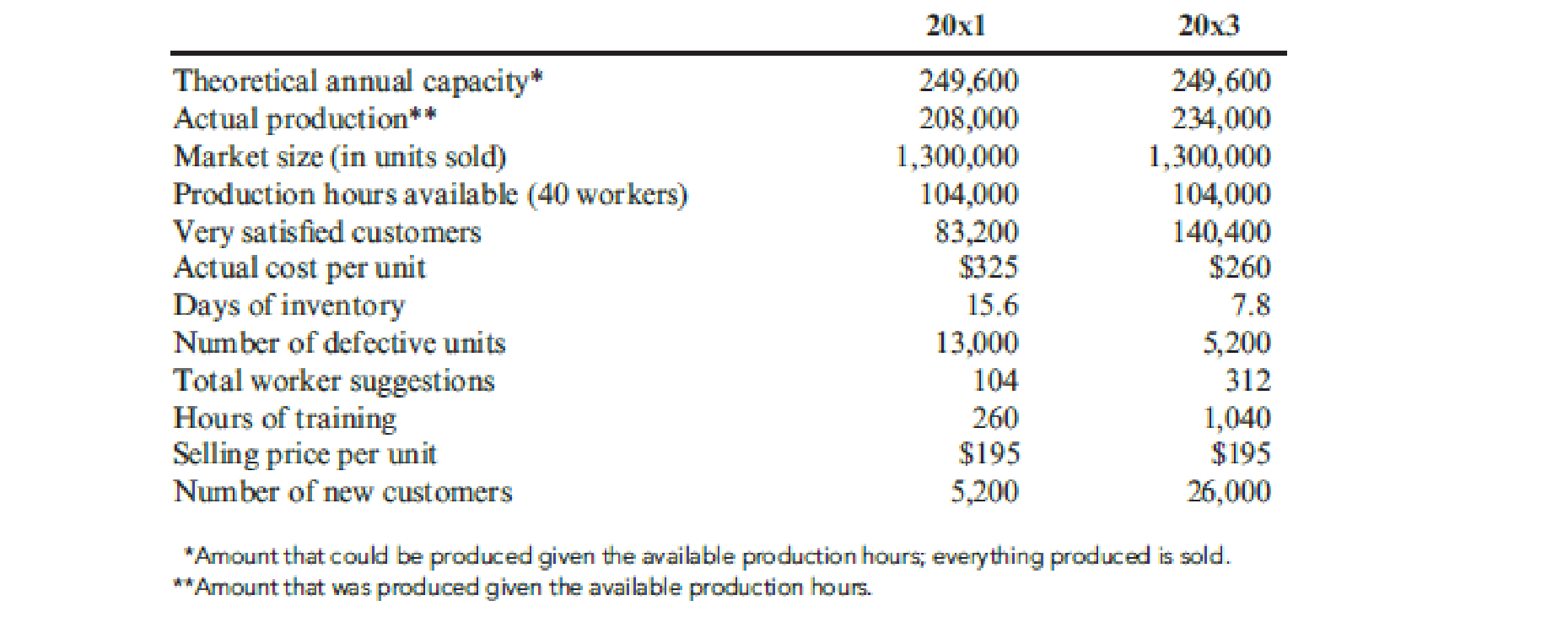

At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered:

Required:

- 1. Compute the following measures for 20x1 and 20x3:

- a. Actual velocity and cycle time

- b. Percentage of total revenue from new customers (assume one unit per customer)

- c. Percentage of very satisfied customers (assume each customer purchases one unit)

- d. Market share

- e. Percentage change in actual product cost (for 20x3 only)

- f. Percentage change in days of inventory (for 20x3 only)

- g. Defective units as a percentage of total units produced

- h. Total hours of training

- i. Suggestions per production worker

- j. Total revenue

- k. Number of new customers

- 2. For the measures listed in Requirement 1, list likely strategic objectives, classified according to the four Balance Scorecard perspectives. Assume there is one measure per objective.

1. a

Compute the actual velocity and cycle time for 20x1 and 20x3.

Explanation of Solution

Cycle time and velocity: “Cycle time and velocity are two operational “measures of responsiveness”. Cycle time is the spans of time taken to produce a unit of output from the time of receipt of materials till the good is supplied to finished goods inventory. Therefore, cycle time is the time taken to produce a product”. Velocity is the number of units of output that could be produced within a given period of time”

Strategy Translation: Strategy translation is the process of specifying objectives, measures, targets, and initiatives for each individual perspective. Strategic focus is created by translating the organizations’ strategy into operational objectives and performance measures for four different perspectives.

Calculate actual velocity for 20x1:

Calculate cycle time for 20x1:

Calculate actual velocity for 20x3:

Calculate cycle time for 20x3:

b.

Calculate percentage of total revenue from new customers:

Explanation of Solution

Calculate percentage of total revenue from new customers during 20x1:

Calculate percentage of total revenue from new customers during 20x3:

c.

Calculate the percentage of satisfied customers.

Explanation of Solution

Calculate the percentage of satisfied customers for 20x1:

Calculate the percentage of satisfied customers for 20x3:

d.

Calculate value of market share.

Explanation of Solution

Calculate value of market share for 20x1:

Calculate value of market share for 20x3:

e.

Calculate percentage change in actual product cost for 20x3.

Explanation of Solution

Calculate percentage change in actual product cost for 20x3.

f.

Calculate percentage change in days of inventory for 20x3.

Explanation of Solution

Calculate percentage change in days of inventory for 20x3:

g.

Calculate the defective units as a percentage of total units produced.

Explanation of Solution

Calculate the defective units as a percentage of total units produced for 20x1:

Calculate the defective units as a percentage of total units produced for 20x3:

h.

Calculate the total hours of training.

Explanation of Solution

The total hours of training during 20x1 is 260 hours and for 20x3 is 1,040 hours.

i.

Calculate per production worker.

Explanation of Solution

Calculate per production worker for 20x1:

Calculate per production worker for 20x3:

j.

Calculate total revenue.

Explanation of Solution

Calculate total revenue during 20x1:

Calculate total revenue during 20x3:

k.

Identify the number of new customers during 20x1 and 20x3.

Explanation of Solution

The number of new customers during 20x1 is 5,200 and for 20x3 are 26,000.

2.

Provide strategic objective classified according to the four balance scorecard perspectives.

Explanation of Solution

Balanced Scorecard: Balanced scorecard is a management and planning strategy for organizational processes of defining the goals to be achieved, allocation of daily assignments on the basis of strategy, alignment of the projects on the basis of their priority and watchdog roles for its respective progress and achieving desired targets. Even though balances scorecards change from one firm to another firm, most have a combination of customer measures, measures of learning and growth, financial measures and internal business process measures.

| Strategic Objective | Measure |

| Financial | |

| Reduce unit cost | “Unit cost reduction in percentage” |

| Increase total revenue | “Revenue” |

| Develop new revenue | “Percentage of new revenues” |

| Customer | |

| Increase customer satisfaction | “Percentage of very satisfied customers” |

| Increase customer acquisition | “Number of new customers” |

| Increase market share | “Market share” |

| Process | |

| Decrease process time | “Cycle time/ velocity” |

| Decrease inventory | “Days of inventory” |

| Improve product quality | “Percentage defects” |

| Learning/Growth | |

| Increase employee capability | “Training hours” |

| increase employee motivation | “Recommendations per worker” |

Table (1)

Want to see more full solutions like this?

Chapter 13 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- Mit Distributors provided the following inventory-related data for the fiscal year: Purchases: $385,000 Purchase Returns and Allowances: $10,200 Purchase Discounts: $4,300 Freight In: $55,000 Beginning Inventory: $72,000 Ending Inventory: $95,500 What is the Cost of Goods Sold (COGS)?arrow_forwardanswer ? general accountingarrow_forwardBrightTech Corp. reported the following cost of goods sold (COGS) figures over three years: • 2023: $3,800,000 • 2022: $3,500,000 • 2021: $3,000,000 If 2021 is the base year, what is the percentage increase in COGS from 2021 to 2023?arrow_forward

- Sun Electronics operates a periodic inventory system. At the beginning of 2022, its inventory was $95,750. During the year, inventory purchases totaled $375,000, and its ending inventory was $110,500. What was the cost of goods sold (COGS) for Sun Electronics in 2022?arrow_forwardi want to this question answer of this general accountingarrow_forwardA clothing retailer provides the following financial data for the year. Determine the cost of goods sold (COGS): ⚫Total Sales: $800,000 • Purchases: $500,000 • Sales Returns: $30,000 • Purchases Returns: $40,000 • Opening Stock Value: $60,000 • Closing Stock Value: $70,000 Administrative Expenses: $250,000arrow_forward

- subject : general accounting questionarrow_forwardBrightTech Inc. had stockholders' equity of $1,200,000 at the beginning of June 2023. During the month, the company reported a net income of $300,000 and declared dividends of $175,000. What was BrightTech Inc.. s stockholders' equity at the end of June 2023?arrow_forwardQuestion 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year: Net Sales $100,000 Debtor's turnover ratio (based on net sales) 2 Inventory turnover ratio 1.25 fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% gross profit margin 25% return on investments 2% Use the given information to fill out the templates for incomestatement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $) Sales 100,000 Cost of goods sold gross profit other expenses earnings before tax tax @ 50% Earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $) Liabilities Amount Assets Amount Equity Net fixed assets long term debt 50,000 Inventory short term debt debtors cash Total Totalarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,