Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 23rd + Cengagenowv2, 2 Terms Printed Access Card

23rd Edition

ISBN: 9780357252352

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 3CE

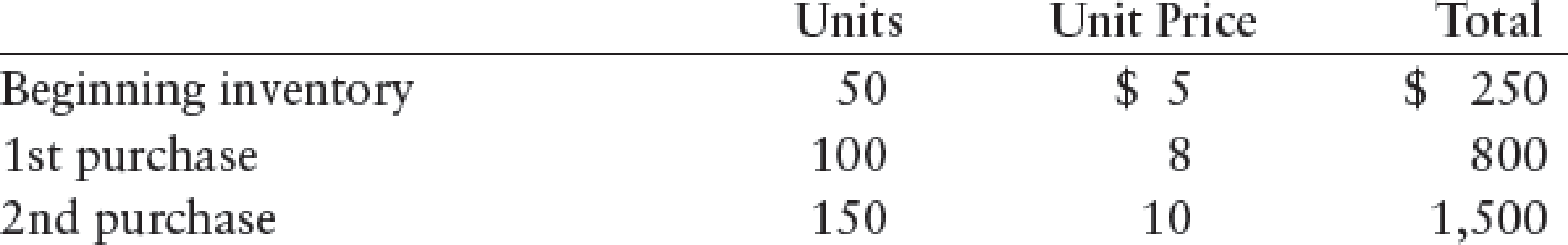

Use the following information to compute cost of goods sold under the FIFO and LIFO inventory methods. The firm sold 200 units.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The contribution margin ratio is calculated as how? a) Gross margin divided by sales b) Operating income divided by sales c) Contribution margin divided by sales d) Net income divided by sales

Answer. General Account

Colfax Company incurred production labor costs of $5,400 in February

(payable In March) for work requiring 1,100 standard hours at a

standard rate of $15 per hour; 1,200 actual direct labor hours were

worked. Based on this information, which one of the following would be

included in the journal entry to record the labor costs?

a. $16,500 credit to Work-in-process Inventory.

b. $1,500 credit to labor Efficiency Variance.

c. $16,200 credit to Wages Payable.

d. $1,500 credit to Labor Rate Variance.

Chapter 13 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 23rd + Cengagenowv2, 2 Terms Printed Access Card

Ch. 13 - An overstatement of ending inventory in the year...Ch. 13 - An understatement of ending inventory in the year...Ch. 13 - LO2 Under the perpetual system of accounting for...Ch. 13 - LO3 A fiscal year that starts and ends at the time...Ch. 13 - LO3 If goods are shipped FOB shipping point, the...Ch. 13 - An understatement of ending inventory in the year...Ch. 13 - Prob. 2MCCh. 13 - In rimes of rising prices, the inventory cost...Ch. 13 - In rimes of rising prices, the inventory cost...Ch. 13 - In the application of lower-of-cost-or-market,...

Ch. 13 - LO1 If the ending inventory is overstated by...Ch. 13 - Using the following information, compute the...Ch. 13 - Use the following information to compute cost of...Ch. 13 - Kulsrud Company would like to estimate the current...Ch. 13 - What financial statements are affected by an error...Ch. 13 - What is the main difference between the periodic...Ch. 13 - Is a physical inventory necessary under the...Ch. 13 - Is a physical inventory necessary under the...Ch. 13 - In a period of rising prices, which inventory...Ch. 13 - What two factors are taken into account by the...Ch. 13 - Which inventory method always follows the actual...Ch. 13 - When lower-of-cost-or-market is assigned to the...Ch. 13 - List the three steps followed under the gross...Ch. 13 - List the five steps followed under the retail...Ch. 13 - INVENTORY ERRORS Assume that in year 1, the ending...Ch. 13 - JOURNAL ENTRIESPERIODIC INVENTORY Paul Nasipak...Ch. 13 - JOURNAL ENTRIESPERPETUAL INVENTORY Joan Ziemba...Ch. 13 - ENDING INVENTORY COSTS Sandy Chen owns a small...Ch. 13 - LOWER-OF-COST-OR-MARKET Stalberg Companys...Ch. 13 - SPECIFIC IDENTIFICATION, FIFO, LIFO, AND...Ch. 13 - COST ALLOCATION AND LOWER-OF-COST-OR-MARKET...Ch. 13 - Prob. 8SPACh. 13 - RETAIL INVENTORY METHOD The following information...Ch. 13 - INVENTORY ERRORS Assume that in year 1, the ending...Ch. 13 - JOURNAL ENTRIESPERIODIC INVENTORY Amy Douglas owns...Ch. 13 - JOURNAL ENTRIESPERPETUAL INVENTORY Doreen Woods...Ch. 13 - ENDING INVENTORY COSTS Danny Steele owns a small...Ch. 13 - LOWER-OF-COST-OR-MARKET Bouie Companys beginning...Ch. 13 - SPECIFIC IDENTIFICATION, FIFO, LIFO, AND...Ch. 13 - COST ALLOCATION AND LOWER-OF-COST-OR-MARKET Hall...Ch. 13 - GROSS PROFIT METHOD A flood completely destroyed...Ch. 13 - RETAIL INVENTORY METHOD The following information...Ch. 13 - Hurst Companys beginning inventory and purchases...Ch. 13 - Bhushan Company has been using LIFO for inventory...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the following event: Owner made contribution to the firm. Which of the following combination of changes in the accounting equation describes the given event? a. Liabilities decrease; Owners' equity increase b. Assets decrease; Liabilities decrease c. Assets decrease; Owners' equity decrease d. Assets increase; Assets decrease e. Assets increase; Liabilities increase f. Assets increase; Owners' equity increasearrow_forwardSUBJECT = GENERAL ACCOUNTarrow_forwardthis is general account questionarrow_forward

- Thompson Company has a standard of 3.1 pounds of materials per unit, at $15.10 per pound. In producing 980 units, Thompson used 2,830 pounds of materials at a total cost of $44,500. What is Thompson's total materials variance? a. $1,767 Favorable b. $1,374 Favorable c. $1,374 Unfavorable d. $1,767 Unfavorablearrow_forwardFinancial Accountarrow_forwardA parcel of land that was originally purchased for $85,000 is offered for sale at $150,000, is assessed for tax purposes at $95,000, is recognized by its purchasers as easily being worth $140,000, and is sold for $137,000. What is the effect of the sale on the accounting equation for the seller? A) Assets increase by $52,000; owner's equity increases by $52,000. B) Assets increase by $85,000; owner's equity increases by $85,000. C) Assets increase by $137,000; owner's equity increases by $137,000. D) Assets increase by $140,000; owner's equity increases by $140,000. E) None of the above.arrow_forward

- Need general account solutionsvarrow_forwardGeneral accountarrow_forwardOverhead application to costs is a critical issue for the costing of your products. We are studying several ways to handle this situation. Describe overhead and the overhead application process. What would cause an overhead to be overapplied, or underapplied. Discuss the results to your decision making and the financial statements for each of those two situations. Describe how the over or under application of overhead should be corrected in the accounting records.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License