Holiday Entertainment Corporation (HHC), a subsidiary of New Age Industries, manufactures go-carts and other recreational vehicles. Family recreational centers that feature not only go-cart tracks but miniature golf, batting cages, and arcade games as well have increased in popularity. As a result, HEC has been receiving some pressure from New Age’s management to diversify into some of these other recreational areas. Recreational Leasing, Inc. (RLI), one of the largest firms that bases arcade games to family recreational centers, is looking for a friendly buyer. New Age’s top management believes that RLI’s assets could be acquired for an investment of $3.2 million and has strongly urged Bill Grieco, division manager of HEC, to consider acquiring RLI.

Grieco has reviewed RLI’s financial statements with his controller. Marie Donnelly, and they believe the acquisition may not be in the best interest of HEC. “If we decide not to do this, the New Age people are not going to be happy.” said Greco. “If we could convince them to base our bonuses on something other than

New Age Industries traditionally has evaluated all of its divisions on the basis of return on investment. The desired

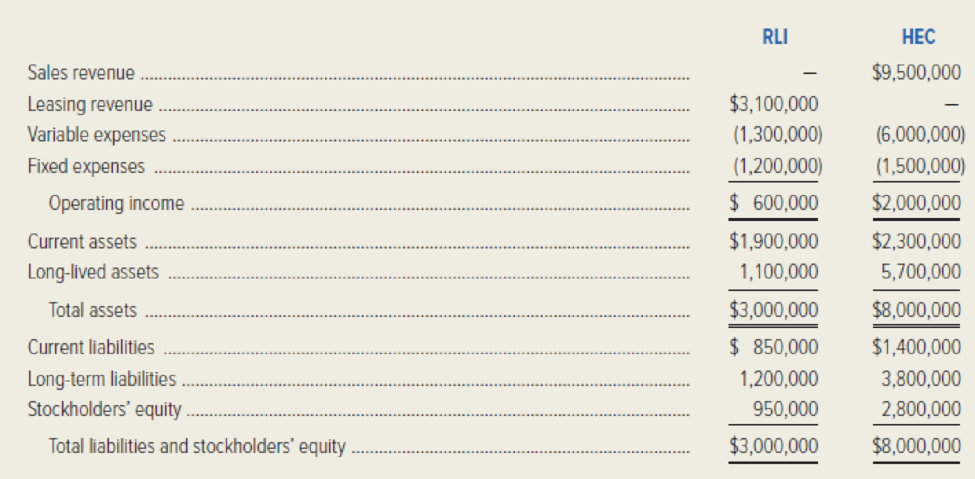

In the following table are condensed financial statements for both HEC and RLI for the most recent year.

Required:

- 1. If New Age Industries continues to use ROI as the sob measure of divisional performance, explain why Holiday Entertainment Corporation would be reluctant to acquire Recreational Leasing, Inc.

- 2. If New Age Industries could be persuaded to use residual income to measure the performance of HEC, explain why HEC would be more willing to acquire RLI.

- 3. Discuss how the behavior of division managers is likely to be affected by the use of the following performance measures: (a) return on investment and (b) residual income.

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Need help with this general accounting questionarrow_forwardCullen Beatty plans to start a consulting business-Cullen Consulting Services. In preparation to do this, on April 1, 20X1, he invested $56,000 in cash and $23,000 in equipment, and opened an account at Office Plus by purchasing $1,750 in office supplies which is due by the end of the month. He then signed a one-year lease agreement on an office building for $8,400, paying the full amount in advance. Prepare a Balance Sheet for Cullen Consulting Services as of April 1, 20X1, before he conducts any services. Cash Equipment Prepaid rent CULLEN CONSULTING SERVICES Balance Sheet April 1, 20X1 Assets Liabilities $ 47,600 Accounts payable 23,000 8,400 Owner's Equity $ 1,750 Cullen Beatty, Capital 77,250 Total Assets $ 79,000 Total Liabilities and Owner's Equity $ 79,000arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,420,000, $144,000 in the common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,620,000, $154,000 in the common stock account and $2,990,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,000 and the company paid out $149,000 in cash dividends during 2022. The firm’s net capital spending for 2022 was $1,000,000, and the firm reduced its net working capital investment by $129,000. What was the firm's 2022 operating cash flow, or OCF?arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning