Concept explainers

Sensitivity Analysis

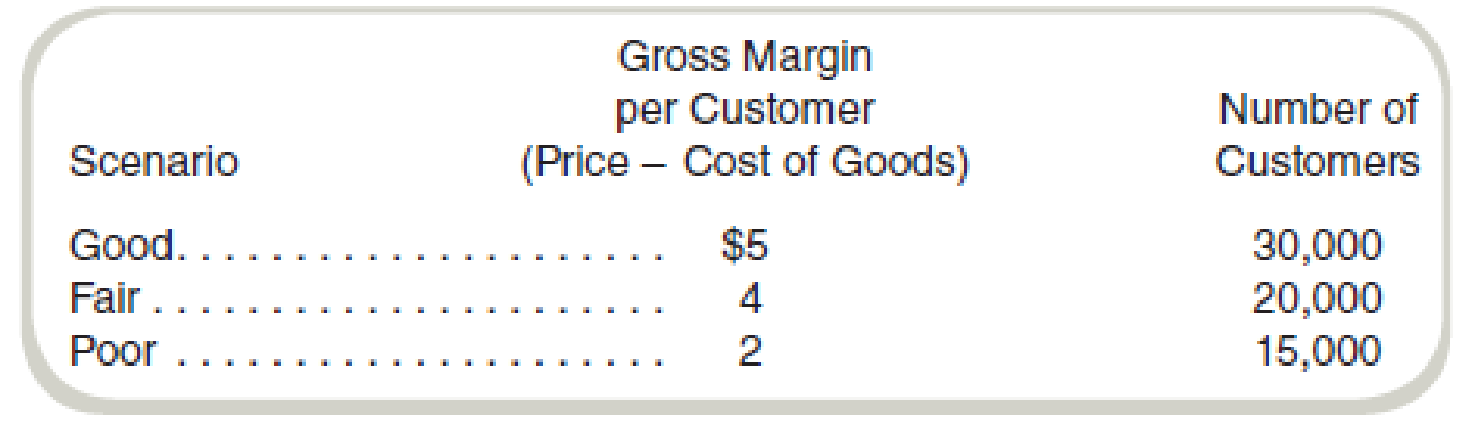

Sanjana’s Sweet Shoppe operates on the boardwalk of a New England coastal town. The store only opens for the summer season and the business is heavily dependent on the weather and the economy in addition to new competition. Sanjana Sweet, the owner, prepares a budget each year after reading long-term weather

Sanjana assumes, for simplicity, that the gross margin and the estimated number of customers are independent. Thus, she has nine possible scenarios. In addition to the cost of the products sold, Sanjana estimates staffing costs to be $25,000 plus $2 for every customer in excess of 20,000. The marketing and administrative costs are estimated to be $10,000 plus 3 percent of the gross margin.

Required

Use a spreadsheet to prepare an analysis of the possible operating income for Sanjana similar to that in Exhibit 13.15. What is the range of operating incomes?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

FUNDAMENTALS OF COST ACCOUNTING W/CONNE

- What is the total cost of job.... Please answer the general accounting questionarrow_forwardArmour, Inc., an advertising agency, applies overhead to jobs on the basis of direct professional labor hours. Overhead was estimated to be $226,000, direct professional labor hours were estimated to be 28,000, and direct professional labor cost was projected to be $425,000. During the year, Armour incurred actual overhead costs of $205,200, actual direct professional labor hours of 23,900, and actual direct labor costs of $333,000. By year-end, the firm's overhead wasarrow_forwardWhat is the degree of opereting leverage? General accountingarrow_forward

- Given correct answer financial accounting questionarrow_forwardPlatz Company makes chairs and planned to sell 4,100 chairs in its master budget for the coming year. The budgeted selling price is $36 per chair, variable costs are $17 per chair, and budgeted fixed costs are $45,000 per month. At the end of the year, it was determined that Platz actually sold 4,400 chairs for $145,700. Total variable costs were $50,375 and fixed costs were $38,000. The volume variance for sales revenue was: a. $14,500 unfavorable b. $11,200 favorable c. $10,800 favorable d. $12,700 favorablearrow_forwardProvide correct answer the general accounting questionarrow_forward

- Helparrow_forwardWhat is the degree of opereting leverage?arrow_forwardSimba Company's standard materials cost per unit of output is $13.63 (2.35 pounds * $5.80). During July, the company purchases and uses 3,000 pounds of materials costing $17,200 in making 1,450 units of the finished product. Compute the total, price, and quantity materials variances.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub