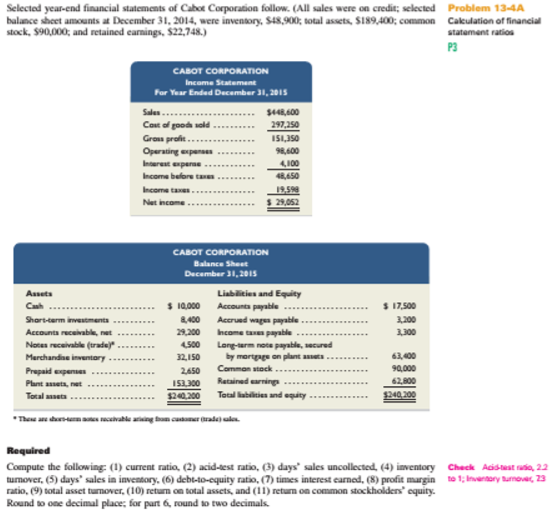

Selected year-end and financial statement of Cobalt Corporation follow. (All sales were on credit; Selected

Required

Compute the following; (1)

Round to one decimal places; for part 6, round to two decimals.

(1)

Introduction:

Liquidity or short-term ratios determines the ability of a firm to pay its current obligations. A good liquidity ration states that the company has liquid assets which can be easily convertible into cash. It includes current ratio, quick ratio etc.

To calculate:

Current ratio.

Answer to Problem 4PSA

Current ratio is 3.62:1

Explanation of Solution

= $86,900

= $24,000

= 3.62:1

(2)

Introduction:

Liquidity or short-term ratios determines the ability of a firm to pay its current obligations. A good liquidity ration states that the company has liquid assets which can be easily convertible into cash. It includes current ratio, quick ratio etc.

To calculate:

Acid-test ratio.

Answer to Problem 4PSA

Acid-test ratio is 2.2:1

Explanation of Solution

= 2.2:1

(3)

Introduction:

Days sales uncollected ratio helps the creditors and investors to measure the time in which company collects its account receivable.

To calculate:

Days sales uncollected.

Answer to Problem 4PSA

Days sales uncollected = 24 days

Explanation of Solution

= 24 days

(4)

Introduction:

Inventory turnover ratio measures how many times inventory is sold during a period.

To calculate:

Inventory turnover ratio.

Answer to Problem 4PSA

Inventory-turnover ratio is 7.3 times.

Explanation of Solution

= $40,525

= 7.3 times

(5)

Introduction:

Days sales in inventory calculates the time period which company takes to convert its inventory into sales.

To calculate:

Days sales in inventory.

Answer to Problem 4PSA

Days sales in inventory = 50 days

Explanation of Solution

= 50 days.

(6)

Introduction:

Debt-equity ratio measures the proportion of debt and equity in the capital structure.

To calculate:

Debt to equity ratio.

Answer to Problem 4PSA

Debt to equity ratio is 1.7:1

Explanation of Solution

= $87,400:

= $152,800

= 1.7:1

(7)

Introduction:

Time interest earned ratio measures the amount of income that will be required for for covering the interest expenses in the future.

To calculate:

Time interest earned.

Answer to Problem 4PSA

Time interest earned= 11.8

Explanation of Solution

= 11.8

(8)

Introduction:

Profit margin ratio is calculated by dividing net income by the net sales.

To calculate:

Profit margin ratio.

Answer to Problem 4PSA

Profit margin ratio is 6.4%

Explanation of Solution

= 6.4%

(9)

Introduction:

Asset turnover ratio calculates the ability of a company to generate sales with the total assets.

To calculate:

Asset-turnover ratio.

Answer to Problem 4PSA

Asset-turnover ratio = 1.8

Explanation of Solution

= 1.8:

(10)

Introduction:

Return on total asset is a ratio that calculated by dividing earning before income tax by total assets.

To calculate:

Return on total asset.

Answer to Problem 4PSA

Return on total asset is $0.18

Explanation of Solution

= $0.18

= $44,550

(11)

Introduction:

Return on common stockholder’s equity is calculated by dividing net income by shareholder’s equity. It helps in measuring the financial performance of a company.

To calculate:

Return on common stockholder’s equity.

Answer to Problem 4PSA

Return on common stockholder’s equity is $0.19

Explanation of Solution

= $0.19:

Want to see more full solutions like this?

Chapter 13 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

- Financial Accounting Question please answerarrow_forwardHow much of every retail sales dollar is made up of merchandise cost on these general accounting question?arrow_forwardThe company where Daniel works produces skateboards locally but sells them globally for $60 each. Daniel is one of the production managers in a meeting to discuss preliminary results from the year just ended. Here is the information they had in front of them: Standard Quantity per Unit Standard Price Wood 2.50 feet $4.00 per foot Wheels 5.00 wheels $0.50 per wheel Direct labor 0.30 hours $14.00 per hour Actual results: . • Quantity of wood purchased, 225,000 feet; quantity of wood used, 220,000 feet. Quantity of wheels purchased, 418,800 wheels; quantity of wheels used, 400,800 wheels. Actual cost of the wood, $4.20 per foot. Actual cost of the wheels, $0.55 per wheel. • Quantity of DL hours used, 26,400 hours; actual cost of DL hours, $15.20 per hour. Actual units produced, 80,000 skateboards. (a) Complete a variance analysis for DM (both wood and wheels) and DL, determining the price and efficiency variances for each; be sure to specify the amount and sign of each variance. DM- Wood…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,