Entries for selected corporate transactions

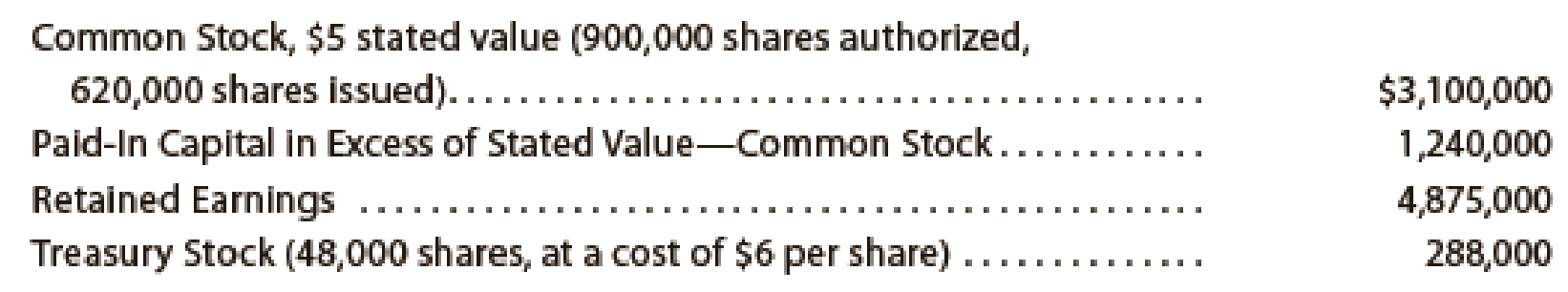

Nav-Go Enterprises Inc. produces aeronautical navigation equipment. The stockholders’ equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 20Y3, are as follows:

The following selected transactions occurred during the year:

Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $34,320.

Mar. 15. Sold all of the

Apr. 13. Issued 200,000 shares of common stock for $8 per share.

June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share.

July 16. Issued the certificates for the dividend declared on June 14.

Oct. 30. Purchased 50,000 shares of treasury stock for $6 per share.

Dec. 30. Declared a $0.08-per-share dividend on common stock.

31. Closed the two dividends accounts to

Instructions

- 1. Enter the January 1 balances in T accounts for the stockholders’ equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends.

- 2.

Journalize the entries to record the transactions and post to the eight selected accounts. - 3. Prepare a retained earnings statement for the year ended December 31, 20Y3.

- 4. Prepare the Stockholders’ Equity section of the December 31, 20Y3, balance sheet Using Method 1 of Exhibit 8.

(1) and (2)

Journalize the transactions and post to the eight selected accounts.

Explanation of Solution

Common stock: These are the ordinary shares that a corporation issues to the investors in order to raise funds. In return, the investors receive a share of profit from the profits earned by the corporation in the form of dividend.

Treasury Stock: It refers to the shares that are reacquired by the corporation that are already issued to the stockholders, but reacquisition does not signify retirement.

Par value: It refers to the value of a stock that is stated by the corporation’s charter. It is also known as face value of a stock.

Stated value: It refers to an amount per share, which is assigned by the board of directors to no par value stock.

Issue of common stock for non-cash assets or services: Corporations often issue common stock for the services received from attorneys or consultants as compensation, or for the purchase of non-cash assets such as land, buildings, or equipment.

Record the transactions for Incorporation ME.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) | |

| 20Y3 | ||||

| January | 15 | Cash Dividends Payable | 34,320 | |

| Cash | 34,320 | |||

| (To record the payment of cash dividends) | ||||

| March | 15 | Cash | 324,000 | |

|

Treasury stock | 288,000 | |||

|

Paid-in capital from treasury stock | 36,000 | |||

| (To record sale of treasury stock for above the cost price of $6 per share) | ||||

| April | 13 | Cash | 1,600,000 | |

| Common Stock | 1,000,000 | |||

|

Paid-in Capital in Excess of stated value Common Stock | 600,000 | |||

| (To record issuance of 200,000 shares in excess of stated value) | ||||

| June | 14 | Stock Dividends (4) | 184,500 | |

|

Common Stock Dividends Distributable (5) | 123,000 | |||

|

Paid-in Capital in excess of Stated Value-Common stock (6) | 61,500 | |||

| (To record the declaration of stock dividends) | ||||

| July | 16 | Common Stock Dividends Distributable (5) | 123,000 | |

| Common Stock | 123,000 | |||

| (To record the distribution of stock dividends) | ||||

| October | 30 | Treasury stock | 300,000 | |

| Cash | 300,000 | |||

| (To record the purchase of 50,000 shares of treasury stock) | ||||

| December | 30 | Cash Dividends (8) | 63,568 | |

| Cash Dividends Payable | 63,568 | |||

| (To record the declaration of cash dividends) | ||||

| December | 31 | Income summary | 775,000 | |

| Retained Earnings | 775,000 | |||

| (To close the income summary account) | ||||

| December | 31 | Retained Earnings | 248,068 | |

| Stock dividends (4) | 184,500 | |||

| Cash Dividends (8) | 63,568 | |||

| (To record the closing of stock dividends and cash dividends to retained earnings account) | ||||

Table (1)

Working notes:

(1)

Calculate treasury stock cost per share.

(2)

Compute number of shares outstanding after the issuance of common stock on April 13.

(3)

Compute the stock dividends shares.

(4)

Compute the stock dividends amount payable to common stockholders.

(5)

Compute common stock dividends distributable value.

(6)

Compute paid-in capital in excess of par value-common stock.

(7)

Compute number of shares outstanding as on December 30.

(8)

Calculate the amount of cash dividend declared on December 28.

Post the above journal entries into the stockholders’ equity accounts for Incorporation ME.

Common stock account is a component of stockholder’s equity with a normal credit balance.

| Common stock | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| January 1 | Balance | $3,100,000 | |||

| April 13 | Cash | $1,000,000 | |||

| July 16 | Stock dividends distributable | $123,000 | |||

| Total | $ 0 | Total | 4,223,000 | ||

| December 31 | Balance | $4,223,000 | |||

Table (2)

Paid-in capital in excess of stated value - Common stock account is a component of stockholder’s equity with a normal credit balance.

| Paid-in capital in excess of stated value - Common stock | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| January 1 | Balance | $1,240,000 | |||

| April 13 | Cash | $600,000 | |||

| June 14 | Stock dividends | $61,500 | |||

| Total | $ 0 | Total | $ 1,901,500 | ||

| December 31 | Balance | $ 1,901,500 | |||

Table (3)

Retained earnings are a component of stockholder’s equity with a normal credit balance.

| Retained earnings | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| December 31 | Cash and stock dividends | $248,068 | January 1 | Balance | $4,875,000 |

| December 31 | Income summary | $775,000 | |||

| Total | $248,068 | Total | $5,650,000 | ||

| December 31 | Balance | $5,401,932 | |||

Table (4)

Treasury stock is a component of stockholder’s equity with a normal debit balance.

| Treasury stock | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| January 1 | Balance | $288,000 | March 15 | Cash | $288,000 |

| October 30 | Cash | $300,000 | |||

| Total | $ 588,000 | Total | $288,000 | ||

| December 31 | Balance | $ 300,000 | |||

Table (5)

Paid-in capital from treasury stock is a component of stockholder’s equity with a normal credit balance.

| Paid-in capital from treasury stock | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| March 15 | Cash | $36,000 | |||

| Total | $ 0 | Total | $36,000 | ||

| December 31 | Balance | $36,000 | |||

Table (6)

Stock dividend distributable is a contra stockholder’s equity with a normal credit balance.

| Stock dividend distributable | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| July 16 | Common stock | $123,000 | June 14 | Stock dividend | $123,000 |

| Total | $123,000 | Total | $123,000 | ||

| December 31 | Balance | $0 | |||

Table (7)

Stock dividend is a component of stockholder’s equity with a normal debit balance.

| Stock dividend | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| June 14 | Stock dividend distributable | $123,000 | December 31 | Retained earnings | $184,500 |

| July 5 | Paid in capital in excess of stated value –Common value | $61,500 | |||

| Total | $184,500 | Total | $184,500 | ||

| December 31 | Balance | $0 | |||

Table (8)

Cash dividend is a component of stockholder’s equity with a normal debit balance.

| Stock dividend | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| December 30 | Cash dividend payable | $63,568 | December 31 | Retained earnings | $63,568 |

| Total | $63,568 | Total | $63,568 | ||

| December 31 | Balance | $0 | |||

Table (9)

(3)

Prepare a retained earnings statement for the year ended December 31, 20Y1.

Explanation of Solution

Retained earnings statement: This is a financial statement that shows the amount of the net income retained by a company at a particular point of time for reinvestment and pays its debts and obligations. It shows the amount of retained earnings that is not paid as dividends to the shareholders.

Prepare a retained earnings statement for the year ended December 31, 20Y1.

| Incorporation NE | |||

| Retained Earnings Statement | |||

| For the Year Ended December 31, 20Y1 | |||

| Retained earnings, January 1, 20Y1 | $4,875,000 | ||

| Net income for year | $775,000 | ||

| Less: Dividends: | |||

| Cash | -$63,568 | ||

| Stock | -$184,500 | -$248,068 | |

| Change in retained earnings | $526,932 | ||

| Retained earnings, December 31, 20Y6 | $5,401,932 | ||

Table (10)

(4)

Prepare the stockholders’ equity section of the December 31, 20Y1, balance sheet.

Explanation of Solution

Stockholders’ equity: It refers to the amount of capital that includes the amount of investment by the stockholders, earnings generated from the normal business operations, and less any dividends paid to the stockholders.

Prepare the stockholders’ equity section of the December 31, 20Y1, balance sheet.

| Incorporation NE | |||

| Partial Balance Sheet | |||

| December 31, 20Y1 | |||

| Stockholders' Equity | Amount | Amount | Amount |

| Paid-in capital: | |||

| Common stock, $5 stated (900,000 shares authorized; 620,000 shares issued, 794,600 shares outstanding) | $4,223,000 | ||

| Excess over stated value | $1,901,500 | ||

| Paid-in capital, common stock | $6,124,500 | ||

| From sale of treasury stock | $36,000 | ||

| Total paid-in capital | $6,160,000 | ||

| Retained earnings | $5,401,932 | ||

| Total | $11,562,432 | ||

| Treasury common stock (50,000 shares at cost) | -$300,000 | ||

| Total stockholders' equity | $11,262,432 | ||

Table (11)

Want to see more full solutions like this?

Chapter 13 Solutions

Financial Accounting

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardCan you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning