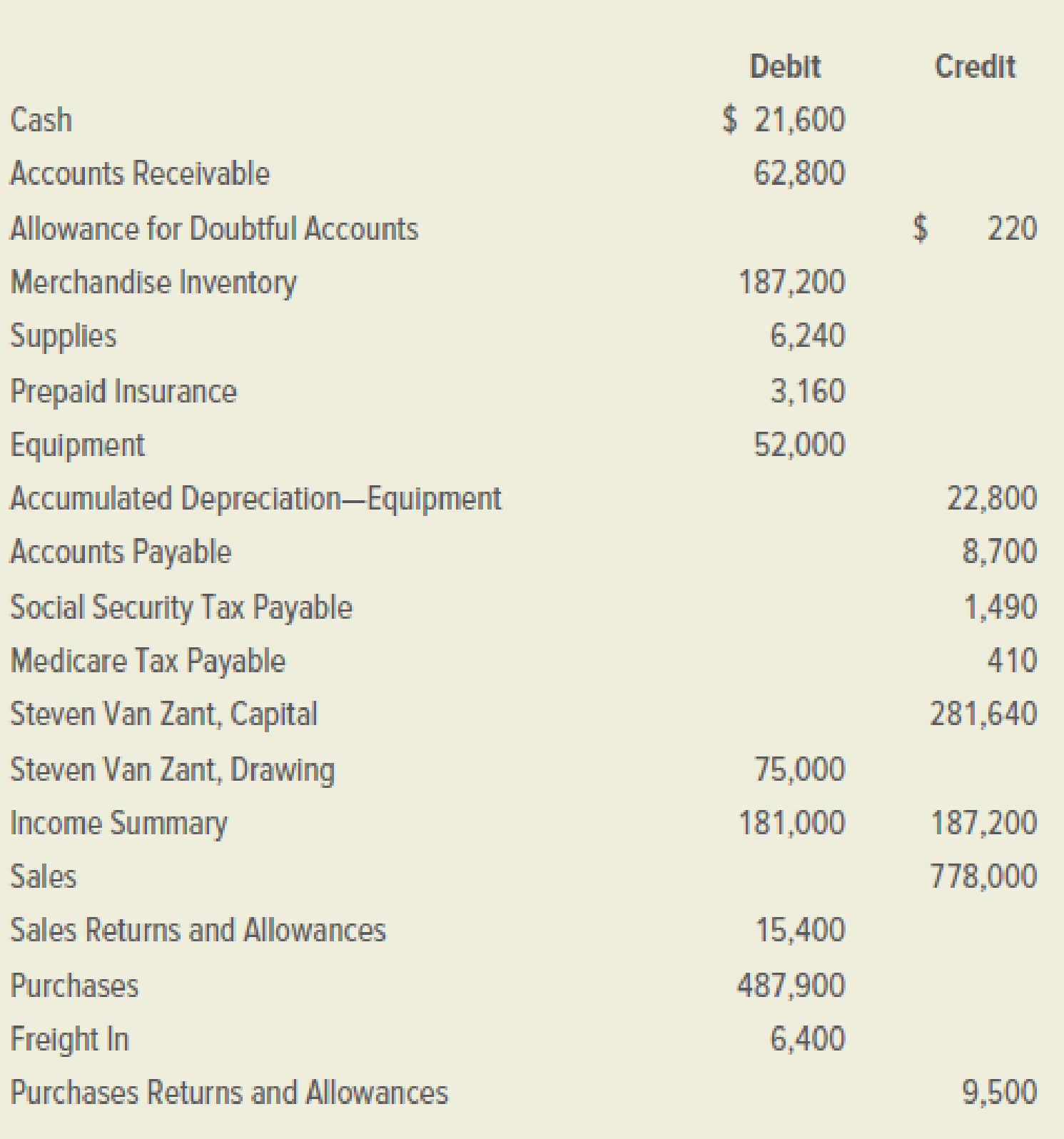

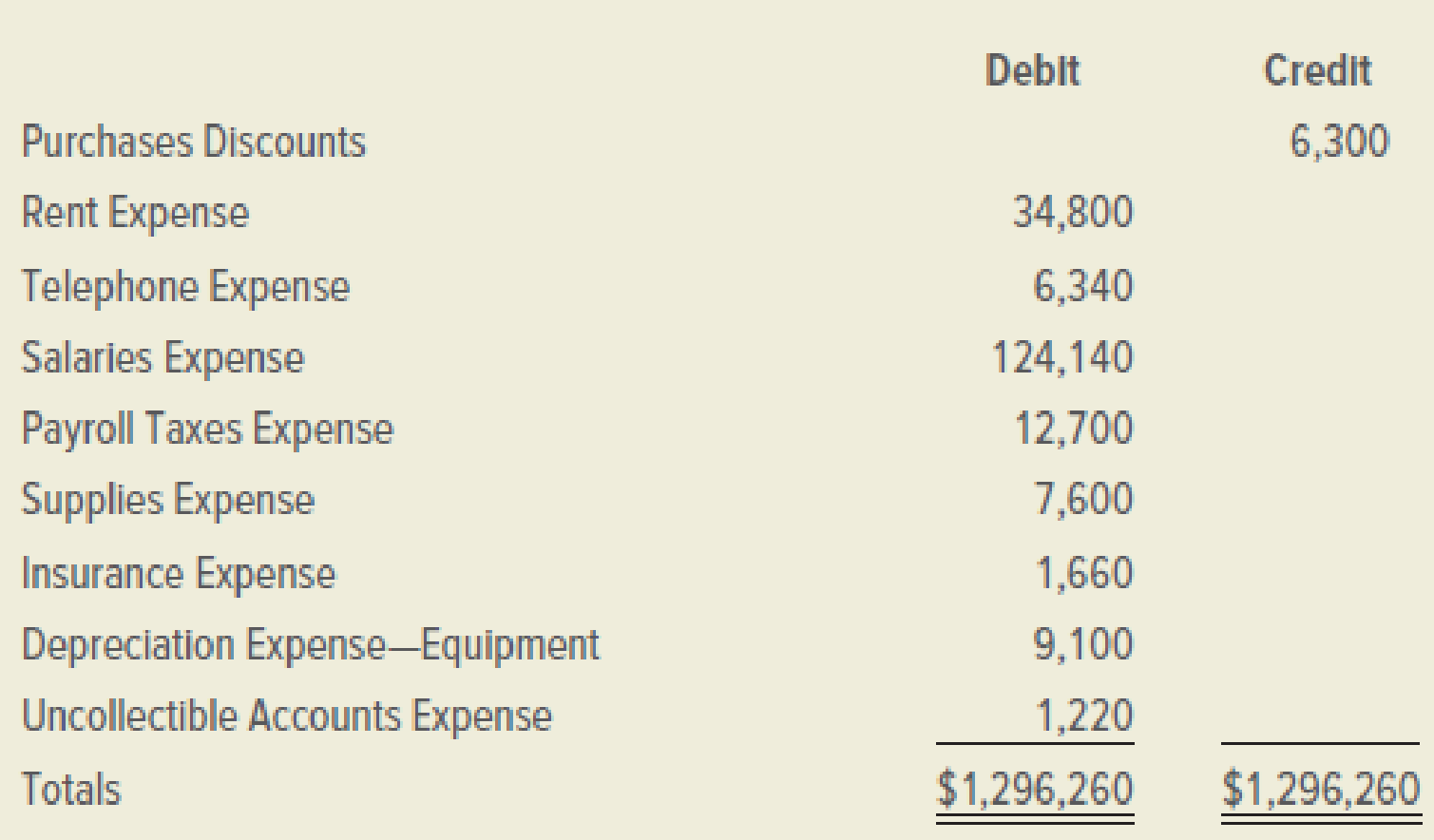

Chapter 13, Problem 8E

The Adjusted

ACCOUNTS

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

None

What is the total period cost for the month

financial accounting

Chapter 13 Solutions

GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

Ch. 13 - Why are financial statements prepared in...Ch. 13 - What is the distinction between current...Ch. 13 - Prob. 1.3SRQCh. 13 - Which of the following is not a current asset? a....Ch. 13 - How should purchases returns and allowances be...Ch. 13 - Assume that a business listed the Freight In...Ch. 13 - Why do adjusting entries need detailed...Ch. 13 - Which adjusting entries should be reversed?Ch. 13 - Prob. 2.3SRQCh. 13 - A reversing entry is made for an end-of-period...

Ch. 13 - Prob. 2.5SRECh. 13 - At the end of the previous accounting period, an...Ch. 13 - Prob. 1CSRCh. 13 - Prob. 2CSRCh. 13 - Prob. 3CSRCh. 13 - Prob. 4CSRCh. 13 - Which of the following should have a debit balance...Ch. 13 - Prob. 6CSRCh. 13 - Prob. 7CSRCh. 13 - Prob. 1DQCh. 13 - Prob. 2DQCh. 13 - What are operating expenses?Ch. 13 - Prob. 4DQCh. 13 - Prob. 5DQCh. 13 - Prob. 6DQCh. 13 - Prob. 7DQCh. 13 - Prob. 8DQCh. 13 - Prob. 9DQCh. 13 - Prob. 10DQCh. 13 - Prob. 11DQCh. 13 - Prob. 12DQCh. 13 - Prob. 13DQCh. 13 - Prob. 14DQCh. 13 - Prob. 15DQCh. 13 - Prob. 16DQCh. 13 - Prob. 17DQCh. 13 - Gomez Company had a current ratio of 2.0 in 2018...Ch. 13 - Prob. 1ECh. 13 - Prob. 2ECh. 13 - The worksheet of Bridgets Office Supplies contains...Ch. 13 - Prob. 4ECh. 13 - Prob. 5ECh. 13 - Prob. 6ECh. 13 - Prob. 7ECh. 13 - The Adjusted Trial Balance section of the...Ch. 13 - Prob. 9ECh. 13 - Prob. 10ECh. 13 - Superior Hardwood Company distributes hardwood...Ch. 13 - Good to Go Auto Products distributes automobile...Ch. 13 - Obtain all data necessary from the worksheet...Ch. 13 - Obtain all data that is necessary from the...Ch. 13 - Prob. 5PACh. 13 - ComputerGeeks.com is a retail store that sells...Ch. 13 - Hog Wild is a retail firm that sells motorcycles,...Ch. 13 - Prob. 3PBCh. 13 - Prob. 4PBCh. 13 - The data below concerns adjustments to be made at...Ch. 13 - Programs Plus is a retail firm that sells computer...Ch. 13 - Teagan Fitzgerald is the owner of Newport Jewelry,...Ch. 13 - Prob. 1MFCh. 13 - Spectrum Company had an increase in sales and net...Ch. 13 - Prob. 3MFCh. 13 - Prob. 4MFCh. 13 - Prob. 5MFCh. 13 - Prob. 6MFCh. 13 - Prob. 7MFCh. 13 - It is standard accounting procedures, or GAAP, to...Ch. 13 - McCormick Company, Incorporated, is a global...Ch. 13 - The Fashion Rack is a retail merchandising...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- No WRONG ANSWERarrow_forwardDetermine the variable cost per unitarrow_forwardGinx Enterprises had $250,000 in sales on account last year. The beginning accounts receivable balance was $15,000, and the ending accounts receivable balance was $22,000. The company's average collection period (age of receivables) was closest to: (a) 19.54 days. (b) 36.68 days. (c) 27.02 days. (d) 52.45 days.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License