Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 25P

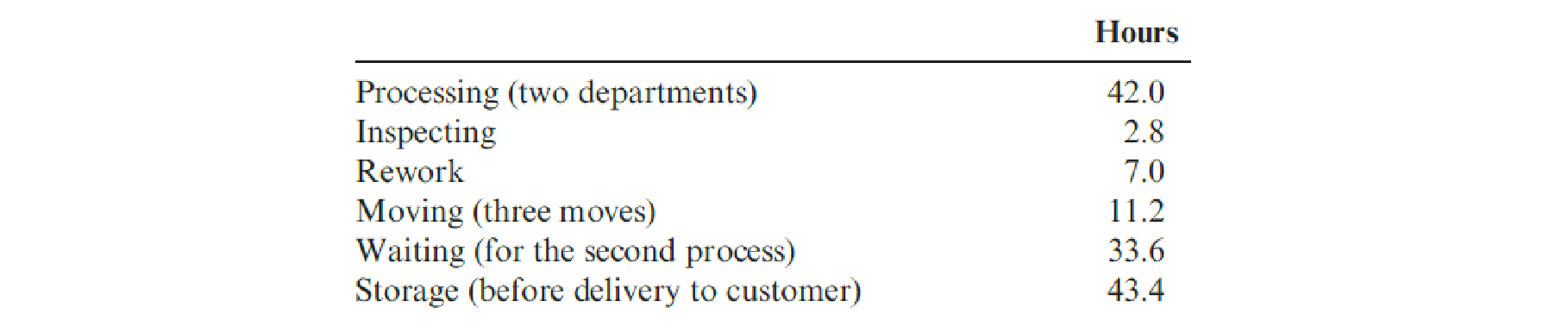

Auflegger, Inc., manufactures a product that experiences the following activities (and times):

Required:

- 1. Compute the MCE for this product.

- 2. A study lists the following root causes of the inefficiencies: poor quality components from suppliers, lack of skilled workers, and plant layout. Suggest a possible cost reduction strategy, expressed as a series of if-then statements that will reduce MCE and lower costs. Finally, prepare a strategy map that illustrates the causal paths. In preparing the map, use only three perspectives: learning and growth, process, and financial.

- 3. Is MCE a lag or a lead measure? If and when MCE acts as a lag measure, what lead measures would affect it?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Dana intends to invest $32,000 in either a Treasury bond or a corporate bond. The Treasury bond yields 5 percent before tax, and the corporate bond yields 6 percent before tax. Assume Dana's federal marginal rate is 24 percent and she itemizes deductions.

Required:

a-2. How much interest after-tax would Dana earn by investing in the corporate bond?

b-2. How much interest after-tax would Dana earn by investing in the corporate bond as per requirement b-1?

compute overhead cost per unit for of the two product using activity-based costing and round activity rate to 2 decimal places and other answers to the nearest whole dollat amount

PLEASE HELP ME WITH THIS ACCOUNTING PROBLEM

Chapter 13 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 13 - Describe a strategic-based responsibility...Ch. 13 - What is a Balanced Scorecard?Ch. 13 - What is meant by balanced measures?Ch. 13 - Prob. 4DQCh. 13 - Prob. 5DQCh. 13 - What are stretch targets? What is their strategic...Ch. 13 - Prob. 7DQCh. 13 - What are the three strategic themes of the...Ch. 13 - Prob. 9DQCh. 13 - Explain what is meant by the long wave and the...

Ch. 13 - Prob. 11DQCh. 13 - Prob. 12DQCh. 13 - What is a testable strategy?Ch. 13 - Prob. 14DQCh. 13 - Prob. 15DQCh. 13 - Norton Company has the following data for one of...Ch. 13 - Craig, Inc., has provided the following...Ch. 13 - Prob. 3CECh. 13 - The following comment was made by the CEO of a...Ch. 13 - Prob. 5ECh. 13 - Prob. 6ECh. 13 - Consider the following list of scorecard measures:...Ch. 13 - Hatch Manufacturing produces multiple machine...Ch. 13 - Computador has a manufacturing plant in Des Moines...Ch. 13 - Refer to Exercise 13.9. Assume that the company...Ch. 13 - The following if-then statements were taken from a...Ch. 13 - Consider the following quality improvement...Ch. 13 - Bannister Company, an electronics firm, buys...Ch. 13 - Prob. 14ECh. 13 - In a balanced scorecard, a key strategic if-then...Ch. 13 - Which of the following objectives would be...Ch. 13 - A manufacturing cell produces 40 units in five...Ch. 13 - Which of the following objectives would likely be...Ch. 13 - Which of the following objectives would likely be...Ch. 13 - Carson Wellington, president of Mallory Plastics,...Ch. 13 - At the end of 20x1, Mejorar Company implemented a...Ch. 13 - Refer to the data in Problem 13.21. 1. Express...Ch. 13 - The following strategic objectives have been...Ch. 13 - Lander Parts, Inc., produces various automobile...Ch. 13 - Auflegger, Inc., manufactures a product that...Ch. 13 - Prob. 26PCh. 13 - At the beginning of the last quarter of 20x1,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Let's say that Dr. Tim’s Company purchased a heavy-duty truck on July 1, 2021, for $30,000. It was estimated that it would have a useful life of 10 years and then would have a trade-in value of $6,000. The company uses the straight-line method. It was traded on August 1, 2026, for a similar truck costing $42,000; $16,000 was allowed as trade-in value (also fair value) on the old truck and $26,000 was paid in cash. A comparison of expected cash flows for the trucks includes the exchange lacks commercial substance. What is the entry to record the trade-in? Truck (new) $42,000 Accumulated Depreciation $12,200 ($30,000 - $6,000) x (61 months / 120 months) Loss on Disposal of Trucks $1,800 ($30,000 - $12,200 - $16,000 [trade-in] Trucks (old)…arrow_forward16. Candy Company projects the following sales: BB (Click on the icon to view the projected sales.) Candy collects sales on account in the month after the sale. The Accounts Receivable balance on January 1 is $12,300, which represents December's sales on account. Candy projects the following cash receipts from customers: BEE (Click on the icon to view the cash receipts from customers.) Recalculate cash receipts from customers if total sales remain the same but cash sales are only 5% of the total. Begin by computing the cash sales and sales on account for each month if cash sales are only 5% of the total. January February March Cash sales (5%) Sales on account (95%) Total sales $ 31,000 $ 27,000 $ 33,000 Data table X I Data table - X January February March January February March Cash sales (10%) $ 3,100 $ 27,900 Sales on account (90%) 2,700 $ 24,300 3,300 29,700 Cash receipts from cash sales Cash receipts from sales on account $ 3,100 $ 2,700 $ 12,300 27,900 3,300 24,300 $ 31,000 $…arrow_forward11. Kapper Company projects 2025 first quarter sales to be $35,000 and increase by 15% per quarter. Determine the projected sales for 2025 by quarter and in total. Round answers to the nearest dollar. 12. Fagg Company manufactures and sells bicycles. A popular model is the XC. The company expects to sell 2,100 XCs in 2024 and 2,000 XCs in 2025. At the beginning of 2024, Friedman has 380 XCs in Finished Goods Inventory and desires to h of the next year's sales available at the end of the year. How many XCs will Fagg need to produce in 2024? 11. Kapper Company projects 2025 first quarter sales to be $35,000 and increase by 15% per quarter. Determine the projected sales for 2025 by quarter and in total. Round answers to the nearest dollar. Determine the projected sales for each quarter, then compute the projected sales for 2025. Base sale amount Quarter 1 Multiplier for sales increase = Projected sales for the quarter Larrow_forward

- 15. Callarman Company began operations on January 1 and has projected the following selling and administrative expenses: (Click on the icon to view the selling and administrative expenses.) Determine the cash payments for selling and administrative expenses for the first three months of operations. (Complete all answer boxes. Enter a "0" for zero amounts.) Rent Expense Utilities Expense Depreciation Expense Insurance Expense Total cash payments for selling and administrative expenses Data tables January February March Rent Expense Utilities Expense Depreciation Expense Insurance Expense $1,400 per month, paid as incurred 800 per month, paid in month after incurred 1,000 per month 50 per month, 9 months prepaid on January 1 Print Donearrow_forwardMatch the budget types to the definitions. Budget Types 5. Financial 6. Flexible 7. Operating 8. Operational 9. Static 10. Strategic Definitions a. Includes sales, production, and cost of goods sold budgets b. Long-term budgets c. Includes only one level of sales volume d. Includes various levels of sales volumes e. Short-term budgets f. Includes the budgeted financial statementsarrow_forward14. Cain Company is a sporting goods store. The company sells a tent that sleeps six people. The store expects to sell 280 tents in 2024 and 360 tents in 2025. At the beginning of 2024, Cain Company has 30 tents in Merchandise Inventory and desires to have 60% of the next year's sales available at the end of the year. How many tents will Cain Company need to purchase in 2024? Begin by selecting the labels, then enter the amounts to compute the budgeted tents to be purchased. Plus: Total tents needed Less: Budgetec Budgeted tents returned Budgeted tents to be sold Desired tents in ending inventory Tents in beginning inventory Zarrow_forward

- Calculate Airbnb inventory turnover for the year 2024. ( (COGS) was $1.829 billion for the previous 12 months)(average inventory for 2024 is showing a significant increase, with the company reporting over $491 million) What does inventory turnover tells an investor?arrow_forwardCariman Company manufactures and sells three styles of door Handles: Gold, Bronze and Silver. Production takes 50, 50, and 20 machine hours to manufacture 1,000-unit batches of Gold, Bronze, and Silver Handles, respectively. The following additional data apply: Projected sales in units Per Unit data: Gold Bronze Silver 60,000 100,000 80,000 2. Determine the activity cost driver rate for setup costs and inspection costs? 3. Using the ABC system, for the Gold style of Handle: a. Calculate the estimated overhead costs per unit? b. Calculate the estimated operating profit per unit? 4. Explain the difference between the profits obtained from the traditional system and the ABC system. Which system provides a better estimate of profitability? Selling price $80 $40 $60 Direct materials $16 $8 $16 Direct labour $30 $6 $18 Overhead cost based on direct labour hours (traditional system) $24 $6 $18 Hours per 1,000-unit batch: Direct labour hours Machine hours Setup hours Inspection hours 80 20 60…arrow_forwardI need some help with problem B. I have done the work, but I'd like to make sure if I have done the calculations correctly. If you see anything else that is wrong, please let me know.arrow_forward

- Module 6 Discussion Discuss the significance of recognizing the time value of money in the long-term impact of the capital budgeting decision. 60 Replies, 59 Unread Σarrow_forwardHow many weeks of supply does summit logistics Inc. Hold ?arrow_forwardI need some help with letter c. I have done the calculations correctly, but if there is anything wrong, please correct them.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Relevant Costing Explained; Author: Kaplan UK;https://www.youtube.com/watch?v=hnsh3hlJAkI;License: Standard Youtube License