Clearview Window Company manufactures windows for the home-building industry. The window frames are produced in the Frame Division. The frames are then transferred to the Glass Division, where the glass and hardware are installed. The company’s best-selling product is a three-by-four-foot, doublepaned operable window.

The Frame Division also can sell frames directly to custom home builders, who install the glass and hardware. The sales price for a frame is $80. The Glass Division sells its finished windows for $190. The markets for both frames and finished windows exhibit

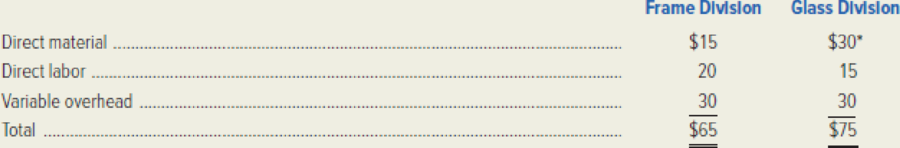

The standard variable cost of the window is detailed as follows:

*Not including the transfer price for the frame.

Required:

- 1. Assume that there is no excess capacity in the Frame Division.

- a. Use the general rule to compute the transfer price for window frames.

- b. Calculate the transfer price if it is based on standard variable cost with a 10 percent markup.

- 2. Assume that there is excess capacity in the Frame Division.

- a. Use the general rule to compute the transfer price for window frames.

- b. Explain why your answers to requirements (1a) and (2a) differ.

- c. Suppose the predetermined fixed-

overhead rate in the Frame Division is 125 percent of direct-labor cost. Calculate the transfer price if it is based onstandard full cost plus a 10 percent markup.- d. Assume the transfer price established in requirement (2c) is used. The Glass Division has been approached by the U.S. Army with a special order for 1,000 windows at $155. From the perspective of Clearview Window Company as a whole, should the special order be accepted or rejected? Why?

- e. Assume the same facts as in requirement (2d). Will an autonomous Glass Division manager accept or reject the special order? Why?

- f. Comment on any ethical issues you see in the questions raised in requirements (2d) and (2e).

- 3. Comment on the use of full cost as the basis for setting transfer prices.

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

MANAGERIAL ACCOUNTING W/CONNECT CODE

- Summit Beverages purchased a delivery truck for $90,000. The company estimates a 5-year useful life with a residual value of $10,000. Using the double-declining balance depreciation method, what is the depreciation expense for the first year?arrow_forwardNorthern Lights Inc. had net credit sales of $600,000 and accounts receivable of $75,000 at the beginning of the year and $85,000 at the end of the year. What is the accounts receivable turnover ratio for the company?arrow_forwardcorrect answer pleasearrow_forward

- Provide solutionarrow_forwardEvergreen Systems started the year with $980,000 in total assets and $450,000 in total liabilities. During the year, the company generated $160,000 in net income, paid $35,000 in dividends, and issued common stock worth $55,000. What is the company's total equity at the end of the year?arrow_forwardAnswer please but not use aiarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education