Concept explainers

Comprehensive Budget Plan

Brighton, Inc., manufactures kitchen tiles. The company recently expanded, and the controller believes that it will need to borrow cash to continue operations. It began negotiating for a one-month bank loan of $500,000 starting May 1. The bank would charge interest at the rate of 1 percent per month and require the company to repay interest and principal on May 31. In considering the loan, the bank requested a

The following information is available:

- The company budgeted sales at 600,000 units per month in April, June, and July and at 450,000 units in May. The selling price is $4 per unit.

- The inventory of finished goods on April 1 was 120,000 units. The finished goods inventory at the end of each month equals 20 percent of sales anticipated for the following month. There is no work in process.

- The inventory of raw materials on April 1 was 57,000 pounds. At the end of each month, the raw materials inventory equals no less than 40 percent of production requirements for the following month. The company purchases materials in quantities of 62,500 pounds per shipment.

- Selling expenses are 10 percent of gross sales. Administrative expenses, which include depreciation of $2,500 per month on office furniture and fixtures, total $165,000 per month.

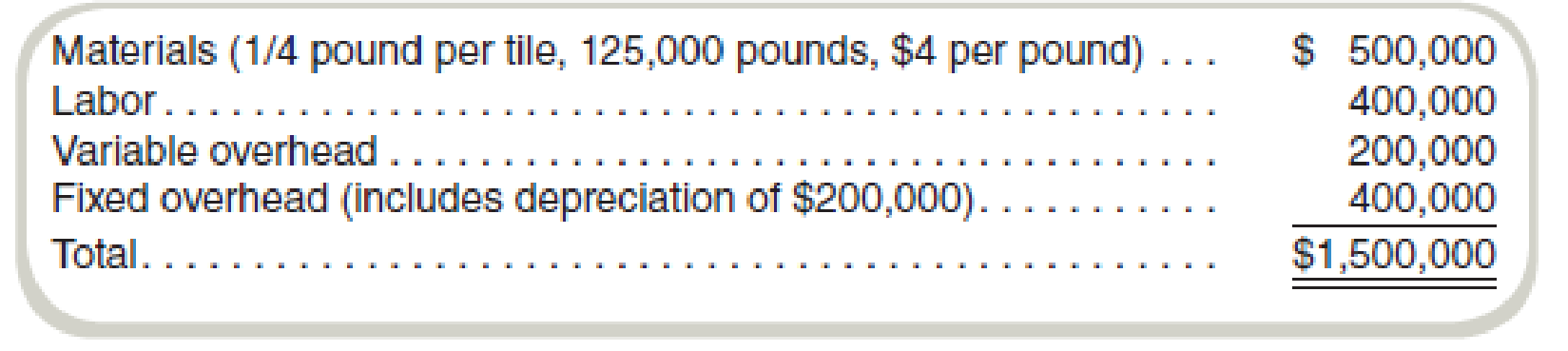

- The manufacturing budget for tiles, based on normal production of 500,000 units per month, follows:

Required

- a. Prepare schedules computing inventory budgets by months for:

- 1. Production in units for April, May, and June.

- 2. Raw materials purchases in pounds for April and May.

- b. Prepare a projected income statement for May. Cost of goods sold should equal the variable

manufacturing cost per unit times the number of units sold plus the total fixed manufacturing cost budgeted for the period. Assume cash discounts of 1 percent andbad debt expense of 0.5 percent.

a.

Prepare schedules computing inventory budgets by months for:

1. Production in units for April, May and June.

2. Raw materials purchases in pounds for April and May.

Answer to Problem 61P

The estimated level of production is 570,000, 480,000 and 600,000 for April, May and June. The estimated level of purchase is $133,500 and $78,000 for April and May.

Explanation of Solution

1.

Budgeted production:

Budgeted production is the total number of goods that need to be produced to attain the targeted sales for the budgeted period. It is calculated by adjusting the beginning and closing inventory.

Calculate the production in units for April, May and June:

|

Company B Budgeted Production statement For the month end 31 June (in units) | |||

| Particulars | April | May | June |

| Estimated sales | 600,000 | 450,000 | 600,000 |

| Add: closing stock required (1) | 90,000 | 120,000 | 120,000 |

| Total requirement of units | 690,000 | 570,000 | 720,000 |

| Less: opening stock | 120,000 | 90,000 | 120,000 |

| Estimated level of production | 570,000 | 480,000 | 600,000 |

Table: (1)

Thus, the estimated level of production is 570,000, 480,000 and 600,000 for April, May and June.

Working note 1:

Calculate the closing stock required:

| Particulars |

Sales (a) |

% of sales (b) |

Closing stock |

| April | 450,000 | 20% | 90,000 |

| May | 600,000 | 20% | 120,000 |

| June | 600,000 | 20% | 120,000 |

Table: (2)

2.

Budgeted purchase:

Budgeted purchase is the total amount of goods that is needed to purchase in order to attain the targeted sales. It is calculated by adjusting the inventory.

Calculate the budgeted purchase of raw material for April and May:

|

Company B Budgeted Purchase Statement For the month end 30 May | ||

| Particulars | April | May |

| Estimated level of production (2) | $142,500 | $120,000 |

| Add: closing stock required (3) | $48,000 | $60,000 |

| Total requirement of units | $190,500 | $180,000 |

| Less: opening stock | $57,000 | $102,000 (4) |

| Estimated level of purchase | $133,500 | $78,000 |

Table: (3)

Thus, the estimated level of purchase is $133,500 and $78,000 for April and May.

Working note 2:

Calculate the estimated level of production ($):

| Particulars |

Total units (a) |

Rate per unit (b) |

Amount |

| April | 570,000 | $0.25 | $142,500 |

| May | 480,000 | $0.25 | $120,000 |

| June | 600,000 | 0.25 | $150,000 |

Table: (4)

Working note 3:

Calculate the closing stock required:

|

Month |

Production for next month ($) (a) |

% requirement (b) |

Amount |

| April | $120,000 (2) | 40% | $48,000 |

| May | $150,000 (2) | 40% | $60,000 |

Table: (5)

Working note 4:

Calculate the opening stock for May:

Closing stock of April will be the opening stock of May so the value can be found out with the calculation of closing stock of April.

b.

Prepare a projected income statement for May. Cost of goods sold should equal the variable manufacturing cost per unit times the number of units sold plus the total fixed manufacturing cost budgeted for the period.

Answer to Problem 61P

The net profit for the month of May is $33,000.

Explanation of Solution

Projected income statement:

Projected income statement is a statement that shows the total income and expenses of the budgeted period. The last year’s income statement is used and some estimates are made for the items that may change in the budgeted period.

Projected income statement for Company B:

|

Company B Projected Income Statement For the month of May | ||

| Particulars | Amount | Total amount |

| Net Sales revenue (a) (5) | $1,773,000 | |

| Less: cost of goods sold: | ||

| Variable cost of sales (7) | $990,000 | |

| Fixed cost of sales | $400,000 | |

| Total cost of goods sold (b) | $1,390,000 | |

| Gross profit | $383,000 | |

| Less: expenses: | ||

| Selling expenses (8) | $180,000 | |

| Administrative expenses | $165,000 | |

| Interest expenses (9) | $5,000 | |

| Total expenses (f) | $350,000 | |

| Net profit | $33,000 | |

Table: (6)

Thus, the net profit for the month of May is $33,000.

Working note 5:

Calculate the sales revenue:

| Particulars | Amount | Total amount |

| Sales revenue | $1,800,000 | |

| Less: cash discount | $18,000 | |

| Less: estimated bad debts (6) | $9,000 | $27,000 |

| Net sales | $1,773,000 |

Table: (7)

Working note 6:

Calculate the estimated bed debts:

Working note 7:

Calculate variable cost:

Working note 8:

Calculate the selling expenses:

Working note 9:

Calculate the interest expense:

Want to see more full solutions like this?

Chapter 13 Solutions

FUNDAMENTALS OF COST ACCOUNTING IA

- Trevino Apparel Company manufactures and sells women's blouses. Each blouse (unit) requires 2.2 yards of fabric. Selected data from Trevino's master budget for next quarter are shown below: Each unit requires 1.8 hours of direct labor, and the average hourly cost of Trevino's direct labor is $12. What is the cost of Trevino Apparel Company's direct labor in October if they produce 10,500 blouses?arrow_forwardGeneral accountingarrow_forwardWhat is the sustainable rate of growth? General accountingarrow_forward

- What is the company's plantwide overhead rate?arrow_forwardHii ticher please provide correct answer general Accountingarrow_forwardFelker Health Center measures its activity in terms of patient visits. Last month, the budgeted level of activity was 1,460 patient visits and the actual level of activity was 1,580 patient visits. The cost formula for administrative expenses is $2.50 per patient visit plus $17,800 per month. The actual administrative expense was $22,250. Last month, the spending variance for administrative expenses was _.arrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College